The FTSE 100 Index rose 2.2% on Friday after US employment data failed to meet expectations, causing the dollar to drop – boosting prospects for London-listed commodity stocks.

A cheaper US dollar increases demand for commodities priced in dollars as they become cheaper to purchase.

The dollar dropped against a basket of currencies after nonfarm payrolls only increased by 151,000 jobs last month, falling short of consensus expectations of 180,000. Meanwhile, the unemployment rate did not drop, contrary to expectations, and remained unchanged at 4.9 percent.

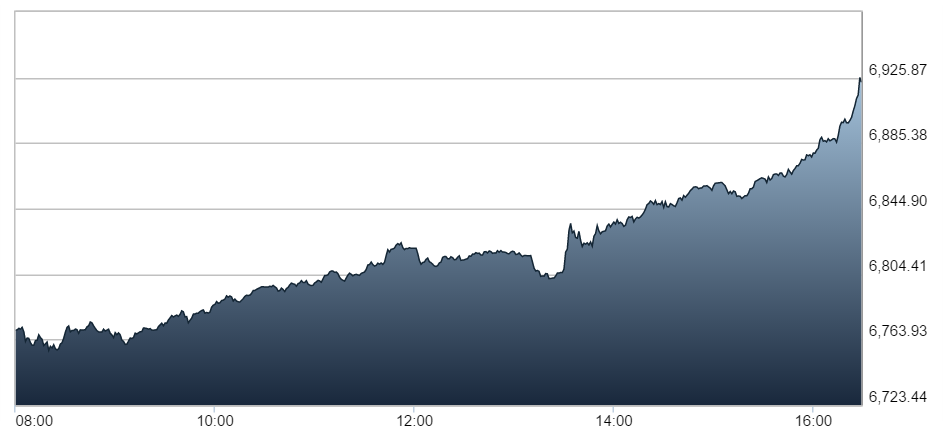

FTSE 100 chart – 09/02/2016

Oil giants BP and Royal Dutch Shell rose 2.9% and 2.8% respectively. Mining firms also benefited, with Anglo American up 2.5%, Randgold Resources up 2.9% and Fresnillo closing 3% higher.

The FTSE 100 closed up 148.63 points at 6894.60. The biggest risers were Hikma Pharmaceuticals up 107p to 2185p, Imperial Brands up 167.5p to 4130p, Old Mutual up 7.8p to 200p, and Unilever up 135.5p to 3663p.

Marcus Bullus, trading director at MB Capital, was quoted by This is Money as saying: “There was a quiet confidence the US economy would put in a bigger than expected number on Friday and pick up where June and July left off.

“It didn’t prove to be.

“After this mildly disappointing August print, a rate hike in September is less likely but it’s still on the table.

“Despite the weaker than expected headline number, Janet Yellen may yet decide to try and get ahead of the curve.”

The UK market was also lifted by a recovery in the construction sector.

The Markit/CIPS purchasing managers’ index for the sector rose to 49.2 in August. While the reading stayed below the 50 level, which indicates contraction, it was a significant improvement on July’s figures of 45.9 – the lowest reading in seven years.

Spreadex financial analyst Connor Campbell was quoted by the IB Times as saying that the survey and other recent reports “pointed to a less perilous post-Brexit situation than was forecast”.