UK industrial **output rose by 2.1% on the month in November 2016 while the country’s goods trade deficit with the rest of the world widened to £12.2 billion.

** Output in this context refers to total production.

The increase in total production was mainly due to higher mining and quarrying output (up 8.2%), the end of a maintenance period in the oil and gas industry and an increase in manufacturing.

According to the Office for National Statistics (ONS), manufacturing rose by 1.3% in November, a recovery from October’s 1.0% contraction. The largest contribution came from pharmaceuticals, which rose by 11.4%.

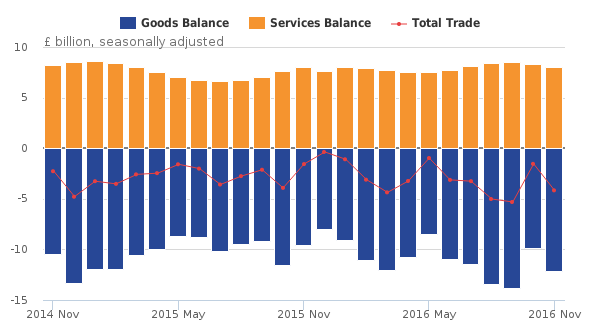

Separate figures by the ONS revealed that the deficit on trade in goods and services was estimated to have been £4.2 billion in November, a widening from £2.6 billion in October, reflected by a £3.3 billion increase in imports, partially offset by a £0.7 billion increase in exports.

The UK’s deficit on trade in goods increased to £12.2 billion, widening by £2.3 billion from October 2016.

Total trade prices for exports and imports dropped in November 2016 by 1.9% and 1.0% respectively, coinciding with a slight recovery in the value of sterling.

The largest contributor to the increase in imports was machinery and transport equipment, which rose by £1.4 billion.

The ONS said: “The widening of the deficit in November 2016 is attributed to trade in goods in which there were increased imports from both EU and non-EU countries, partially offset by an increase in exports to EU countries.”

The monthly deficit with the EU rose to a record £8.6 billion in November, up from £7.8bn in October.

According to a report by The Financial Times, many commentators expect the depreciation of the sterling to eventually boost demand for British exports and decrease demand for imports, which would help improve the trade balance.

However, as the FT notes in its report, demand can take time to adapt and the immediate effect of depreciation is typically a rise in the cost of import.

“For now, the UK trade numbers are exhibiting the traditional J-curve effect” James Knightley, senior economist at ING, was quoted by The Financial Times as saying.

“However, over the coming year we expect to see the weak pound’s boost to competitiveness become more broadly felt,” Knightley added.