UK inflation stayed unchanged at 0.6 percent in August, as measured by the Consumer Prices Index (CPI), despite an increase in the cost of imported raw materials.

The CPI 12-month rate measures the amount prices have changed over the period of a year. Between August 2015 and August 2016 this figure stood at 0.6%, meaning that a basket of goods and services that cost £100.00 in August 2015 would have cost £100.60 in August 2016.

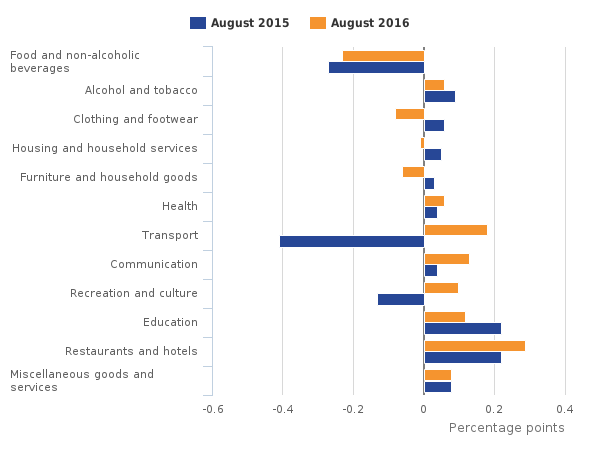

The main upward contributors to change in the rate were rising food prices and air fares, in addition to a smaller fall in the price of motor fuels than a year ago.

This was partly offset by cheaper hotel accommodation prices and smaller rises in the prices of alcohol, clothing and footwear compared to the previous year.

Contributions to the CPI 12-month rate: August 2015 and August 2016:

Core consumer price inflation, which excludes food and energy costs, held steady at 1.3 percent.

The Retail Price Index (RPI), a measure of UK inflation used for a wide range of purposes such as the indexation of pensions, rents and index-linked gilts, fell to 1.8% in August from 1.9% in the previous month. Indexation refers to the pegging of one economic variable, such as pensions, wages, expenditure, to another – usually the inflation rate.

Inflationary pressures are building

The cost of fuel and materials for UK manufacturers rose at their fastest rate since December 2011 in August, up 7.6 percent on a year earlier – led by an 18.9 percent surge in the cost of imported metal.

Despite increasing manufacturing costs, the prices charged of goods leaving the factory only rose 0.8%, less than forecast but still the biggest increase since January 2014.

“Raw material costs have risen for the second month running, partly due to the falling value of the pound, though there is little sign of this feeding through to consumer prices yet,” ONS statistician Mike Prestwood said.

Ben Brettell, senior economist at Hargreaves Lansdown, was quoted by the BBC as saying: “It is clear businesses importing materials from abroad are facing significantly higher costs. These companies must choose whether to absorb the increase or pass it on to consumers.

“Assuming at least some will choose the latter route, this could lead to higher consumer prices down the line.”