UK June unemployment declined by 132,000 compared to May, hitting a six-year low of 6.4%, according to figures published by the Office for National Statistics (ONS). Wages, on the other hand, rose by just 0.6%, the lowest rise in five years.

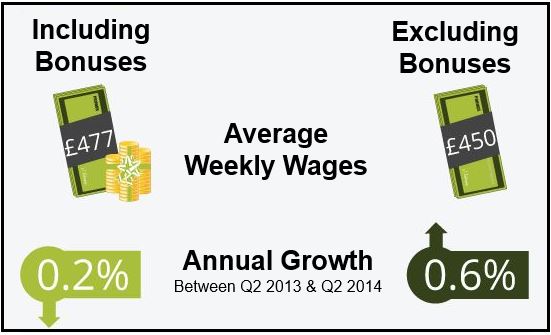

When bonuses are included, wages declined by 0.2% , the first decrease since 2009.

According to the ONS, weak wage increases were due to an abnormally high number of workers postponing bonus payments until the top rate of tax was reduced to 45% from 50% last year, which have distorted year-to-year comparisons.

Below are some highlighted data from the ONS. Unless otherwise stated, all figures refer to Q2 2014 (May-June period):

- There were 30.60 million people in work in the UK, 167,000 more than in Q1.

- The employment rate (proportion of 16-to-64 year-olds in work) was 73% – higher than in Q1 and in 2013.

- There were 2.08 million unemployed individuals – 132,000 and 437,000 fewer than in Q1 and one year ago respectively.

- At 6.4%, the UK’s unemployment rate is the lowest since 2008.

- There were 8.86 million economically inactive people, i.e. 16-to-64 year-olds out of work and not seeking or available to work, an increase of 15,000 compared to Q1, but 130,000 fewer than in Q2 2013.

- Including bonuses, wages in the UK were 0.2% lower than in Q2 2013. Excluding bonuses, wages increased 0.6% compared to Q2 2013. With inflation at 1.9%, British people’s purchasing power is declining.

With wage growth below annual inflation for several years, British workers say they feel poorer today, despite a booming economy. (Photo data source: ONS)

Interest rate dilemma

The Governor of the Bank of England, Mark Carney, says historically-low wage increases combined with labor tightening, rising house prices and a rapidly-growing economy have made it extremely difficult to determine when interest rates should rise.

The Bank of England today reduced its wage growth forecast by 50% for 2014 to 1.25%. When wage growth is low, it means there is still plenty of spare capacity in the economy.

According to the UK’s central bank, spare capacity is a measurement of the economy’s under-performance, usually caused by low business investment in machinery, technology or new hiring.

Economic recovery ‘still fragile’

David Kern, Chief Economist at the British Chambers of Commerce, explains that although the latest unemployment figures are encouraging, weak wage growth suggests that the economic recovery “although on the right track, is still fragile.”

Mr. Kern said:

“The earnings figures confirm that there are no serious inflationary pressures at present, with the strength of sterling also putting downward pressure on inflation. In this environment, the MPC needs to take its time before considering a rise in interest rates, and assure businesses that when they eventually start rising, this will happen slowly and at a measured pace.”

In Q2 2014, UK GDP recovered completely from the shrinkage caused by the global financial crisis and the recession that followed it. The IMF says that the British economy is the fastest growing of the G-7 nations.

Most Brits today are grateful the country opted not to enter the Eurozone. In Q2 the German economy shrank, Italy is in recession again and French GDP has posted zero growth for the last six months.