The UK Leading Economic Index (LEI) was up by 0.1% in July, while the Coincident Economic Index (CEI) remained unchanged, says The Conference Board.

The LEI gives us an indication of near future economic activity, while the CEI looks at the economic situation at the moment. Economists use the CEI to determine where exactly in the economic cycle a country is.

UK July LEI up again

The UK’s LEI for July rose for the 7th month running.

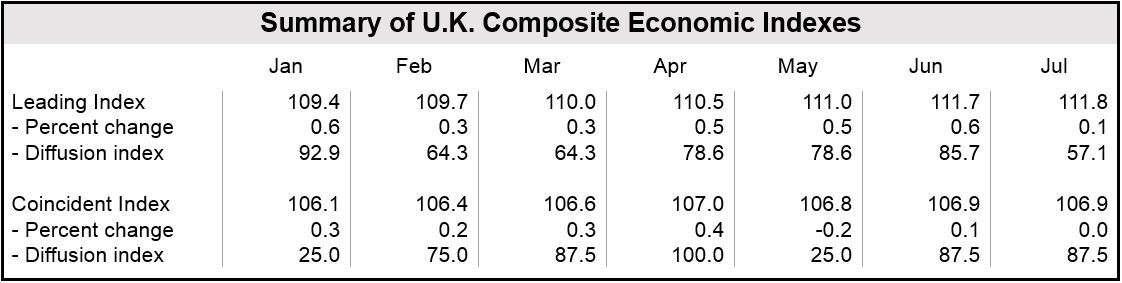

From January to July 2014, the Leading Economic Index (LEI) rose 2.2% (c.4.4% annually), which was less than the 4.9% posted for the previous six months.

Over the last six months, six of the seven components that make up the LEI contributed positively.

For July’s LEI compared to June, four of the seven components contributed positively.

Below is a list of the seven components and how they contributed, in order, with the largest contributor first:

- yield spread (positive),

- order book volume (positive),

- productivity for the whole economy (positive),

- total gross operating surplus of corporations (positive),

- volume of expected output (negative),

- consumer confidence (negative),

- stock prices (negative).

After July’s 0.1% increase, UK’s LEI currently stands at 111.8 (2004=100), after rising 0.5% and 0.6% in May and June respectively.

Over a six-month period to the end of July, the LEI rose 2.2%, with six of the seven components contributing positively.

(Data source: The Conference Board)

UK July CEI unchanged

The Coincident Economic Index (CEI) stayed the same in July compared to June.

During the first seven months of this year, the CEI rose by 0.8% (c. 1.5% annually), which was less than the 1.2% (c.2.5% annually) posted for the previous six months. All four components that make up the CEI contributed positively to the figure.

For just the month of July, all four components also contributed positively to the CEI figure. The four components are:

- employment (positive),

- industrial production (positive),

- real household disposable income (positive),

- retail sales (positive).

Real gross domestic product (GDP) grew by 3.5% (annually) in Q2 2014, compared to 3.1% in Q1.

After July’s (unchanged) result, UK’s CEI currently stands at 106.9 (2004=100), after falling in May by 0.2% and rising in June by 0.1%.

Over a 6-month period ending in July, the CEI rose by 0.8%, with all four components contributing positively.

Ataman Ozyildirim, Director for Business Cycle and Growth Research at The Conference Board, said:

“The Leading Economic Index for the U.K. increased only slightly in July amid weakening production expectations, consumer confidence, and stock markets.”

“Although the six month growth rate of the LEI still points to economic expansion that will be stronger than in continental Europe, rising tensions in Eastern Europe, persistent deflation in the Euro Area, and now the prospect of an independent Scotland pose increasing uncertainty and risks to the U.K. economy.”

(Data source: The Conference Board)

In August, the British Chambers of Commerce forecast that UK GDP will grow by 3.2% in 2014.