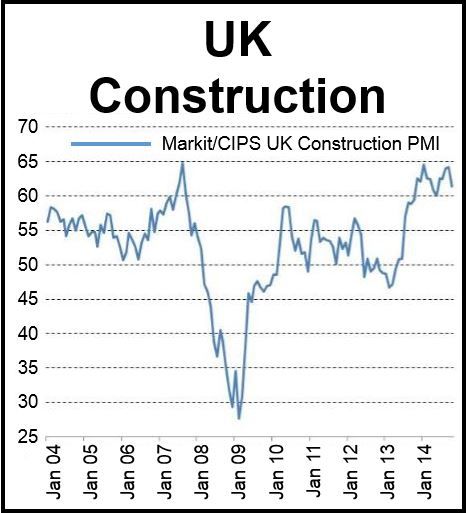

The Markit/CIPS UK construction Purchasing Managers’ Index (PMI) fell from 64.2 in September to 61.4 in October, making it the slowest-growing month since May. The decline was sharper than economists had predicted.

House building, an important driver of construction figures, dipped to its slowest pace of growth in a year.

The figure of 61.4 does not mean a contraction. Any reading above 50 points to expansion.

Construction activity in the UK has increased for 18 successive months, which is the longest stretch of non-stop expansion since the global financial crisis of 2008 hit.

The strongest-performing category was commercial construction, even though it also posted a 5-month low.

Some survey respondents commented that unfavorable market conditions made clients become more cautious regarding development projects.

Of the components that make up the Index, civil engineering activity in October was the weakest (but still grew).

(Source: Markit/CIPS UK Construction PMI)

Despite the slowdown in growth, construction firms continued hiring new staff at a “sharp” pace in October, reflecting strong pipelines of existing work.

Fifty-five percent of respondents expect business activity to increase during the next twelve months, compared to just 9% who predict a reduction.

Senior Economist at Markit and author of October’s survey, Tim Moore, said:

“October’s survey provides the first indication that the chill winds blowing across the UK housing market have started to weigh on the booming residential building sector. Hous building activity still increased at a strong pace overall, but the sharp growth slowdown since this summer reflects the greater caution towards new development projects amid tighter mortgage lending conditions and renewed uncertainties about the demand outlook.

David Noble, Group CEO at the Chartered Institute of Procurement & Supply, said:

“This month the construction sector maintained an impressive growth trajectory and true grit with continuing strong levels of new business, albeit at a slower pace.”

“Though it appears that the euphoria of the last few months is now settling down to a slightly more modest level of expansion, delivery times continue to lengthen and suppliers of raw materials are in high demand, making the completion of construction projects more challenging and showing how the number of available suppliers has not yet reached pre-recession levels.”