The UK economy has suffered “dramatic deterioration” in business activity following last month’s Brexit vote and faces an increasing threat of a recession, according to data released by research group Markit.

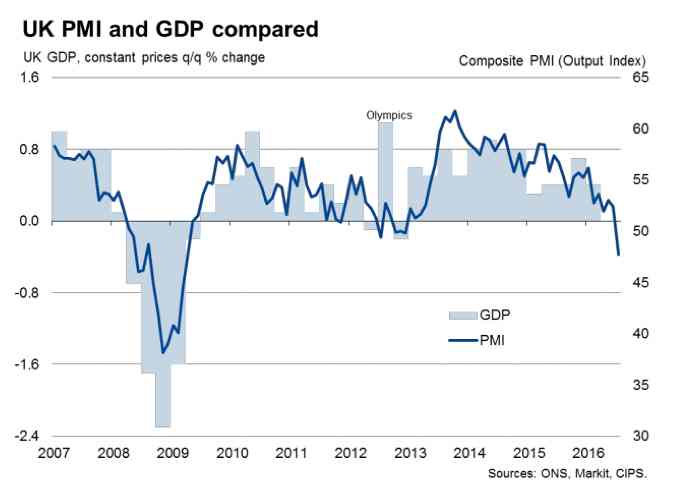

The composite purchasing managers’ index (PMI), a combination of manufacturing and services readings, dropped to 47.7 points in July from 52.4 – against a forecast of 49 – in the steepest decline since the height of the financial crisis in early 2009.

The services index dropped from 52.3 in June to an 88-month low of 47.4 in July, while manufacturing dropped from 52.1 in June to 49.1 in July.

Any reading below 50 indicates contraction.

Many believe that the risk of a recession in the second half of 2016 is now significant.

Markit chief economist Chris Williamson said:

“July saw a dramatic deterioration in the economy, with business activity slumping at the fastest rate since the height of the global financial crisis in early-2009.

“The downturn, whether manifesting itself in order book cancellations, a lack of new orders or the postponement or halting of projects, was most commonly attributed in one way or another to ‘Brexit’

“At this level, the survey is signalling a 0.4% contraction of the economy in the third quarter, though much of course depends on whether we see a further deterioration in August or if July represents a shock-induced nadir. Given the record slump in service sector business expectations, the suggestion is that there is further pain to come in the short-term at least.”

Britain’s new finance minister Philip Hammond told Sky News in an interview: “Our economy has suffered a shock from the referendum vote… that has had an impact on confidence.”

“Our job is to try and restore as much certainty as we can as quickly as we can,” he added.

Bank of England is under more pressure to cut rates from their record low of 0.5%.

James Smith, an economist at ING Bank, was quoted by the Guardian as saying:

“This [report] helps cement our view that the Bank of England will deliver additional stimulus when they release their August inflation report.

“We expect a 25 basis point rate cut and an initial £50-60bn round of quantitative easing (potentially with an additional amount to follow over coming months) to help offset some of the economic impact of heightened uncertainty.”