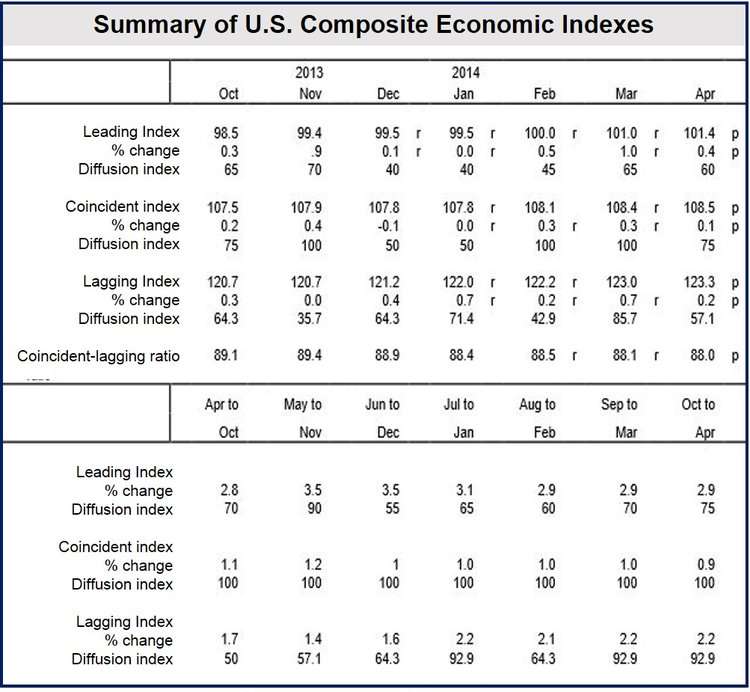

The US economic outlook continued to improve in April as The Conference Board Leading Economic Index (LEI) rose +0.4%, compared to a +1% increase in March and +0.5% in February. The Lagging Economic Index increased by +0.2%, compared to +0.7% in March and +0.2% in February.

Ataman Ozyildirim, an economist at The Conference Board, said:

“The LEI rose for the third consecutive month, driven largely by improving housing and financial market conditions. This latest report suggests the economy will continue to expand, and may even pick up steam through the second half of the year.”

Ken Goldstein, another Conference Board economist, explained that the LEI has remained positive despite abnormally harsh winter conditions which virtually brought the economy to a standstill. During the first quarter of 2014, the US economy grew by just +0.1%.

Goldstein forecasts annual GDP (gross domestic product) growth nearing the 3% range for 2014 if consumers continue spending and businesses accelerate the pace of investment.

US Leading Economic Index (LEI) for April

The US LEI increased in April for the third month running. April’s gain was driven by positive contributions from building permits and the yield spread.

Over the six-month period ending on April 30th, the LEI rose by +2.9% (approx. +6% annual rate), around the same pace as during the previous six months. The strengths among the leading indicators remain more widespread than the weaknesses.

Positive contributors – of the ten components that make up the LEI, five increased in April. They were, in order of the size of their positive impact:

- Interest rate spread

- Building permits.

- The Leading Credit Index (inverted).

- Manufacturers’ new orders for consumer goods and materials.

- Average consumer expectations for consumer conditions.

The negative contributors – in order of the size of their impact, were:

- Average weekly manufacturing hours.

- Average weekly initial claims for unemployment insurance (inverted).

- Manufacturers’ new orders for non-defense capital goods excluding aircraft.

- The ISM new orders index.

Stock prices remained unchanged in April.

In April, the LEI stood at 101.4 (2004=100)

(Source: The Conference Board)

US Coincident Economic Index (CEI) for April

The US CEI edged up slightly in April. The CEI is a measure of current economic activity.

The CEI increased by +0.9% (approx. +1.9% annually) over the six-month period ending on April 30th, 2014, slower than the +1.1% (approx. +2.3% annually) increase registered during the previous six months. However, the strengths among the CEI components remain very widespread.

As the lagging economic index continued to rise more rapidly than the CEI, the coincident-to-lagging ratio was down slightly in April.

Gross Domestic Product (GDP) grew at a +0.1% annual rate during Q1 2014, after a +2.6% increase in Q4 2013.

Of the four components that make up the CEI, three made positive contributions in April. The positive contributors were, in order of the size of their impact:

- Employees in non-agricultural payrolls.

- Personal income less transfer payments.

- Manufacturing and trade sales.

Industrial production made a negative contribution.

The CEI for April stood at 108.5% 92004=100). It had risen by +0.3% in March and +0.3% in February.

US Lagging Economic Index (LAG) for April

US LAG for April stood at 123.3 (2004=100), with three of its seven components contributing positively.

Below is a list of the seven components and how they contributed to April’s LAG:

- Commercial and industrial loans outstanding – UP.

- Average duration of unemployment (inverted) – UP.

- The ratio of consumer installment credit to personal income – UP.

- The ratio of manufacturing and trade inventories to sales – SAME.

- The change in index of labor cost per unit of output – SAME.

- Manufacturing and the average prime charged – SAME.

- The change in CPI for services – DOWN.

According to revised data, US LAG rose +0.7% in March and 0.2% in February.