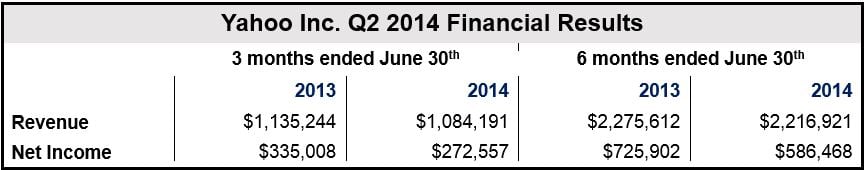

Yahoo Q2 profits fell by 18% to $270 million and revenues also declined, by 3% to $1.084 billion, the Internet giant reported on Tuesday. The weak performance was mostly due to a steep drop in digital display advertising, which fell by 8%. Yahoo’s financial hopes now lie almost entirely on the Alibaba IPO.

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) in Q2 2014 were $340 million, eight percent less than in Q2 2013.

In the past five quarters, four have reported declining revenues. Q2 2014 posted the worst revenues since CEO Marissa Mayer took over two years ago.

Ms.Mayer said she was not satisfied with the company’s Q2 results. Some areas, she explained, did show strength, but their growth was outweighed by declines.

Yahoo Search grew by 6% year-on-year on a revenue ex-TAC basis and nineteen percent in search click-driven revenue.

In Q2 2014, Yahoo’s social, mobile, video and native areas collectively gained almost 90% compared to Q2 2013. A number of displays are still an area of investment and transition, the company added.

Ms. Mayer said:

“In Q2, we saw display revenue decline, further highlighting the fact that we need to work faster to ameliorate the negative trends. I believe we can and will do better moving forward. Overall, I remain confident in Yahoo’s future, our strategy, and our return to long-term growth.”

Was Q1 2014 just a blip?

Ms. Mayer told analysts that Yahoo’s transformation will take several years, and probably a little longer than they had originally forecast. This is a completely different sentiment from the previous quarter when she said Q1’s results were “evidence that we are on the right course.”

In Q1 Yahoo posted its first revenue increase in over a year. Analysts now believe it may have just been a blip. The company continues to fail to persuade advertisers to move from Google and Facebook, which still completely dominate the online and mobile advertising markets.

The price-per-ad plunged by 24% in the second quarter.

Yahoo ad prices, which have declined during the whole of this year, suggest that the company’s new ad offerings are not attracting advertisers. The company had hoped its “in-stream” adverts that appear in the middle of the web pages of Yahoo News and Yahoo Finance would catch on.

Advertisers are shifting from the more expensive graphical banner ads, something that Yahoo has specialized in, towards cheaper adverts that target each individual visitor, an area in which Google and Facebook have thrived.

Once Yahoo was the biggest display ad seller in the US. eMarketer forecasts its market share will fall from 7.1% in 2013 to 6% this year, even though the overall market is expected to grow by 23.8% this year.

(Data Source: Yahoo Inc.)

Yahoo relying on Alibaba’s IPO

Despite gloomy financial results, which have haunted the company for several quarters, the imminent initial public offering (IPO) in the New York Stock Exchange of Chinese online retailer Alibaba will give Yahoo, which has a 22.6% stake in the company, a giant financial boost.

Yahoo had planned to sell 208 million shares when Alibaba is floated. However, the two companies have agreed that the number of shares required to be sold will be only 140 million. It will sell 27% of its Alibaba stake rather than the originally-planned 40%. This means that Yahoo will get less cash from the sale of shares, bit will be able to hold on to stocks that could be worth a great deal more as Alibaba grows.

The Sunnyvale-based Internet corporation stressed that it will return at least half of the Alibaba sale proceeds (net of tax) to investors.

The Wall Street Journal quotes Sameet Sinha, a B. Riley & Co analyst, who estimates Yahoo’s Alibaba stake to be worth approximately $38 billion. After paying capital-gains on the sale of shares this year, it should make about $6.7 billion, which would mean about $3.35 billion for shareholders.

Despite the exciting news for shareholders from Alibaba’s expected IPO proceeds, Yahoo shares dropped 2% in after-hours trading.

Yahoo announced this week it will be broadcasting a string of live concerts by famous artists, including Usher, Justin Timberlake, Kiss, and the Dave Matthews Band.