Fire damage or a loss caused by flooding can imperil a family business. Small businesses operate on thin margins and don’t have access to the same resources that major corporations have to get through tougher times. They can’t survive long without operating revenue, which only gets truer in these uncertain times.

With an unprecedented number of small businesses facing closure, even the widespread supports available, any kind of additional loss like a fire or flood can push a small business over the edge.

If you suffer a physical loss at your business on top of the current uncertainty resulting from the global pandemic, your insurance can be the lifeline that keeps you open. Ideally, business insurance should pay for structural damage, lost contents, inventory, and equipment, and potentially lost profits. Before you start your commercial damage claim, find the answer to these important questions:

1. Do You Need Help with Your Claim?

If your business is going to get back up and running, you’re going to need all the funds you can get from your insurer. To make sure that happens, you’ll need to be accurate, thorough, and timely when it comes to completing and filing all the paperwork. It can also mean negotiating with the insurer when they try to mitigate their own losses.

For major claims, hiring an insurance lawyer can help you approach your claim with confidence. Insurance law firms like Virani Law will negotiate your commercial damage claim with the insurer’s loss adjusters. They combine legal expertise with their knowledge of insurance claims, and if need be, can also deal with dispute resolution or legal actions related to the claim.

2. Do You Own the Premises?

Unless your business owns the building in which its located, coverage for structural damage will not be part of your commercial damage claim. Instead, that will be dealt with by the property owner, which could mean that you have less control over the process.

One of the best things you can do for yourself if you do not own the property is to stay in communication with the landlord so that you can coordinate rebuilding efforts with your own claim. Try to get copies of any reports that the landlord gets in the event your own insurer does not come in and do inspections.

One complication to keep in mind: sometimes insurance policies have a time limit for Guaranteed Replacement Cost coverage (coverage that guarantees you have enough funds to replace lost contents at the current market rate). If the structure is not rebuilt before that period expires, you may need to find an alternative storage solution so that you can get those items replaced in time.

3. Do You Have Business Interruption Insurance?

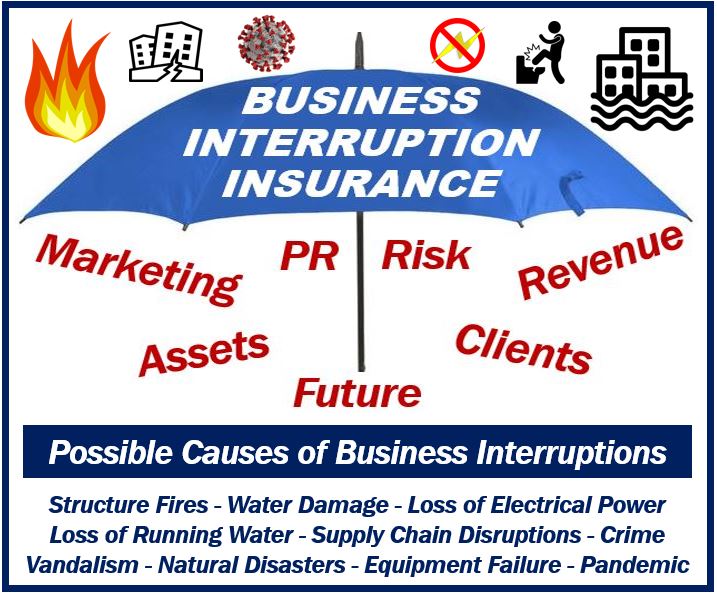

Check your insurance policy for details about business interruption insurance. It’s a type of coverage that can be added to commercial property insurance, and while not every business has it, it can really make the difference between reopening and closing your doors forever.

Business interruption insurance covers lost business income during the period of restoration (where business income is your net profit before taxes) as well as ongoing expenses such as payroll, loan payments, and other obligations that don’t stop just because you can’t continue to operate.

Your commercial insurance claim is essential if you want to reopen your family business. Working with an insurance lawyer could just save your business.

Interesting related article: “What is Insurance?“