Back in 2014, Australia’s Leading Economic Index was rising by 0.4%, indicating an improved future outlook. However, in 2019, household debt is more than 200% of the average income making Australia’s household debt one of the highest in the world.

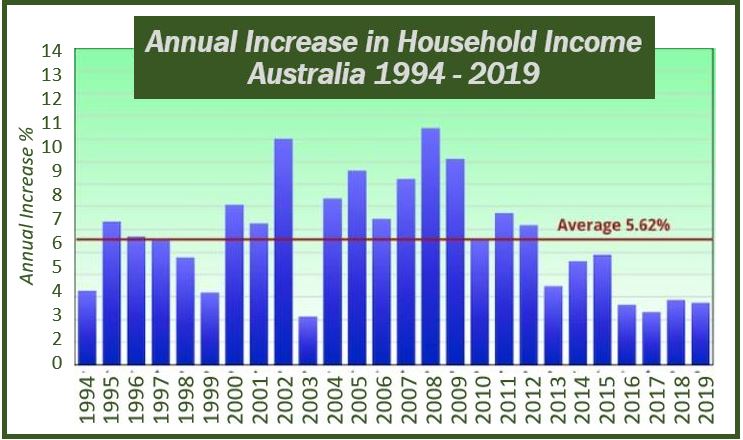

Data shows wealth and income are shifting away from households and individuals into the corporate sector at an accelerating rate. After adjusting for inflation, what seemed to be an increase in income per adult turns out to be a decrease.

Wealth per person is declining in Australia

Total household wealth in Australia declined by 2.38% in 2018, which amounts to a decline in $12,190 per adult. Since the end of 2017, the total decline per person is $14,900. Household savings have also taken a dive since 2016.

What’s going on, Australia?

Australia is seeing a strange pattern in the economy that doesn’t make sense. However, some say the drop in household wealth and income comes from tax levels, wages, penalty rates, government spending, and infrastructure investment designed to maximize corporate profits and minimize household incomes.

Families are struggling

Regardless of why Australia’s economy is in trouble, families are struggling. Fathers are under pressure to work long hours and care for their children, but often need to choose one or the other. It’s difficult for fathers to be an involved parent when they need to spend a full day at work to earn enough money to support their family. Still, fathers are doing a bigger share of caring for their kids than ever before, mostly because mothers are working, too. By 2016, 66% of Australian households had two working parents.

Although a federal leave program gives new fathers two weeks of paid leave, only 25% of fathers claim this time off. The most likely reason is the low pay rate. The government will only pay fathers the national minimum wage, which means a huge pay cut for some. The limited time off (2 weeks) presumes new fathers will play a limited role in caring for a young child, and employers won’t acknowledge a father’s need for more time to care for their kids.

Despite the government’s good intentions, fathers still need to choose between caring for their kids or bringing home the paycheck to support their entire family.

Financial struggles can tear a family apart

Fathers know they can’t afford to take a smaller paycheck and are reluctant to do so for the sake of their kids. They don’t want to create more financial struggle or more debt than they’ve already got.

Financial trouble is a source of frustration, pain, and arguments among families. Spouses are especially prone to arguments about money. According to Investopedia, sex and money are the top two reasons couples fight. When it comes to money, there’s never enough and spouses disagree on how it should be spent. Marriage lawyers have even published a booklet citing financial matters as a major cause for broken marriages.

Unfortunately, money troubles can break a family apart. For spouses getting a divorce, the money troubles don’t stop once the paperwork is filed. Working with a family lawyer to split financial assets and property can perpetuate the financial frustrations and make one party feel like they’re not getting enough.

It’s widely known that money troubles ruin marriages. Debt can be especially crushing. In the United States, studies have shown that large amounts of debt cause couples to fight more about money. However, when couples work together to eliminate debt, their relationship shifts. The peace of mind they feel from eliminating debt is carried over into their relationship. Suddenly, there’s space for the relationship instead of a giant ball of frustration.

Australia’s household debt points to a high cost of living

Eliminating debt is important, but it doesn’t solve the problem of declining household income and rising poverty level. According to The Guardian, the Australian Council of Social Service estimates 38% of those living below the poverty line are working, and 15% of all part-time workers live in poverty.

Perhaps the cost of living has risen in ways that aren’t so obvious, as in taxes and other rising costs. It’s unclear exactly why Australia is struggling, but hopefully a solution will become clear in the near future.