Whether people are keen or reluctant to buy and sell stocks depends partly on their brain activity. Scientists in Germany, Switzerland, and the USA have developed a model that helps us understand stock-purchasing behavior for the first time. In other words, it shows us that the degree of activity in a region of the brain influences stock trading behaviors.

Blue chip stocks, for example, are good long-term investments. Blue chip companies are those that we consider as being reliable – they have a history of good performance.

Then, why do Germans shy away from investing their money in stocks, including blue chip ones?

In this new study, Alexander Niklas Häusler and colleagues set out to find out whether brain activity determines stock purchases. Häusler is a doctoral student at the Center for Economics and Neuroscience, part of the University of Bonn in Germany.

Brain activity – the anterior insular

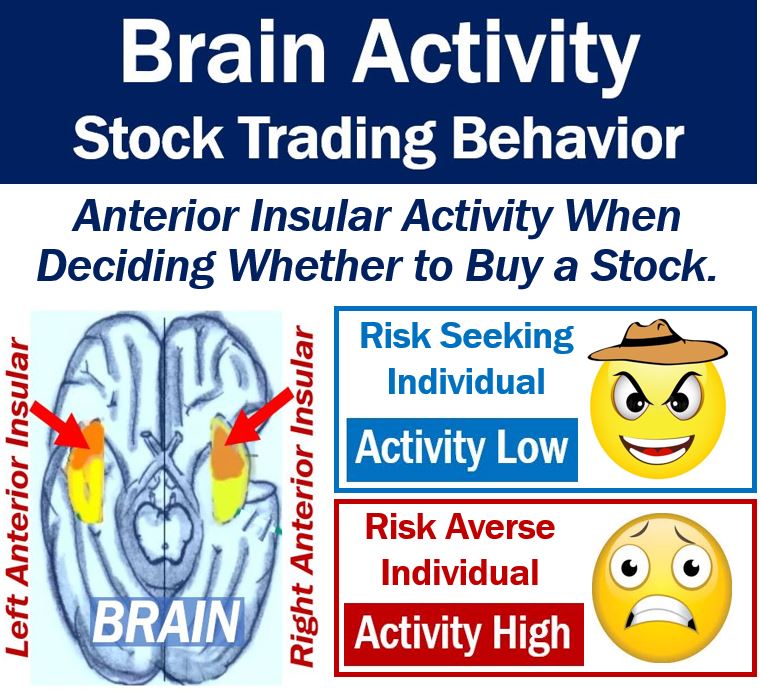

The researchers found that the cortical regions of the anterior insular were more active among individuals who never traded stocks.

The same region among experienced stock traders, on the other hand, was less active.

The researchers wrote about their study and findings in the prestigious Nature journal Scientific Reports (citation below).

The study

The scientists gathered and analyzed data on 157 male participants. They were between 29 and 50 years of age.

Häusler explained:

“In this age group, we can assume that all participants have gained at least some experience with financial investments and that their decisions are more realistic.”

They limited the study to just male participants because they wanted to exclude gender-specific effects.

Measuring brain activity using fMRI

First, the participants filled in a questionnaire. It had questions about their investment behavior and their economic situation.

It also asked them about their willingness to take risks. In other words, it asked them whether they had debts, traded stocks, and how risk-seeking or risk-averse they were regarding financial instruments.

A risk-averse person does not want to take risks. Risk-seeking people, on the other hand, love risky investments. We also call them ‘risk loving.’

Then, they underwent an fMRI scan. fMRI stands for functional Magnetic Resonance Imaging. This type of scan detects changes associated with blood flow. Imagine that MRI scans are still photographs while fMRI scans are video recordings.

The participants answered a question while undergoing the fMRI scan. The question was: “Should I buy a safe bond or perhaps make twice as much profit on a stock?” They answered the question by pushing a button.

The outcome was then displayed, after which the participants received the final sum of the experiment.

According to the University of Bonn:

“To allow for an adequate statistical evaluation of the results, each choice was repeated by the participants a total of 96 times.”

Brain activity was a factor

The experiment demonstrated that the anterior insular played an important role in the participants’ behaviors.

The cerebral cortex is the furrowed outer layer of gray matter in the brain’s cerebrum. It is associated with voluntary movement, learning, memory, and the expression of individuality, i.e., higher brain functions. The anterior insular exists in both hemispheres of the cerebral cortex.

The right and left variants of this region of the brain were particularly active among risk-averse participants. Particularly when they made decisions regarding purchasing stocks and pushed the button.

Regarding the anterior insular cortex, Häusler said:

“The anterior insular cortex acts like a stop sign and thus cautions against risky decisions.”

Among the participants who had already purchased stocks in the past, the structure was considerably less active.

Brain activity and reward outcomes

Contrastingly, there was a tiny difference between conventional investors and new stock buyers when their stock trading was very profitable.

It seems, therefore, that brain activity relates to the actual behavior rather than the reward outcomes.

Häusler said:

“The attitude towards riskier or less risky decisions showed a stronger correlation to the actual behavior than the reward outcomes.”

The two factors, i.e., risk tolerance and risk optimism, are important for this attitude. People with more risk optimism strongly believe that investing in stocks results in big profits.

If you enjoy the thrill and excitement of risky decisions, you have a high-risk tolerance.

Both factors play a vital role in the relationship between the purchase of shares in real life and the anterior insular.

They act as mediators between real-life stock trading behavior and brain activity.

Two important factors

The researchers’ risk models showed that two factors, apart from education and income, influenced stock purchase decisions:

– Risk tolerance.

– Risk optimism.

Senior author, Prof. Dr. Bernd Weber, head of the University of Bonn’s Center for Economics and Neuroscience, said:

“The exciting thing about our study is that it combines laboratory experiments with behavior in real life.”

“We are able to demonstrate that the collection of psychological and neuroscientific data helps us to better understand everyday behavior.”

Prof. Dr. Camelia M. Kuhnen, from the University of North Carolina’s Kenan-Flagler Business School, was also a co-author. Häusler spent two months with Prof. Dr. Kuhnen in Chapel Hill analyzing the data.

Dr. Sarah Rudorf, from the University of Bern in Switzerland, worked closely with researchers from the University of Bonn gathering data.

The Frankfurt Institute for Risk Management and Regulation (FIRM) funded the study.

Citation:

‘Preferences and beliefs about financial risk taking mediate the association between anterior insula activation and self-reported real-life stock trading,’ Alexander N. Häusler, Camelia M. Kuhnen, Sarah Rudorf, and Bernd Weber. Scientific Reports, volume 8, article number: 11207 (2018). Published: 25 July 2018. DOI: https://doi.org/10.1038/s41598-018-29670-6.