You work all of your life and then you retire.

But once you stop working, how will you survive and maintain your lifestyle without a steady income?

This question has been pondered by nearly every worker at one point or another. And even for the people who started planning for retirement early, maximizing their annual contributions to their 401k plans and avoiding the temptation of dipping into those retirement savings- they still may struggle with the logistics of retirement.

It can be a challenging proposition in the best of times, but with the recent pandemic which caused 37.4% of people between the ages of 45 and 64 to either lose their jobs or to lose a portion of their pre-pandemic income, it can seem like a daunting task. The pandemic also resulted in 52% of people reporting that they had to dip into their long-term savings since the pandemic began.

Now more than ever, you need to be resilient, flexible and resourceful in planning your retirement strategy.

If you develop and stick with a well-thought out plan, you can ensure that you don’t outlive your savings.

Follow these five steps

Here are five steps which can help you build a steady retirement income:

-

Purchase High Dividend-Paying Stocks

The best strategy for securing a retirement income stream is to invest funds in items which pay out cash payments over time. When planning for your retirement, choosing your investments between a mix of stocks and bonds is a great option, with stocks offering the opportunity to grow wealth over time, while bonds provide securities – but with lower returns than stocks.

Dividend-paying stocks allow investors to get higher returns but at a lower risk. Many companies pay out dividends to shareholders as a reward for investing in their business. These payments usually come as cash payments paid out weekly, monthly, quarterly, or annually.

Dividend stocks are designed to preserve principal amounts and provide reliable retirement income over the long-term.

Global dividends are forecast to rise to $1.39 trillion in 2021, up slightly from previous estimates to reflect a stronger-than-expected recovery in company payouts. Dividends had briefly slumped in 2020 against the backdrop of the COVID-19 pandemic as regulatory constraints and government pressures restricted payments.

-

Purchase Real Estate

Investing in real estate can be a lucrative investment with massive potential to provide you with sufficient funds during your retirement. For starters, once you owe your home and have paid it fully, you no longer will be required to pay rent (or a mortgage). While you still need to upkeep your property even after it is paid off, eliminating rent and mortgages is the first step to a happy retirement.

Real estate can generate other forms of income such as rent and appreciation (when you sell or flip a property for profit).

Purchasing a property and renting it out allows you to receive a monthly income from a tenant, while also providing the service to them of a roof over their head. It is not all fun and games though as renting properties can have plenty of drawbacks including the actual management of the property, providing home repairs in a timely fashion and ensuring you receive payment from your tenants in a timely manner.

Flipping houses, also known as wholesale real estate investing, is the process of purchasing a property with no intention of living in it, but rather with the intention of selling it for a financial gain. The hope is to buy low and sell high. Oftentimes, owners will provide upgrades to the property after initially purchasing it in order to increase its value quickly.

Whether you rent out a property or purchase properties with the sole intention of flipping them, utilizing real estate in your retirement strategy can pay off lucratively. As Mark Twain once said, “Buy land. They’re not making it anymore.”

-

Purchase an Annuity

Purchasing an annuity is one of the smartest and oldest strategies for retirees. If you want to supplement your retirement savings for the rest of your life, an annuity can be one of your best options.

Annuities are investments which convert your savings into income payments for a specified period of time – usually for the rest of your life. You go into contract with an insurance company where you get a guaranteed income in exchange for a lump-sum payment. The amount you receive is dependent on your initial investment, the rate of return your investment will receive annually, and the term period for which you will receive income.

Immediate annuities are designed for the retiree to begin receiving income immediately, while deferred annuities allow the participant to invest immediately but defer receiving regular income at a later date.

While annuities are an amazing option for most retirees, it is crucial to read the fine print in the contract prior to signing, as there can be high fees or surrender charges if you require access to the full amount of your funds in the event of an unexpected event or emergency.

Once you sign up for an annuity, your principal investment is locked in, and it will become very expensive for you to access it. Finding a trusted fiduciary advisor can save you a lot of time and trouble. If you plan on shopping for an annuity, personalized annuity rate comparisons.

-

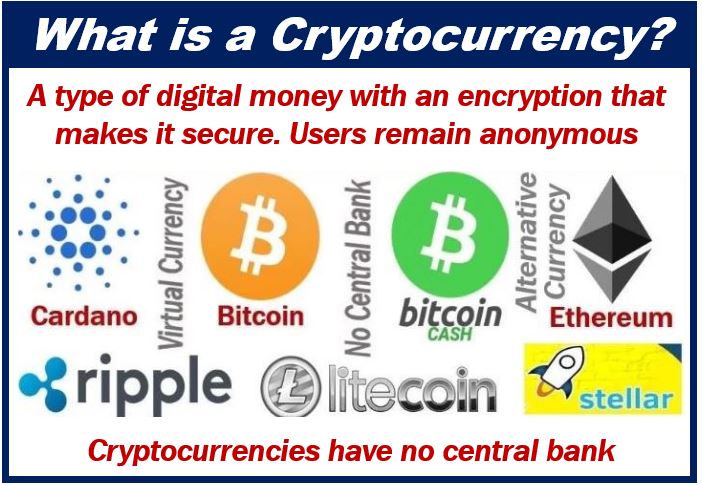

Invest in Cryptocurrency

Crypto investing is an enticing but risky option to include into your retirement strategy due to the volatile swings in value of cryptocurrencies.

A cryptocurrency is a digital or virtual currency that is secured by cryptography. Many cryptocurrencies are decentralized networks based on blockchain technology – a distributed ledger enforce by a disparate network of computers. Cryptocurrencies face criticism for a number of reasons, including their potential use for illegal activities, exchange rate volatility, and vulnerabilities of the infrastructure underlying them. However, they also have been praised for their portability, divisibility, inflation resistance, and transparency.

Many investors do not consider cryptocurrencies to be real investments because they do not generate actual cash flow. A cryptocurrency works more like gold, with the value constantly in motion. To make money, someone has to pay more for the currency that you did. To lose money, someone has to pay less for the currency than you did.

Cryptocurrencies have begun to be offered by some 401K providers as an option to include in your retirement portfolio.

-

Build a Bond Ladder

A bond ladder can be a valuable tool for providing security in retirement. A bond is essentially a loan that you give to a government entity, a municipality, or a corporation in return for regular interest payments.

A bond ladder is a strategy which involves purchasing several small bonds with varying maturity dates as opposed to one larger bond with a single maturity date. In order to build a bond ladder, you purchase several bonds in your account with staggered maturities. Choosing the bonds to build your ladder requires you to give some thought to your risk tolerance, income needs, investable assets, and the time period you are seeking.

The greater the number of bonds in your bond ladder, the more diversified your portfolio will be. This is advantageous so that if any one bond fails, the rest of your bond ladder will keep your portfolio secure.

Using some of these five strategies (or all of them) can get you closer to living your golden years with no financial worries.

Interesting related article: “What is a Pension?“