For businesses, it is necessary to amplify user experiences while simplifying transactional interactions. While exceptional products, heft discounts, and brilliant post-sales services are extremely desirable virtues, seamless payment options are equally important, when it comes to customer acquisition and retention.

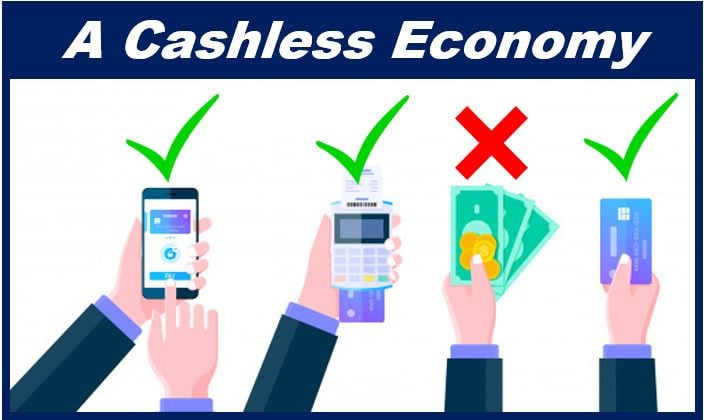

With the digital economy slowly becoming an inseparable part of the global financial landscape, your business must immediately reconsider the existing payment methodologies and accommodate contactless card machines and systems for reaping the diverse benefits of this rewarding transition.

Here are the crucial reasons why businesses must immediately consider diverse forms of cashless payments:

-

Improved Customer Experience

In this highly contested arena, time is a matter of essence. No customer would, therefore, want to stand on queues for placing orders or receiving the concerned products and services. While cash is and will always be a handy way to get things moving, a majority of businesses must incorporate separate counters for mobile payments.

Based on validated surveys, almost 43 percent of regular shoppers in the US. prefer checking out instantaneously by scanning QR codes for making payments quickly and efficiently. Not just that, several companies are already setting up cashless offline and online stores, just to cater to specific payment modes.

-

Better Accounting Experience

Cash-based transactions are harder to manage as you need to have dedicated accountants for tabulating funds right down to the last cent. In case of discrepancies, it becomes even harder to identify the source of the issue, even with cash receipts available for reference. Digital payments like mobile-centric transactions, app-based payments, bank transfers, and payments made via contactless card machines are way easier to manage and keep the records of.

Not just that, cashless transactions minimize chances of errors as you can always take a dispute up with the bank or the transaction co-ordinator. Everything is initiated over the digital platform and therefore, is tabulated. Lastly, if you prefer real-time accounting info while keeping a keen eye on the existing cash flow with these no-contact payment schemes, it becomes easier to take better calls for improving organizational bottom-line.

-

Minimized Risk

Having cash on you attracts unscrupulous and unwanted attention. Businesses that keep cash stashed within the store premises often expose themselves to thefts, burglaries, and other related threats. Not just that, the risk of erroneous balance sheets is also there, provides the employees aren’t attentive enough with the accounts.

Going cashless, therefore, can help mitigate these risks as the money gets deposited directly into the business account without leaving a decipherable trail of cash.

Cashless Payments: Now or Later

2020 has been a strange year for most businesses. Moreover, with people refraining from interacting across the physical realm courtesy of the lingering pandemic threats, this might just be the right time to adopt a cashless transaction module, on a larger scale.

However, the shift might not be instantaneous due to customer inhibitions and lack of actionable technological intelligence, a gradual cashless evolution is what would work best for businesses, especially when it comes to future-proofing the proceedings.

Interesting related article: “What is a Digital Wallet?“