Exchange-Traded Funds (ETFs) had been on the rise since the 2008 financial crisis. Most of the institutional investors and retail traders are content with these instruments due to several important factors. At the same time, many reputable brokerage brands had included ETFs or CFDs based on ETFs into their instruments list, which had further stimulated trading/investments with these assets.

Here are some of the most important advantages of trading ETFs, with an emphasis on the offer provided by ClickTrades, one of the highly praised European trading brands active. The ClickTrades brand is operated by KW Investments Limited, which is authorized and regulated by the Seychelles Financial Services Authority (license number SD020).

Better liquidity conditions

When trading CFDs on ETFs, the exposure is not on a single asset, but on a broader set, which means liquidity conditions are much better. Because of this, pricing will be more accurate and both traders and investors can get in and out of the market, without requotes or delays. Liquidity is a critical aspect, especially in large trading volumes.

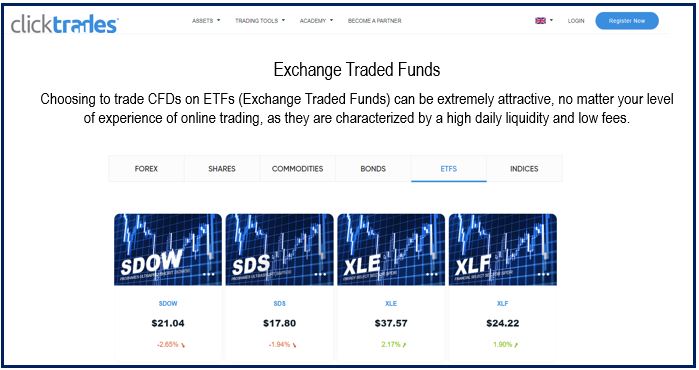

With the ClickTrades CFDs on ETFs offer, traders have the ability to trade on some of the most demanded and most liquid ETFs from the United States and other popular markets. The ClickTrades brand is fully aware that traders need access to a comprehensive list of ETFs and because of that, its varied CFD instrument list enables them to gain exposure on ETFs like DIA, SPY, SDOW, SDS, QQQ, XLF, and many others, with up to 1:100 leverage.

Lower trading costs

Better liquidity comes in hand with lower trading costs. Spreads will be tight and as seen with ClickTrades, commissions on trading CFDs on ETFs are 0.

Retail traders generally ignore the compound effect of high trading costs, but in reality, this is a critical aspect to consider, because it can alter meaningfully the level of profitability. With liquid ETFs, this issue is no longer a concern, considering the associated relatively low trading costs.

This is also facilitating the use of short-term strategies like day trading. In a volatile market, anticipating the long-term direction of the price is a hard task, even for the most experienced individuals.

Due to increased risk, most market participants prefer to get involved just in the short run, in order to negate some of the risks relevant to an extended period exposure.

Efficient technical analysis

Technical analysis works well on liquid instruments. This happens because behind each price move there is a lot of liquidity, and it will take a lot more to generate a counter-trend reaction.

Trading properly generally implies following the dominant market direction and traders can do that by using technical analysis. Like FX and indices, ETFs are instruments that bode well with technical analysis.

ClickTrades had developed a proper ecosystem for trading CFDs on ETFs, integrating a proprietary trading platform facilitating technical analysis strategies. To further support customers, the broker provides access to daily market reviews, analyst recommendations and coverage for premium technical analysis tools like Trading Central.

As a result, traders can spot reliable support/resistance levels, read the price action context, and thus understand how the majority of market participants are trading any given instruments, and by this, enabling them to spot new opportunities.

Trading the broad market performance

Since an ETF is a basket of correlated assets, a trader or investor will gain exposure on the broad market or at least a particular sector of the market. In the traditional stock trading, one should have created a portfolio of uncorrelated assets and at the end of the day, some would have performed better and others not, leading to stable growth in the total asset value, if proper risk management would have been in play.

With ETFs, it is important to spot a market sector or industry that will perform well and gain exposure to stock related to it. Their performance will be different, but overall, the value of the ETF will rise/fall according to how the sector/industry performs.

In 2020, ETFs are demandable, which correlates to the fact that passive investing had surpassed active investing since a year ago. This reaffirms ETFs have an edge over the traditional stocks, in particular when it comes to liquidity, and their ability to help track the broad market performance. With ClickTrades, the exciting world of online CFDs on ETFs trading is open to investors, who keep demanding more exposure to those instruments.

Risk Warning: The materials contained on this document are not made by ClickTrades but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Trading CDF’s involves significant risk of loss

Video – What is a Trader?

Interesting related article: “What is a Trader?“