When the pressure of paying back debts and filing income tax becomes too much to bear, the thought of closing your business and filing for bankruptcy can be the only option. After all, you have to save something for your future and take care of the ongoing necessities while balancing your lifestyle.

Although bankruptcy can be the practical approach to end all the woes, many people dread it for the legal proceedings. Rest assured, an excellent bankruptcy attorney will help you in understanding the process and getting the best results. However, you cannot avoid it if you wish to start fresh. Here are a few insights about this process to help you navigate this journey with a bit of preparedness.

Types of Bankruptcy

You can file for bankruptcy under chapters 7 and 13. In the first case, you get liquid cash for your assets to help you clear your debts. Chapter 13 deals with mostly restructuring. In this, debtors agree on a new payment structure.

If you file for chapter 7 bankruptcy, your business will cease to exist after the completion of the process. Apart from chapters 7 and 13, another common type of bankruptcy filing is chapter 11. Under this, businesses can operate by regrouping financially and clearing their debts.

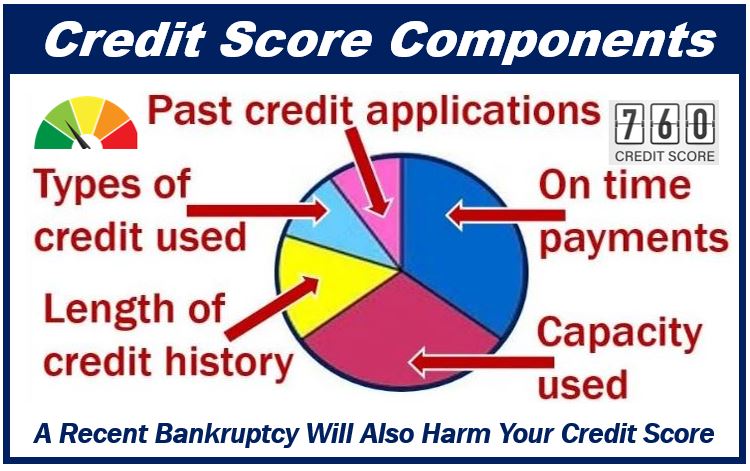

Effect of Bankruptcy on Credit

One of the main risks of filing bankruptcy is losing a solid credit score. It will reflect in your credit history for about ten years. As a result, if you seek lending options, you may face challenges. You may also have to disclose it when you hunt for jobs, fill up medical forms, or other critical documents.

Even if your credit recovers, you will need to report it throughout your lifetime. You can also face difficulty at the time of buying a house, car, or paying for your kid’s higher education. For big purchases, you may have to pay in cash.

Long-drawn Process

You have to be thorough with the documentation and financial details. Sometimes, you may have to appear for a legal proceeding, stopping other essential works. It means you can expect income loss also.

Since there will be public records, anyone can get to learn about your bankruptcy. It would be best if you listened to your attorney and court while following this process. So, if you didn’t hire an attorney, consider getting in touch with one soon. Attorneys will have their charges. So it is important to keep the expenses in mind.

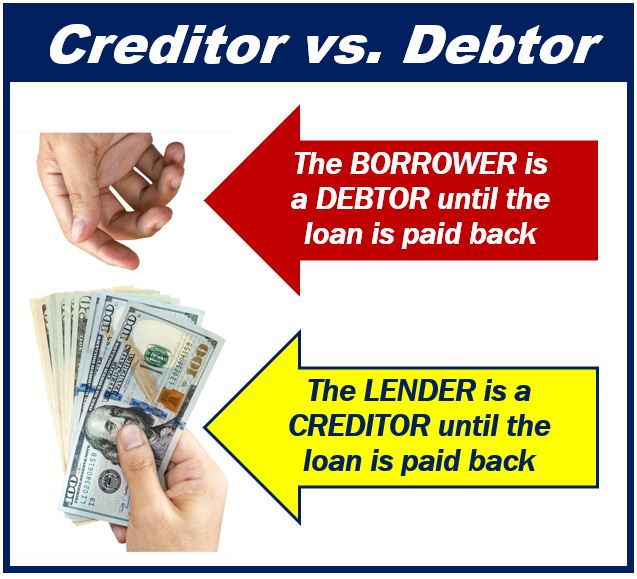

Creditors and Discharge Request

You have to mention all the creditors and the amount you owe to them at the time of bankruptcy filing. After 60 days, creditors can still have a chance to contest your discharge request and file a lawsuit also. However, they have to do it within the deadline. If they don’t, they cannot challenge you to clear their debts.

These are only a few issues. There are many other things also that you should know before taking this step. Although this decision can be helpful in many cases, you still need to have an experienced lawyer’s guidance to overcome all the hurdles and be successful in your endeavor.

Interesting related article: “What is a Creditor?“