Investors have always looked up to debt funds as a good hedge against market volatility. However, debt funds also arouse some doubts in their minds at times, discouraging them from investing in the same. Most investors try their best so that their portfolio does not have to bear the brunt of a market meltdown.

In such a scenario, FD (fixed deposit) is considered to be a preferred investment tool. Many investors see the two on equal footing, while some believe FD has an edge over debt funds, thanks to the former’s assured returns. However, if you are curious to know more about debt funds vs FD, both are actually quite different in many aspects, including liquidity, risk, rate of returns, investment options, and taxation.

What are debt funds?

A debt fund invests a major portion of your money in fixed-income securities such as government securities, debentures, corporate bonds, and other money-market instruments. It is a relatively stable investment option that can aid wealth generation, with a low-risk factor.

What are fixed deposits?

A fixed deposit is a type of account opened in a bank where you can get an assured rate of interest by keeping the funds for a particular period. If you want to get an assured return from funds that are otherwise idle, this is the best option.

Debt funds vs fixed deposit:

a. Variety

When it comes to fixed deposits, you can hardly expect variety. Only the interest rate differs, for example, a small cooperative bank may offer higher rates, while a major bank will pay a lower rate. This is also because smaller banks involve more risk.

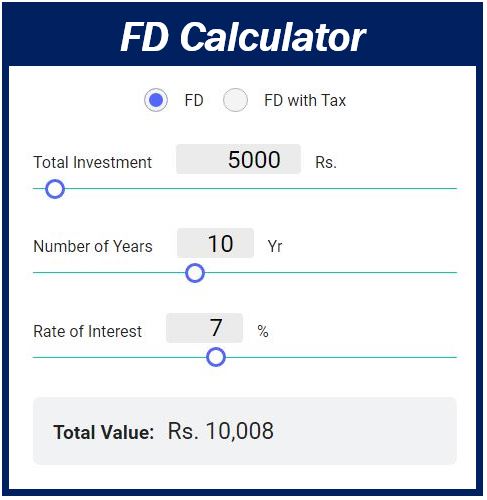

Do have an estimate of your return with the help of an FD calculator before investing. On the other hand, debt funds promise a lot of variety- you can invest in government bonds, PSUs, money market, corporate debentures, a mix of equity and debt, etc. For each type of fund, you will have different risks and returns.

b. Tenure

Fixed deposits are, as the name implies, for a fixed period of time, with the range varying from a week to five years. On the other hand, debt funds are open-ended, with no fixed tenure. You can hold them for as long as you like, be it a day, a week, ten years, and on.

c. Liquidity

Debt funds are more liquid as compared to fixed deposits since you can redeem them at any point. As far as fixed deposits are concerned, you can make premature withdrawals, but you may get a lower interest rate on the amount you have withdrawn.

d. Interest rate risk

In the case of a fixed deposit, the interest rate is fixed for the tenure of the deposit, irrespective of the changes in the overall rates. In a debt fund, however, returns are prone to changes based on the movement of interest rates. With the rise in interest rates, you will find that yields of instruments in your portfolio have taken a hit. Consequently, this brings about a fall in net asset values (NAVs) and thus, your returns. Likewise, NAVs will go up if interest rates fall.

e. Other risks

A fixed deposit involves making an investment in only one entity, the bank, and hence, you are aware of the risks. Smaller the bank, higher the risk, and vice versa. A debt fund, on the other hand, invests in a variety of instruments, so gauging the risk is quite a challenge.

f. Taxation

Fixed deposits and debt funds come with different taxation structures. Interest income from fixed deposits is added to your taxable income and you are supposed to pay income tax according to that income. As far as debt funds are concerned, you have to pay capital gains tax. If you opt to redeem debt funds before three years of investment, the gains will be added to your income, with you having to pay income tax as per your slab rate.

If you hold it for more than 3 years, the tax on debt funds is 20% with indexation, and 10% without indexation. Indexation adjusts the purchase value of your investment for inflation, bringing down the capital gain, and hence your tax burden.

Going by general records observed so far, the best debt funds promise better returns as compared to fixed deposits. As far as taxes are concerned, debt funds could be a more lucrative choice, especially if they are held over the long term. Gone are those days when fixed deposits were the most popular long-term investment goal.

Thanks to the demonetisation in 2016, mutual funds could make the most of the reduced deposit return rates. Besides, the availability of tax-saving mutual funds catapulted mutual funds into great prominence. When debt funds began offering higher returns with liquidity, many low-risk investors settled for it, giving FDs a miss. That being said, you should also consider that in the case of fixed deposits, the returns you earn will not be affected by the market highs and lows. So typically, when it comes to times of low interest rates in the economy, debt funds outdo FDs by a significant margin.

When it comes to inflation adaptability too, debt funds have an edge over FDs. You must be aware that inflation dampens your savings, by bringing about a loss of currency value. Despite the risk, debt funds have the potential to cope with inflation. For example, if you have invested in FD at 6% interest rate and the inflation rate is 5%, the adjusted return would barely be 1%. Thus, one can generally expect higher returns from debt funds. Nevertheless, you should make the choice of FD vs debt fund on the basis of your risk appetite, income tax slab, time horizon, and investment goals.

Interesting related article: “What is an Investment?“