As asset holders, homeowners have many unique opportunities for leveraging the value of their property to secure loans for a range of different purposes, from consolidating debt to undertaking large renovation projects.

Home equity loans and refinancing are both powerful financial tools that help free up cash using the value of your home, but they each offer distinct benefits, but getting the most out of these loans means understanding which loan is best suited to your needs. And that means sorting out the differences between related lending options like home equity loans and refinancing.

What is a Home Equity Loan?

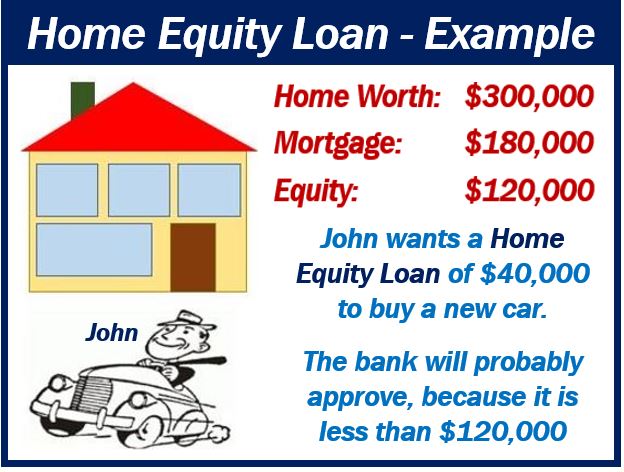

Home equity loans are additional loans homeowners take out against the value of their property, which is why they are often referred to as second mortgages. This financial instrument essentially allows you to borrow against the value you have built up in your home over years of paying your mortgage.

Even if you aren’t finished paying off your mortgage yet, you still own a percentage of the property, and you can use this to free up as much as 85% of the value.

One of the reasons home equity loans in Ontario and other booming real estate markets are so popular is that they also give you immediate access to the increase in market value your home has seen since you purchased it.

There aren’t a lot of restrictions on what the funds can be used for, but most homeowners put the money toward:

- Debt consolidation

- Repairs

- Renovations

- Tuition payments

- Auto repairs/payments/purchases

Because these are secured loans negotiated by professional mortgage brokers, they often come with significantly lower interest than credit cards, payday loans, auto financing, or even student loans, making them a smart way to borrow at lower rates.

What is Refinancing?

The key difference between home equity loans and refinancing is that home equity involves a second loan on top of the mortgage, while refinancing involves a loan that replaces your original mortgage.

People choose to refinance their homes for some of the same reasons they take out home equity loans (debt consolidation and renovation being the big ones) but there are other reasons to refinance — for example, if mortgage rates have dropped since you got your mortgage and you want to take advantage of these rates to secure lower payments.

Both of these options can be effective ways of using the value of your home strategically, but if you want to know which is best for you, make sure to get in touch with a mortgage broker specializing in residential clients who can advise you about which is best for your situation.

Unlike other financial institutions, mortgage brokers work directly for you, and aren’t in the business of selling their own products. Instead, they work to connect you with a variety of lending options.

If you need access to liquidity in the coming year and are thinking about borrowing against your home, get in touch with a mortgage broker to learn more about home equity loans and mortgage refinancing.

Interesting related article: “What is a Home Equity Loan?”