In a perfect world, saving money for rainy days would have been ideal. But, in reality, that’s a lot harder to do, especially with bills piling up monthly and paychecks not enough to cover payables. Worse, when an emergency arises that needs a substantial amount of money, you have no other option but to resort to lending facilities and financial institutions to apply for a loan.

Another problem is that most companies will check your credit score when applying for a loan. Unfortunately, not everyone has established a good credit record. However, this does not mean that they have no other means of getting emergency funds.

Listed below are a few options for people who wish to get an emergency loan while avoiding credit checks. Read on to find out more.

Cash Advance Loans

If you are employed, then you are in luck! You can apply for a cash advance loan.

Cash advance loans are short-term loans that cater to your immediate cash needs until your next paycheck arrives. It’s like getting your salary in advance.

If you are applying for cash advance loans from lenders outside your company, you’ll only need to write a check that coincides with your next paycheck date and assign it with the lender. After that, when you get your salary, the amount will be applied to your loan.

You can also take cash advance loans directly from some employers. These are often known as employer cash advances. In employer cash advances, you will be getting an advance of your salary from your employer. Technically, though, it shall be in the form of a loan. The only thing about this is you will be borrowing money from your own paycheck.

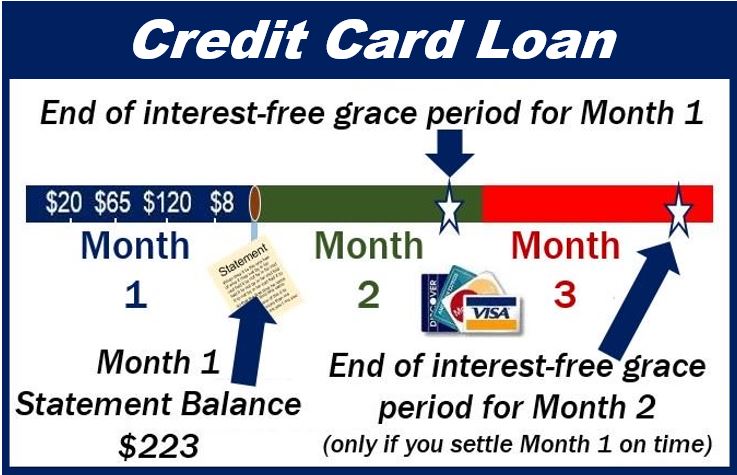

Credit Card Advances

Most credit cards and charge card issuers provide cash advance services to their cardholders. This service allows cardholders to borrow money against their credit limit.

Credit card advances are convenient because you only have to withdraw cash from an ATM, such as debit cards. No hard credit check will be necessary since you have an existing account with the issuing bank.

Credit Unions

If you were previously affiliated with a credit union, you could get a loan from them without going through a credit check.

Credit unions often grant loans with reasonable terms to their members. If you are a member, they can grant your loan application at a fair interest rate and convenient terms. It will also be easy to get a loan from credit unions since they use other data within their reach to determine your creditworthiness. They are not confined to checking your credit score alone.

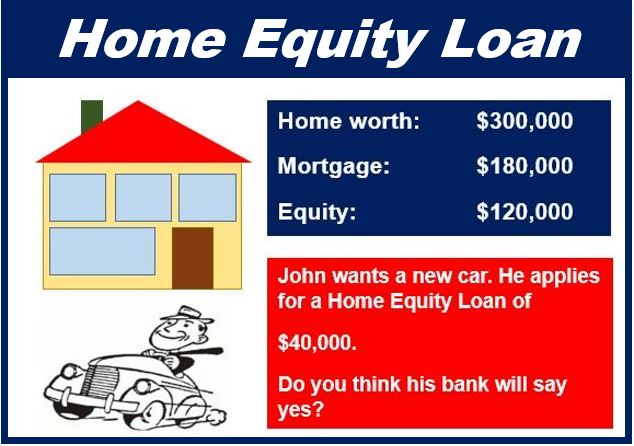

Home Equity Loans

If you have bad credit, another loan option that you can get without having to establish a good credit score is getting a secured loan. One of the most famous examples of secured loans is home equity loans.

Home equity loans allow homeowners to borrow money against the equity in their residences. The amount of money you can loan using your homes depends on your home’s current value.

However, you need to note that failure to pay this type of loan will lead to your home’s foreclosure in favor of the lender.

Auto Loans

Like home equity loans, auto loans are secured loans. You can have your car mortgaged, and use the proceeds for the emergency.

Auto Loans uses your car or any of your motor vehicles as collateral for the loan you will take out from banks and lending companies. Companies granting auto loans will likely not look at your credit score when applying for a loan and only check the documents relating to your car.

Similarly, if you fail to pay your loan, your car held as collateral may be sold at an auction by the lender.

Bad Credit Personal Loans

Some lenders have special programs that can help consumers with bad credit get a loan. One of these programs is bad credit personal loans.

You can get bad credit loans from reputable financial institutions. Some lenders take the form of online lending platforms that offer bad credit personal loans under reasonable terms and conditions. Interest fees for this type of loan vary from lender to lender.

Borrow From Family or Friends

Your family and friends can help you with your emergency financial needs. Since they are close to you, they will not require you to establish your credit score. Your family and friends can aid you by providing you with the amount that you need with less to no stringent conditions. Remember, however, that loans from family and friends should be your last resort. You do not want to have sour relations with family because of unpaid debt.

Takeaway

A loan might be a good source of funds when faced with emergencies that require a substantial amount of money. Although it will be difficult for people with bad credit, getting emergency loans is possible. Like those mentioned, there are credit options that you can apply for that do not need to check your credit record to gauge your creditworthiness.

Video – What is a Secured Loan?

Interesting related article: “What is my Credit Score?”