What are American depositary receipts (ADRs)?

Stocks of foreign companies that trade in American markets are known as American Depositary Receipts (ADRs). Investors purchase ADRs in U.S. dollars, through a U.S. broker-dealer, and during U.S. trading hours. Put simply, ADRs allow American investors to invest in foreign companies in the US marketplace.

In this article, ‘marketplace’ means the same as market, in the abstract sense of the word.

American depositary receipts are certificates that a US depository bank issues. They represent securities of a foreign company trading in an American financial market.

According to the SEC, investors often find it more convenient to own ADRs than the foreign stock itself. SEC stands for the Securities and Exchange Commission; an independent agency of the United States federal government.

Many prefer ADRs because investors can benefit from the protection and transparency facilitated by U.S. securities regulation.

American depositary receipts and American depositary share

The whole issue is known as ADR, while each individual share is called an American Depositary Share (ADS). However, people frequently use them with the same meaning.

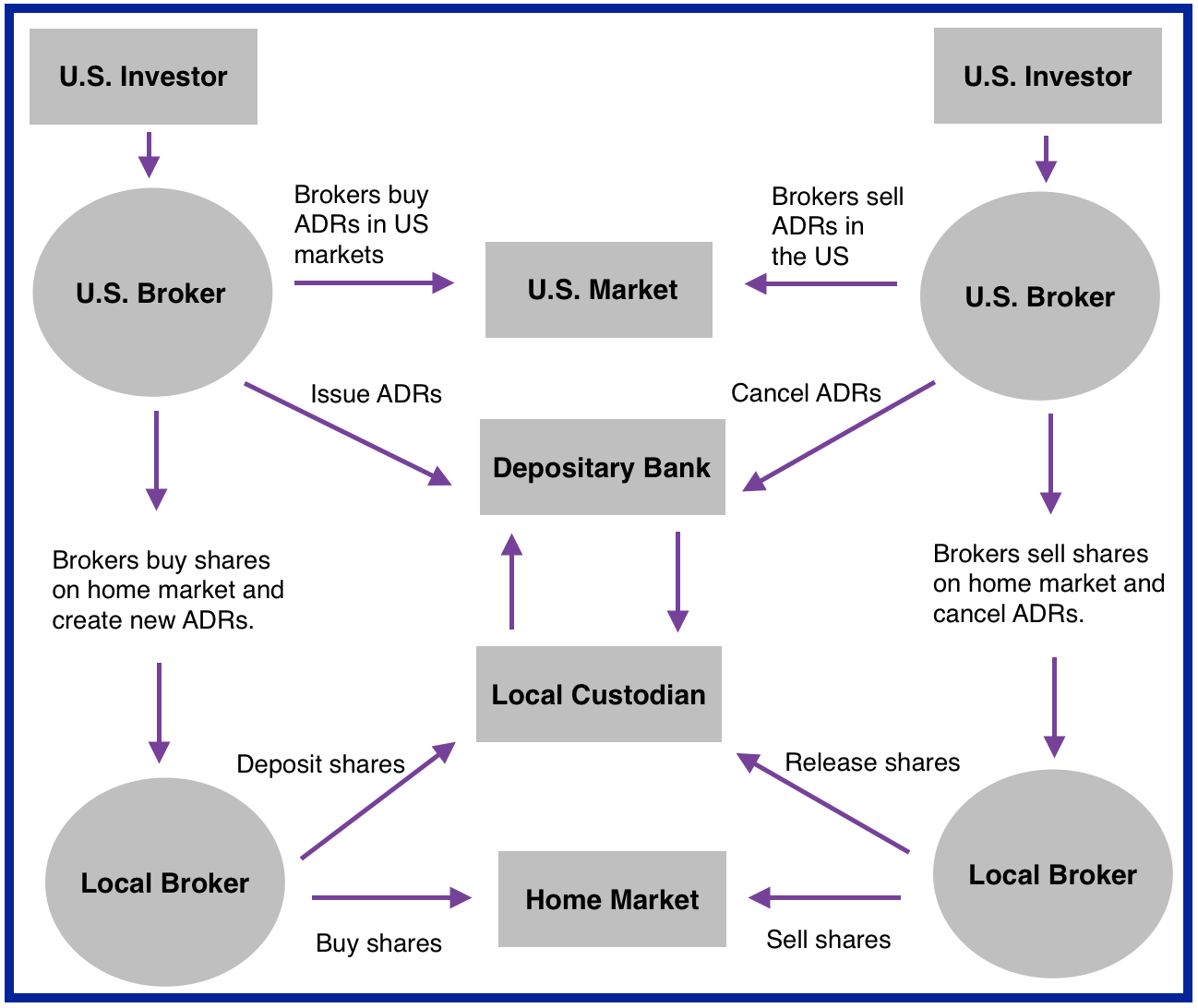

First of all, brokers buy foreign securities directly in the local market (abroad). Subsequently, they then provide the shares to a depository bank, such as Citibank or JP Morgan. Finally, the depository banks issue the ADRs in the US markets.

ADRs allow the foreign issuer to have access to a new market with minimum disclosure and attendant potential liability. Additionally, investors can own foreign securities with the same advantages offered by securities from US issuers.

Where does ADR trading occur?

You can trade ADRs on U.S. national stock exchanges, including the New York Stock Exchange and NASDAQ. You can also buy them on the US OTC (over-the-counter) market.

The owner of American Depositary Receipts has the right to obtain stocks of the foreign company they represent.

There are two main types of American depositary receipts:

- sponsored receipts, and

- unsponsored receipts.

Over the past few years, however, there has been a trend toward sponsored receipts.

The terms ADR and ADS (American Depositary Shares) are frequently used interchangeably. However, an ADR is the certificate that represents an ADS.

American Depositary Receipts started in 1927

British retailer Selfridges introduced the first ADR in the US in 1927 through the bank J.P. Morgan.

According to BNY Mellon, the reduction of global trading & custodian charges associated with depository receipts saves between 10 to 40 basis points annually.

BNY Mellon wrote:

“The demand by investors for Depositary Receipts has been growing between 30 to 40 percent annually, driven in large part by the increasing desire of retail and institutional investors to diversify their portfolios globally.”

“Many investors who do have the capabilities to invest outside the U.S. may prefer to utilize Depositary Receipts because of the convenience, enhanced liquidity and cost effectiveness Depositary Receipts offer compared to purchasing and safe keeping ordinary shares in the home country.”

“In many cases, a Depositary Receipt investment can save an investor up to 10 – 40 basis points annually, compared to the costs associated with trading and holding ordinary shares outside the United States.”

Sponsored ADRs

Sponsored ADRs are usually provided with some form of assistance by the bank to subsidize the administration of owning the security. This type of ADR is subject to the reporting requirements of the SEC.

A foreign private issuer and a depository bank create ADRs jointly. The foreign issuer must sign a Form F-6 registration statement and enters into an agreement with the depositary.

The Form F-6 registration statement governs the rights and responsibilities of the two parties and establishes the allocation of fees.

There are three levels of sponsorship:

- Level 1: these do not need to be registered with the SEC. They do not need to conform to generally accepted accounting principles (GAAP) either. You can only trade Level 1 ADRs over the counter. Experts say they are riskier than the other levels of sponsorship.

- Level 2: these must be SEC-registered. They have to comply with GAAP partially.

- Level 3: these must be SEC-registered. Additionally, they have to comply with GAAP completely. A Level 3 sponsorship is necessary if a company is using ADRs as a primary offering to raise money.

Unsponsored ADRs

Unsponsored ADRs, on the other hand, do not receive much assistance. People buy and sell them on the over-the-counter (OTC) market.

Depositary banks also issue unsponsored ADRs. However, there is no direct involvement of the non-U.S. company. Therefore, the main factor driving unsponsored ADR programs is investor demand.

In the case of unsponsored ADRs, the depositary must file a registration statement under the Securities Act of 1933 on Securities Act Form F-6.

As soon as the statement goes into effect, the depositary can accept deposits of securities of a foreign private issuer. Then the depositary issues American Depositary Receipts.

Unsponsored ADRs are not only for small foreign companies but large ones as well. In fact, ADRs exist for some of the world’s largest and most powerful companies, including BMW, Nestle, and Adidas.

What determines ADR prices?

An ADR’s price depends on the home market’s stock price. You then adjust the price to the ratio of foreign company shares to ADRs. An ADR can represent a fraction of a share, a single share, or multiple shares of a foreign security.

Investors receive ADR dividends in US dollars. In fact, you can essentially trade them as if they were regular shares.

For example, assume that the demand for English chocolate surges in the US. Consequently, a British chocolate maker wants to list its shares on the NYSE to expand its market exposure.

Shares of the UK chocolate company trade on the London Stock Exchange for £3 (equivalent to $4). Imagine a US bank buys 50 million shares and subsequently issues them in the US at a ratio of 15:1. The ADR will have an issue price of $60 ($4 times 15).

The benefits of ADRs for issuers

- Gain access to capital in the U.S.

- Have more corporate visibility in the U.S.

- Diversify shareholder base.

- Expand their share market, improving global liquidity.

- Make it easier for M&A activities, using ADRs as an acquisition currency.

- Create a share plan for American employees.

The benefits of ADRs for investors

- Diversify an investment portfolio on a more global scale.

- Exchange according to American conventions.

- No charges associated with cross-border custody/safe keeping.

- Receive dividend payments in American dollars.

- Better accessibility of research, price and trading information.

For example, if an investor wants to go to England and buy BP shares, they would need to have a British brokerage account. Furthermore, they would also need a mechanism to turn dollars into pounds sterling. They would hold the shares London and receive dividends in pounds sterling.

From an investor’s point of view, an ADR would give them the same equity exposure to BP as ExxonMobil. Additionally, they would get the dividend payments in dollars and could trade it in dollars.

This essentially Americanizes the security and makes it transparent from an investor’s point of view. American Depositary Receipts allow investors do this with stocks of companies based in dozens of different countries.

The size of the ADR market

At the beginning of 2013, there were approximately 2,590 ADRs (1,246 Sponsored / 1,344 Unsponsored). In 2009 there were 2,033 ADRs (1,124 Sponsored / 909 Unsponsored). In 2007 there were 1,256 ADRs (1,127 Sponsored / 129 Unsponsored).

Approximately two-thirds of ADRs are in developed markets, with one-third in emerging markets.

Diagram of how an ADR works

Not only do ADRs allow you to invest in overseas companies, but they allow you to do that at home. Furthermore, they help you diversify your investment portfolio.

Video – OTC Markets Group Explanation

In this video, Jason Paltrowitz, Executive Director of OTC Markets Group, answers questions about what ADRs are and why they are valuable to companies and their investors:

References:

1 “American Depository Receipts: An Introduction to U.S. Capital Markets for Foreign Companies”, Mark Saunders, Fordham International Law Journal, Volume 17, Issue 1

2 Citi Securities and Fund Services, “American Depositary Receipts (ADRs): A Primer”

3 Citi Securities and Fund Services, “Unsponsored American Depositary Receipts (ADRs)”