Bookkeeping involves recording payments and money coming in, i.e., financial transactions. It is the activity of maintaining records of a business’ financial affairs. The term is a rare English word in that it has three successive double letters: oo-kk-ee.

A person who does a company’s bookkeeping is a bookkeeper.

We can write the occupation as one word or two words with a hyphen, i.e., bookkeeper or book-keeper. The former is more common. Whichever one you choose, however, it is important to stick to it throughout the whole text. Do not switch from the one-word to two-word version or vice-versa in the same article.

Bookkeepers

Bookkeepers record all financial transactions on a day-to-day basis. They make sure that a business’ financial records are up-to-date and accurate. Bookkeeping is part of accounting.

Financial transactions include, for example, payments, receipts, sales that individuals, companies, or other organizations make.

The Cambridge Dictionary has the following definition of the term:

“(Bookkeeping is) the job or activity of keeping an exact record of the money that has been spent or received by a business or other organization.”

Bookkeeping vs. accounting

Some people use the two terms interchangeably. They shouldn’t because their meanings are not the same. Both functions, bookkeeping and accounting, are vital for every commercial enterprise.

Bookkeeping

This involves recording all of a company’s financial transactions, i.e., money coming in and going out, on a day-to-day basis. Upper management cannot make corporate decisions based on data provided by a bookkeeper.

Accounting

Accounting is all about interpreting and classifying the financial data. Accountants gather financial data, and then analyze, report, and summarize it. Upper management can make corporate decisions based on data that an accountant provides.

FlatWorldSolutions.com says the following about the two terms:

“The objective of bookkeeping is to keep the records of all financial transactions proper and systematic. The objective of accounting is to gauge the financial situation and further communicate the information to the relevant authorities.”

Bookkeepers typically bring the books to trial balance. Accountants, on the other hand, prepare the balance sheet and income statement using the ledgers and trial balance that the bookkeeper prepared. The balance sheet shows an entity’s financial status at a specific moment in time; usually at the end of a financial year. It may also cover just a three- or six-month period, i.e., a quarter or half-year.

Today it is all computerized

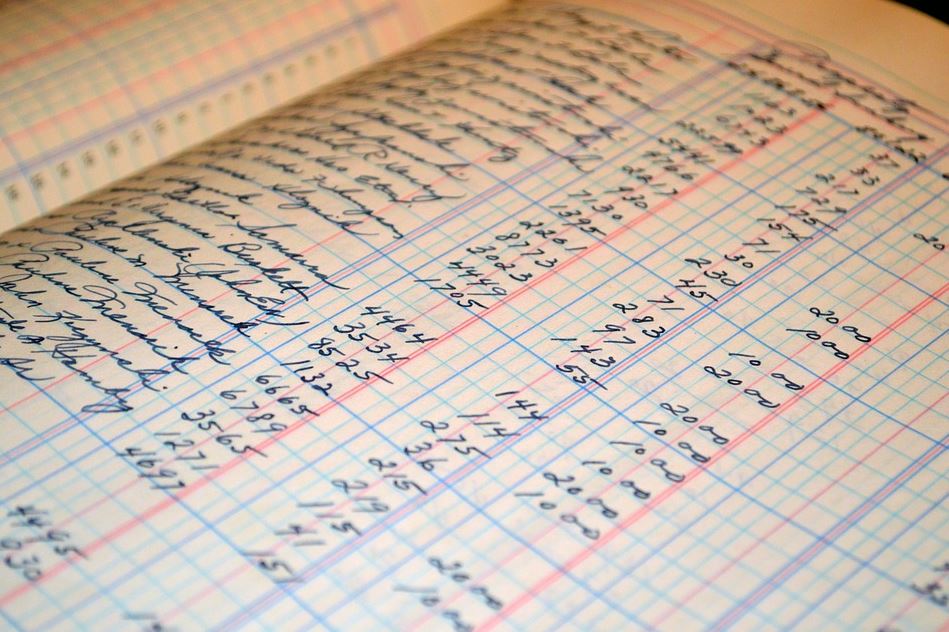

In the past, a company’s books were maintained manually. Humans entered financial data using a quill, pen, biro, or pencil. Today, in most cases, it is all done with the use of computer programs, i.e., software.

Regarding who supervises computerized systems, Wikipedia informs:

“CPAs supervise the internal controls for computerized bookkeeping systems, which serve to minimize errors in documenting the numerous activities a business entity may initiate or complete over an accounting period.”

In the United States and some other English-speaking countries, a CPA is a Certified Public Accountant. The British, Irish, Indian, Australasian, and South African equivalent is a Chartered Accountant.

Benefits of computer software

In a Market Business News article, I listed several reasons why we should use bookkeeping software to run a business:

- It saves money and time.

- A good program can help the business control cash flow.

- Software programs are more accurate than human beings.

- It is an opportunity to automate tedious and repetitive tasks.

- You can back up everything.

- The software can help with tax preparation.

- It does not cost much.