Capital formation – definition and meaning

Capital Formation refers to the increase in the stock of real capital in an economy during an accounting period. In other words, the creation of things that help us produce more. We commonly use the term in the study of macroeconomics. The term capital accumulation has the same meaning. I use the two terms interchangeably in this article.

Capital formation is often seen as the backbone of a nation’s long-term economic development, as it provides the essential tools for productivity and growth.

Capital accumulation involves the creation of more capital goods. For example, buildings, equipment, tools, machinery, and vehicles are capital goods. We use capital goods to make products and provide services.

In economics, capital means the factors of production that we use to create goods.

A country uses capital stock together with labor to produce goods. Capital accumulation occurs when this capital stock increases.

The greater the capital accumulation of an economy is, the faster it can grow its aggregate income.

When a country’s capital stock increases, its production capacity grows too. In other words, the economy can produce more. When we produce more, national income levels subsequently rise.

American economist Simon Smith Kuznets (1901-1985) pioneered the concept of capital formation in the 1930s and 1940s. Kuznets was awarded the 1971 Nobel Memorial Prize in Economic Sciences.

From the 1950s, most countries began using it to measure capital flows.

Economists say that the formation of capital is an essential way of assessing the true financial state of a country. In fact, without it economists would find it extremely difficult to identify the rate of GDP growth. GDP stands for Gross Domestic Product.

Capital formation in national accounts statistics

In national accounts, gross capital formation is the total value of GFCF (gross fixed capital formation), plus net changes to inventories, plus net acquisitions less disposals of valuables for a unit or sector.

In national accounting, total capital formation equals net fixed capital investment, plus the increase in the value of inventories held, plus lending to foreign countries.

We ‘form’ capital when we use our savings for investment purposes – often investment in production. In other words, the formation of capital occurs when we invest in making things.

According to the Nasdaq Business Glossary, capital formation is:

“The expansion of capital or capital goods through savings, which leads to economic growth.”

Capital formation process – 3 steps

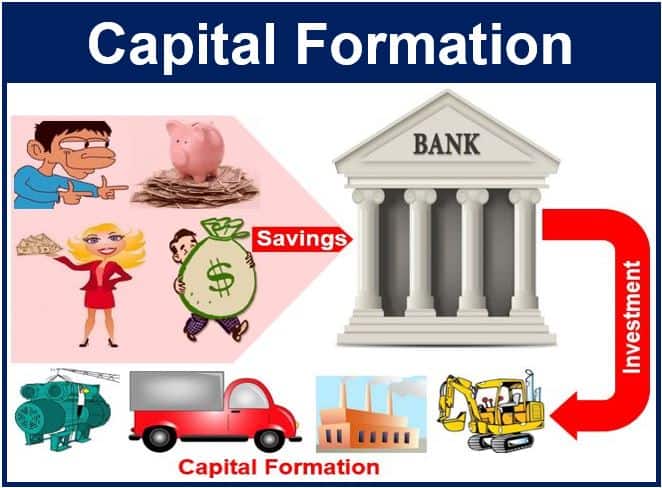

Capital accumulation follows a process of three steps:

- First, growth in the volume of real savings.

- Second, savings mobilization through credit and financial institutions.

- Third, investment of savings.

Hence, the formation of capital is not just a question of saving more, but also using those savings to boost production.

Capital formation also refers to the issue of new securities, which occurs in the primary market. In this context, ‘new securities’ refers to shares and bonds.

Technological advancements in production and manufacturing can significantly contribute to capital formation by enhancing efficiency and productivity.”

“Capital formation” compound nouns

A compound noun is a term consisting of two or more words. Let’s take a look at some compound nouns containing the words “capital formation,” their meanings, and how we can use them in a sentence:

-

Capital Formation Rate

A measure of the rate at which capital is being added to the capital stock in an economy.

Example: “Analysts use the capital formation rate to gauge the investment health of a country.”

-

Capital Formation Strategy

A plan or approach designed to enhance the creation and accumulation of capital within an organization or economy.

Example: “The government’s capital formation strategy focuses on incentivizing private investments in infrastructure.”

-

Capital Formation Process

The method through which savings of individuals or entities are transformed into investable capital.

Example: “A well-structured capital formation process is vital for channeling savings into productive investments.”

-

Capital Formation Trends

Patterns or movements in the way capital is being accumulated over time within an economy.

Example: “The current capital formation trends suggest a shift towards more sustainable and green technologies.”

-

Capital Formation Analysis

The study or examination of how capital is formed in an economy, including factors that affect its growth and sustainability.

Example: “Her thesis presented a thorough capital formation analysis of emerging markets.”

-

Capital Formation Policy

A set of guidelines or regulations aimed at influencing the rate and direction of capital formation in an economy.

Example: “The new capital formation policy introduced by the central bank aims to stimulate economic growth by lowering interest rates for business loans.”

Video – What is Capital Formation

This video presentation, from our sister channel on YouTube – Marketing Business Network, explains what ‘Capital Formation’ is using simple and easy-to-understand language and examples.