Credit card – definition and meaning

A Credit Card is a plastic card that people use to purchase goods and services on credit. The card issuer pays for the purchase, and the cardholder pays the issuer at a later date. In other words, the issuer lends the cardholder the money to buy things.

Credit cards are convenient ways of buying things, especially if you don’t have cash handy. They are also useful if you want easy tracking and security, or simply don’t want to use cash.

After a ‘grace period,’ interest will start to accrue on the outstanding amount.

The card issuer creates a revolving account and provides the cardholder with a line of credit. The customer can borrow money from this line of credit to buy things.

According to Finance Smarti:

“A credit card is a small plastic card that consumers use to pay for goods and services. The cardholder borrows the money for the purchase from the card issuer.”

Credit card vs. debit card

Credit cards are different from charge cards and debit cards. With a debit card, the money comes directly from the customer’s bank account. With a charge card, on the other hand, the customer must pay the balance in full each month.

Below are some highlighted differences between the two types of cards:

Credit Cards:

- Credit cards offer a pre-set borrowing limit, repayable with potential interest.

- Credit card purchases imply deferred payment, beneficial for credit building when paid timely.

- Credit cards may provide rewards, encouraging spending on credit for benefits.

- Not settling the full credit card balance monthly incurs interest, adding to purchase costs.

Debit Cards:

- Debit card purchases instantly reduce your checking account balance.

- Debit transactions require a PIN, ensuring direct bank account debits without debt.

- Specific ATMs allow no-fee debit card withdrawals, which decrease your account balance.

- Losing a debit card risks immediate bank fund losses if not reported quickly.

How credit cards work

When people apply for a credit card, they are effectively applying to borrow money. The issuer will check the applicant’s credit history before approving any application. Details on whether the applicant is a good risk will come from a credit bureau.

The issuer will usually turn down applicants with a bad credit history. In other words, if you have a bad credit score, the issuer is less likely to approve your application.

For those with a decent credit score, the issuer will set a credit limit. This is the maximum amount the holder can spend using the card.

The cardholder receives a statement every month. The statement has details of all the transactions on the card. It also states how much the holder owes. Additionally, the statement includes the minimum payment and the payment due date.

Credit cards often come with additional benefits such as travel insurance, extended warranties, and purchase protection, enhancing consumer confidence and satisfaction with their transactions.

Interest and penalty charges

The majority of cards charge no interest for a specific period. In fact, if you manage your account properly, you need never pay any interest.

As long as you clear the balance in full when you get your statement, there is no interest to pay.

Experts advise cardholders to pay back more than the minimum that appears on the statement. Otherwise, the outstanding balance will grow and start accruing interest.

According to moneysupermarket.com:

“If you make only the minimum monthly payment, it could take many years to clear the debt.”

If you miss a payment or pay back after the deadline, there will be a penalty charge.There will also be a penalty if you go over your limit.

You should contact the card issuer straight away if you run into difficulties.

Credit card issuers now employ sophisticated fraud detection algorithms and real-time monitoring to quickly identify and prevent unauthorized transactions.”

The first credit cards

Credit cards appeared in the first quarter of the 20th century. They were made of cardboard or paper and then embossed metal plates in the 1920s.

-

Diners Club

At the time, you could just use the card with one vendor, for instance, Bloomingdales or Macy’s. It wasn’t until 1949 that the first universal card – Diners Club – came onto the market.

The Diners Club card evolved from a simple idea Wouldn’t it be nice to have a card we could use in more than one place. Also, a card which could serve as a substitute for cash or a checkbook.

At first, Diners Club cards were charge cards. In other words, you had to pay off the balance at the end of the month.

By 1958, other competitors, including American Express and the Hilton Hotel’s Carte Blanche came onto the market.

-

Visa

Also in 1958, Bank of America issued its BankAmericard. In 1966, Bank of America set up a national franchise program. Subsequently, banks across the nation could issue BankAmericard credit cards.

Eventually, in 1976 the franchise was done away with, and BankAmericard became Visa.

-

MasterCard

Several banks in the Northeast of the US had wanted to get together to honor each others’ cards. Then people could use them over a wide geographical area. MasterCard was the result of that desire.

According to bankrate.com, initially, merchants had to pay a fee of seven percent of each transaction amount.

Credit card company and network

Many people think a credit card network is the same as a credit card company. In fact, they are quite different.

Credit card companies are the financial institutions that issue credit cards to holders and service their accounts.

Credit card networks, however, dictate where we can use the cards. They also facilitate the payment process between the credit card issuer, merchant, and holder.

In fact, some card companies are also card networks. For example, Discover and American Express are both. Discover and American Express issue most of the cards on the Discover and American Express networks.

However, a card on the MasterCard or Visa networks could be issued by Wells Fargo, HSBC, or any other bank. Neither Visa nor MasterCard issues them.

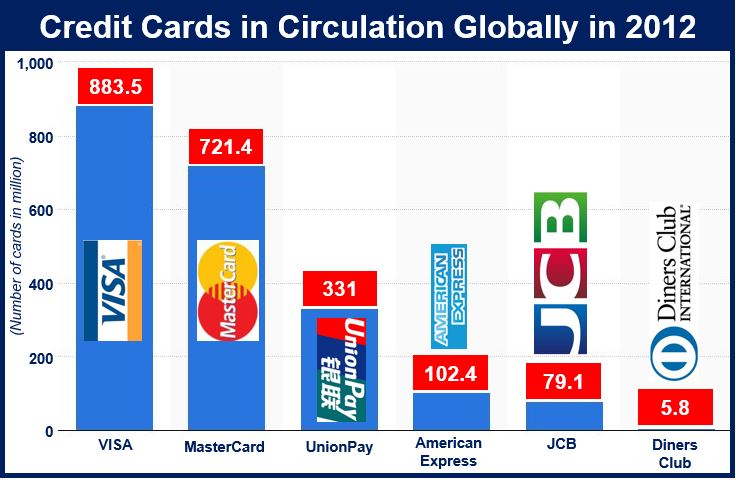

The world’s four major credit card networks are Visa, MasterCard, American Express, and Discover.

Two Videos

These two interesting video presentations, from our sister YouTube channel – Marketing Business Network, explain what ‘Credit Cards’ and ‘Debit Cards’ are using simple, straightforward, and easy-to-understand language and examples.

-

What is a Credit Card?

-

What is a Debit Card?