What is the US Federal Reserve System?

The Federal Reserve System, commonly known as the Federal Reserve (or simply the ‘Fed‘), is the American central banking system.

The Fed was created in 1913. However, to understand how it came about, one needs to read about what happened during the preceding 135 years.

Birth of currency in America (1775-1791): The American Revolution was hugely expensive and needed to be financed. The Continental Congress printed money, the first paper money in America. The notes were known as “continentals”.

As the war progressed more money was printed, which fueled inflation. Inflation got so bad that the notes became virtually worthless. Hence the expression “not worth a continental”.

US tries to set up a central bank (1791-1811): – Alexander Hamilton (1755 or 1757 – 1804), the Treasury Secretary at the time, urged Congress to set up the First Bank of the United States. In 1791 it was established in Philadelphia.

After much opposition, especially from farmers, its 20-year charter expired in 1811 and was not renewed (renewal was turned down by one vote).

The US tries again (1816-1836): Congress narrowly managed to agree to charter the Second Bank of the United States. On becoming president in 1828, Andrew Jackson (1767 – 1845) made a pledge to kill it. He disliked the way it was controlled by bankers and gathered wide support against it. In 1836, the charter was not renewed.

For decades, the country went through a period in which banks issued their own notes and the system became a free-for-all, but also evolved.

From 1873 to 1907 America was plagued by a number of financial panics. A particularly severe panic in 1893 triggered the worst depression the nation had ever seen. Thanks to the intervention by financial mogul J.P. Morgan (1837 – 1913), the economy managed to stabilize.

The Panic of 1907

The Panic of 1907 is also known as the Knickerbocker Crisis or the 1907 Bankers’ Panic. A bout of speculation on Wall Street went bad, triggering a severe and devastating banking panic. The authorities called on J.P. Morgan to intervene again.

By this time, American citizens desperately wanted banking reform. However, there were deep divisions between rich conservatives and ‘progressives’ on how this should be structured.

They all had one thing in common, though: Virtually everybody was in favor of a central banking authority to ensure a stable banking system. Throughout history, bank runs had precipitated serious declines in the economy of the country, and that of many other nations.

Fed’s responsibilities have grown

Since its inception, the Federal Reserve System has assumed an ever-increasing number of roles in monitoring and controlling the US economy.

Congress established three main objectives concerning monetary policy in the Federal Reserve Act:

- generate employment,

- keep prices stable, and

- maintain moderate long-term interest rates.

Maximum employment and stable prices are often considered to be the Federal Reserve’s dual mandate.

According to the Federal Reserve’s Mission, its purpose has since expanded and now includes being in charge of the nation’s monetary policy, supervise and regulate banking institutions, maintain the stability of the financial system, and provide financial services to depository institutions, the U.S. government, and foreign official institutions.

The Federal Reserve plays a key role in US monetary policy by influencing the Federal funds rate – the interest rate at which a depository institution lends funds held at the Federal Reserve Bank.

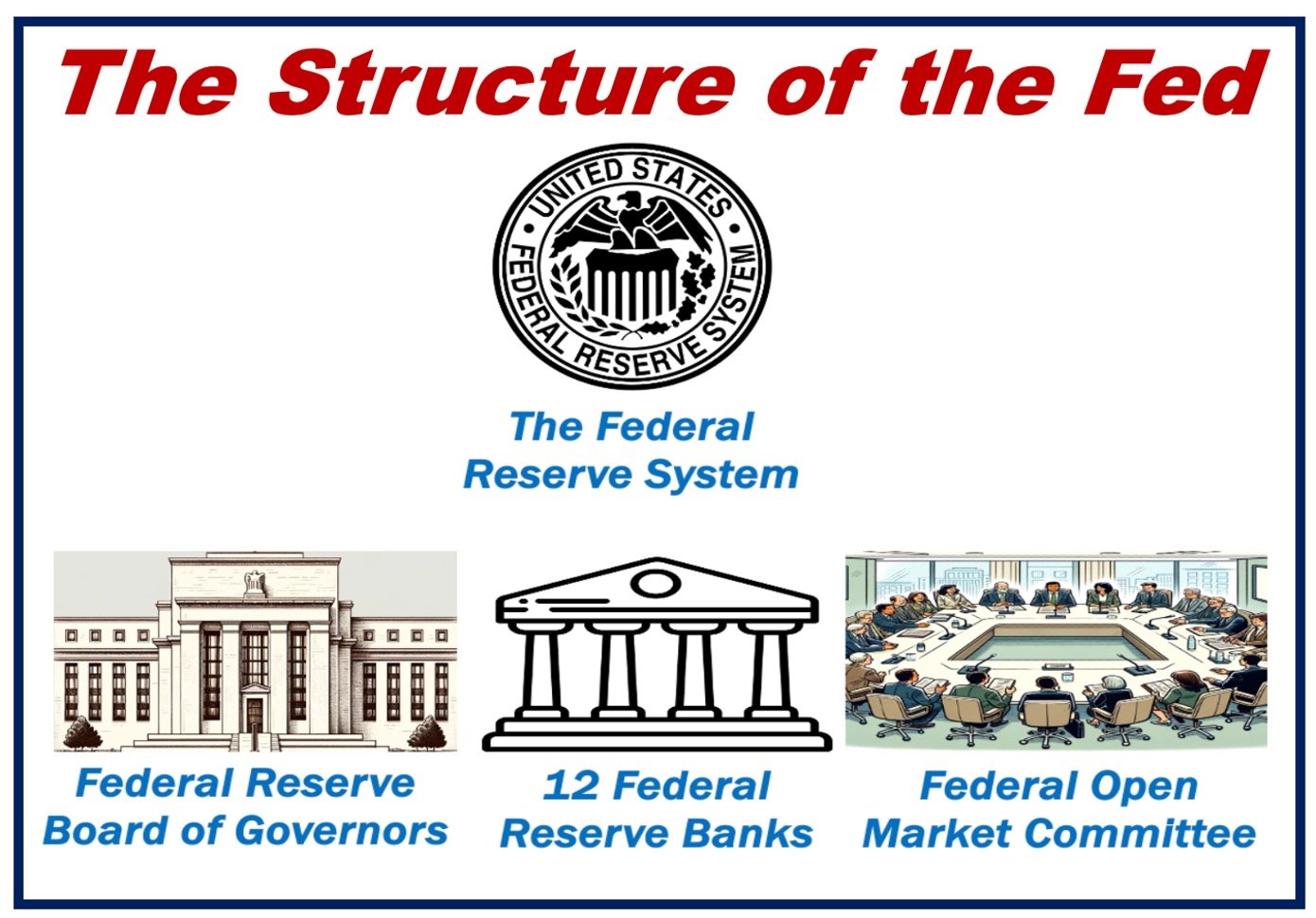

The structure of the Federal Reserve System includes:

- the presidentially appointed Board of Governors,

- the Federal Open Market Committee (FOMC), the 12-member Committee that decides on the Fed funds target and the discount rate,

- twelve regional Federal Reserve Banks,

- the Federal Advisory Council, the Consumer Advisory Council, and the Thrift Institutions Advisory Council.

An ‘independent’ central bank

According to the Board of Governors, the Federal Reserve System is:

“… considered an independent central bank, because its monetary policy decisions do not have to be approved by the President or anyone else in the executive or legislative branches of government.”

“It does not receive funding appropriated by the Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms.”

The President nominates members of the Board of Governors, who are then confirmed by the U.S. Senate. By law, the appointments must yield a “fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country.”

The Board sets reserve requirements and has a shared responsibility with the Reserve Banks for discount rate policy. In addition, the Board supervises and regulates banks that are members of the system, bank holding companies, international banking facilities in the US, and Edge Act and agreement corporations. It also sets margin requirements – limits the use of credit for exchanging securities.

What does the Fed do?

The Federal Reserve System ensures that payment systems are safe and efficient. It is also responsible for processing financial transactions (involving trillions of dollars).

The U.S. Treasury has a checking account with the Fed which is used to handle outgoing government payments and federal tax deposits. The Fed sells and redeems U.S. government savings bonds and bills, in addition to issuing the country’s currency.

The US cash supply is produced by the Bureau of the Mint and Bureau of Engraving and Printing, which is then sold to the Federal Reserve Banks at manufacturing cost. The Federal Reserve then supplies the money to other banks and financial institutions.

Private banks keep their reserves in local Federal Reserve Banks, this helps allow private banks to lend to one another.

In addition to its regulatory functions, the Federal Reserve also actively engages in community development, providing financial literacy programs and resources to foster economic growth and stability across diverse communities.

Where does the Fed operate?

There are 12 Federal Reserve Banks located in New York, San Francisco, Philadelphia, Kansas City, Minneapolis, Boston, Cleveland, Dallas, Atlanta, Chicago, Richmond, and St. Louis.

| Board of Governors of the Federal Reserve System, Washington, D.C. | ||||||||||||||||||||||

| Federal Reserve Bank city | ||||||||||||||||||||||

Federal Reserve Branch city, by District:

|

||||||||||||||||||||||

Source: “The Structure of the Federal Reserve System”

The “Big Four”

In global finance, when talking about the “Big Four”, people are referring to the world’s most influential central banks:

- US: The Federal Reserve System,

- The Eurozone: The European Central Bank,

- UK: The Bank of England,

- Japan: The Bank of Japan.

The Chair

The head of the Federal Reserve System is known as the Chair. Below is a list of all the Chairs since the birth of the Fed in 1913:

- Charles S. Hamlin (1914–1916)

- William P.G. Harding (1916–1922)

- Daniel R. Crissinger (1923–1927)

- Roy A. Young (1927–1930)

- Eugene Meyer (1930–1933)

- Eugene R. Black (1933–1934)

- Marriner S. Eccles (1934–1948)

- Thomas B. McCabe (1948–1951)

- William McChesney Martin (1951–1970)

- Arthur F. Burns (1970–1978)

- G. William Miller (1978–1979)

- Paul Volcker (1979–1987)

- Alan Greenspan (1987–2006)

- Ben S. Bernanke (2006–2014)

- Janet Yellen (2014–2018)

The first woman to hold the position. - Jerome Powell (2018–present

The head of the European Central Bank is called “The President,” while the heads of the central banks of the UK, Ireland, Australia, Canada, New Zealand, and India are known as “Governors.”

Video – What is the US Federal Reserve System (the Fed)?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what the ‘US Federal Reserve System’ is using simple and easy-to-understand language and examples.