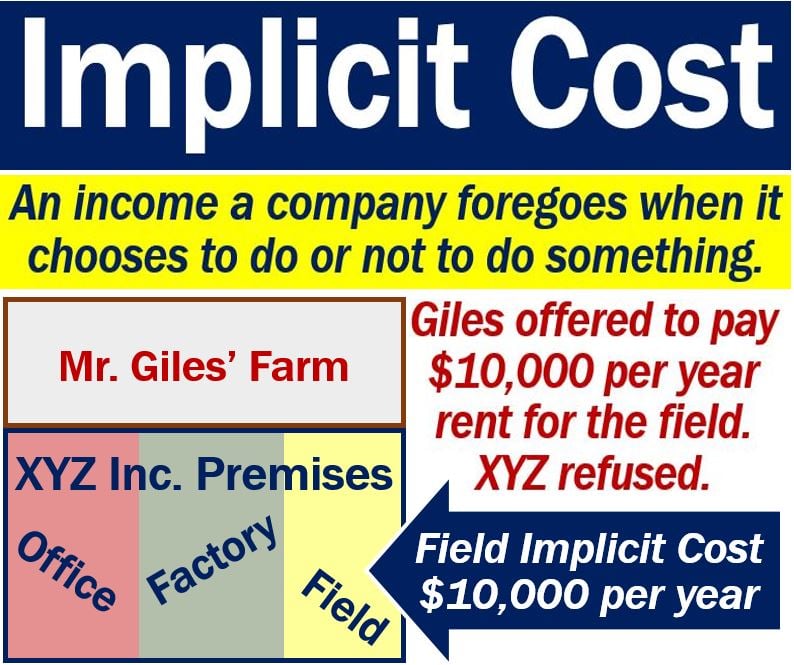

An implicit cost is an opportunity cost that a company does not report as a separate, distinct expense. Implicit costs, in fact, never explicitly state the cost of using a company’s resources for a project. The term refers to any cost that has already taken place but does not necessarily appear as a separate expense.

Put simply; implicit cost refers to any cost that results from an asset rather than selling it or renting it out. It is what a company has to give up by choosing not to exploit an asset.

The terms imputed cost, notional cost, and implied cost mean the same as implicit cost. We can use the term for people or companies. This article focuses mainly on companies, except for the dentist example further down the page.

Implicit cost and opportunity cost

The term refers to the opportunity cost that represents what a company must give up to use a factor of production. The company already owns it and pays no rent on it.

Opportunity cost refers to what a person or business has to give up if they choose to do something. If I study all night, for example, my opportunity cost is a good night’s sleep. In other words, am giving up a good night’s sleep.

Wikipedia has the following definition of the term:

“An implicit cost is any cost that results from using an asset instead of renting it out or selling it.”

Implicit cost if you don’t work

Let’s suppose that Jane is a dentist. She is a successful dentist who earns about $180,000 per year.

With that income, she has been able to get a large mortgage and buy a lovely house. She also has a luxury car and enjoys going abroad on vacation twice a year.

If Jane chose not to work, she would have to forego earning $180,000 per year. The implicit cost of not working would be $150,000 per year.

Explicit vs. implicit cost

There are two types of cost, implicit and explicit costs.

Explicit cost

An explicit cost is an out-of-pocket cost, i.e., payments we make. In other words, when there is an explicit cost, there is a seller and buyer, i.e., there is a transaction.

If I have a business and pay my worker wages, those wages are explicit costs.

Implicit cost

An implicit cost is much more subtle. However, it is just as important as explicit costs.

Implicit costs represent what the company has to forego with an asset it owns

In a typical small business, it could be an asset that the owner contributes. For example, I might use the ground floor of my home as a retail outlet, i.e., a shop.

Accounting and economic profit

According to the Khan Academy, the definitions of explicit and implicit cost are important for two conceptions of profit.

Accounting profit

Accounting profit is total revenue minus all explicit costs, i.e., it is a cash concept.

In other words, accounting profit is the difference between all the money coming in and going out.

Economic profit

Economic profit equals all a company’s revenue minus its total cost. Total cost includes both implicit and explicit costs.

Regarding the difference between these two types of profit, the Khan Academy writes:

“The difference is important. Even though a business pays income taxes based on its accounting profit, whether or not it is economically successful depends on its economic profit.”

Video – Explicit and implicit costs

In this ACDC Leadership video, Mr. Clifford explains the difference between an explicit and implicit cost. He also talks about different types of profit.