What are Installments? Definition and examples

In the world of banking and loans, we call the repayments you make each month to your bank installments. They are the fixed monthly payments a borrower makes to a lender to repay a loan. We also refer to a TV/radio episode as an installment. This article focuses on the financial meaning of the term.

Wikipedia has these meanings for installment:

“A single payment within a staged payment plan of a loan or a hire purchase (installment plan). An episode in a television or radio series. An entry in a film and/or video game series. Serial (literature), a publishing format under which a single large work is presented in contiguous successive publications.”

What do installments include?

In most cases, each installment includes interest on the loan and the principal. Principal, in this context, means the original amount you borrow, before adding other costs such as interest, fees, etc.

In the world’s free-market economies, businesses and consumers take out loans for many reasons. A company may want to borrow money to expand or deal with an unexpected cash flow problem.

Most people borrow money to buy a home. Loans help consumers purchase their cars, expensive vacations abroad, or medical bills.

University students who need to borrow money can arrange a student loan with their bank. In some countries, the state pays part of student loan installments.

Who offers loans?

Banks, finance companies, and credit unions are the most common institutions that lend money to consumers and businesses.

Beware of loan sharks when you are looking for a lender. Loan sharks are unscrupulous moneylenders who charge exorbitant rates of interest. Some of them operate illegally and threaten borrowers who fail to pay their installments on time with violence.

Creditworthiness

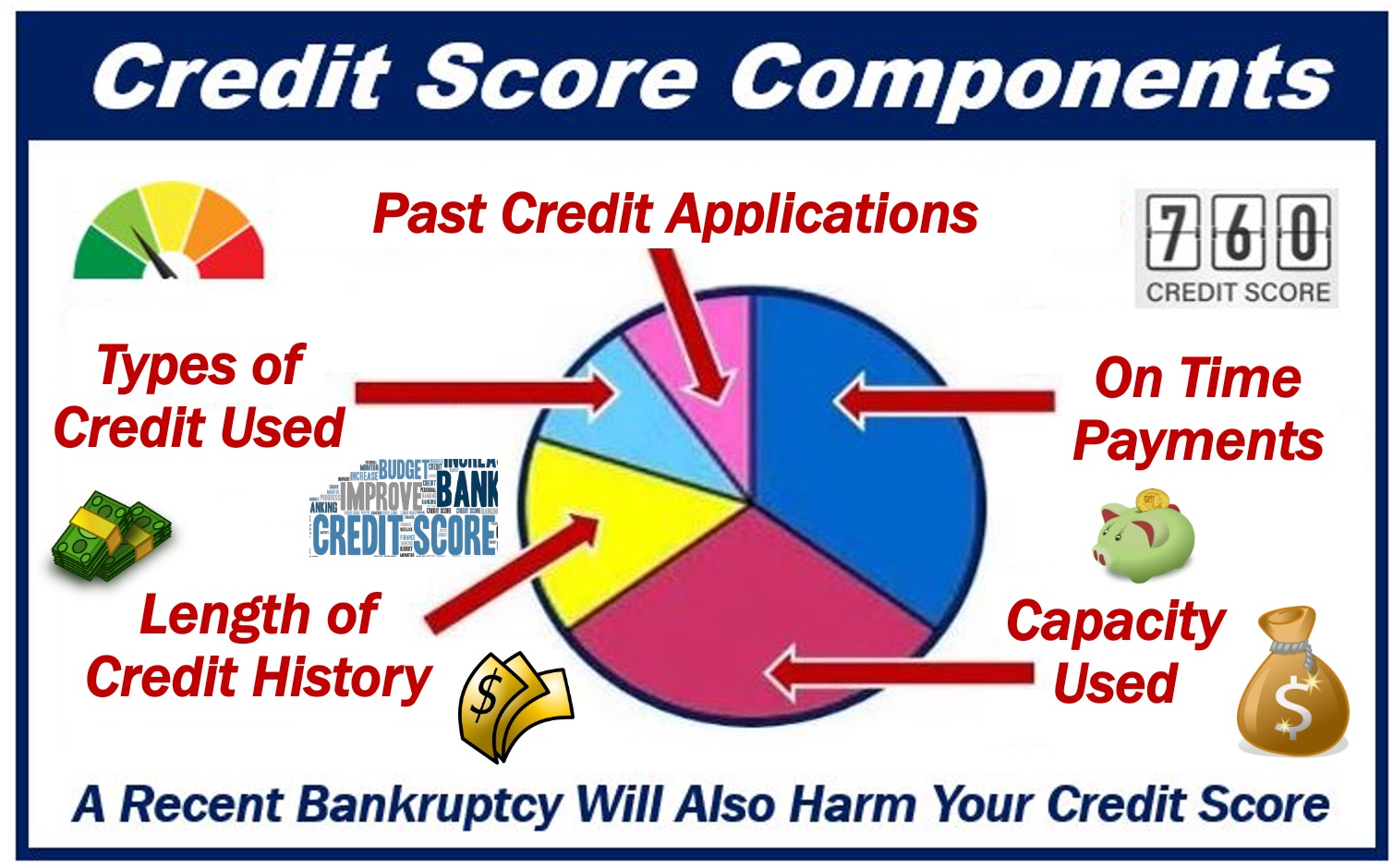

The size and duration of your installments, i.e., how much your monthly repayments are and how long they last, depend on factors such as interest rates and your credit score.

If you have a good credit score, you will most likely enjoy the best terms, such as a relatively low interest rate and a long-term installment plan. You are also more likely to be offered an unsecured loan.

There are secured and unsecured loans. If your lender insists on a secured loan, it means that you must offer something as collateral, i.e., an asset such as your house as security on the loan. If you fail to repay, the lender has the right to seize your asset.

Unsecured loans have no collateral. Banks only offer these types of loans if the customer has a very good credit score. Your credit score tells the lender how creditworthy you are, i.e., whether you are a good or bad risk.

Interest rates

If you have a variable rate loan, your monthly installments may rise when the central bank raises interest rates, and fall when they go down. With a fixed rate loan, on the other hand, your installments remain the same regardless.

If you are wondering whether to take out a loan, check out what is available carefully beforehand. Compare prices, and only consider reputable lenders. Stay well away from loan sharks!