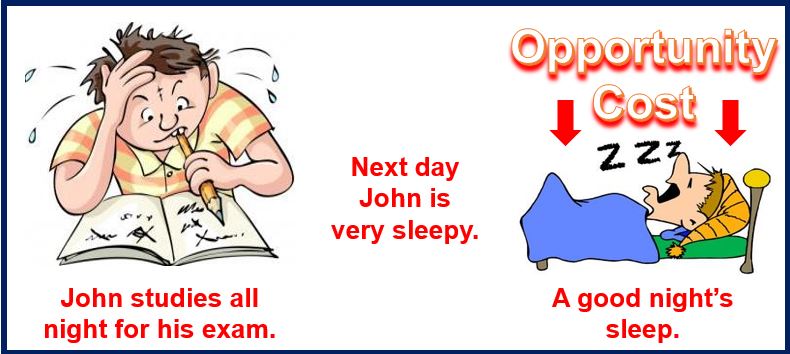

Opportunity cost is the value of the best alternative choice when pursuing a certain action. In other words, the difference in the cost between what you chose to do and what you could have done.

Another way to look at it, is to ask yourself “If I do this, what will I have to give up?” You can then determine whether you are better off with your choice than the alternatives.

Throughout our lives, we face choices. We also have to choose one option each time. Before making a choice, we weigh up all the alternatives and select one.

Hopefully, we choose the one with the most favorable opportunity cost, i.e., one that gives us the best return.

Opportunity cost is essentially the value of the next best alternative use of that resource. It contrasts with absolute advantage.

Absolute advantage compares productivity between one economy, company, or individual with another. Comparative advantage is what a country, for example, should focus on after taking into account all opportunity costs.

A simple real-life example of opportunity cost would be spending time and money going to the theater. The opportunity costs would be lost time watching TV and money that you could have spent on something else.

Implicit cost

Implicit costs are opportunity costs in monetary terms, i.e., we express them in dollars, pounds, euros, etc.

If a company has an asset, such as a field, which it does not sell or rent out, it is losing money. By holding onto that land, it is foregoing the potential rental or sale income.

If a farmer offers to pay $10,000 per year to rent that land, the company’s implicit cost is $10,000 per year. The company is foregoing the $10,000 income.

Economists sometimes describe the term as ‘the basic relationship between scarcity and choice.’ It plays an important role in efficiently using scarce resources.

Opportunity cost in business

Imagine you bought some shares that over a 12-month period brought you a return of just 3%. By using up that money to buy those shares, you gave up the opportunity of an alternative investment. You gave up the opportunity, for example, to invest in a risk-free government bond that yielded 5%.

Your opportunity cost was (minus) -2% (what the shares gave you – minus – what the government bond would have given).

Therefore, we can calculate an opportunity cost as:

What you did – minus – What you could have done

Austrian economist Friedrich von Wieser first coined the term in 1914 in his book ‘Theorie der gesellschaftlichen Wirtschaft.’

French classical economist Frédéric Bastiat first described the concept in 1848 in his essay ‘What Is Seen and What Is Not Seen.’

According to collinsdictionary.com, opportunity cost is:

“The benefit that could have been gained from an alternative use of the same resource.”

The law of increasing opportunity cost states that opportunity costs will rise as a company produces more with its limited resources. In fact, each additional item will carry a larger and larger opportunity cost.

Shadow pricing

The term shadow pricing involves looking at the opportunity cost.

Shadow pricing is a way of estimating the cost of projects, programs, goods and services for which there is no market price.

Even in the rare cases when there are prices, they do not reflect the sacrifices people made.