What is q theory? Definition and meaning

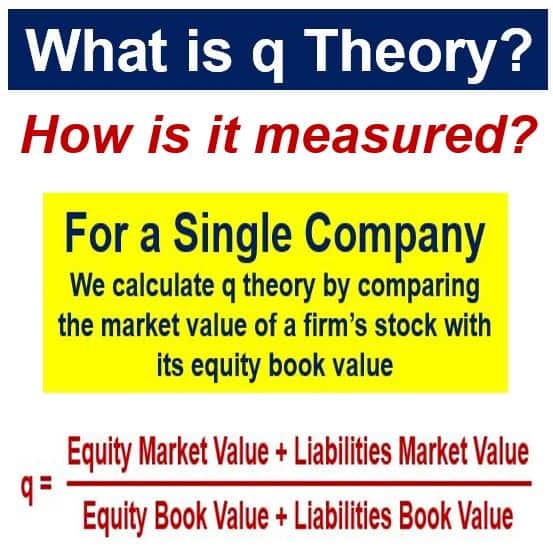

Q Theory, also known as Tobin’s q, Tobin’s q Theory, Kaldor’s V or the q Ratio, is the ratio between the market value of a physical asset and its replacement value. It is a theory of investment behavior in which ‘q’ represents the ratio of a company’s existing shares (share capital) to the replacement cost of its physical assets, i.e. the replacement cost of the share capital.

Q > 1 – according to the theory, if q – which represents the equilibrium – is greater than one, you should invest more in the company because the profits it would generate would be more than the cost of its assets.

Q < 1 – Kaldor’s V also states that if q is smaller than one, the company should sell its assets – it would be better off – rather than attempting to put them to use.

According to experts, the ideal state is when q is roughly equal to 1, which suggests that the company is in equilibrium.

q = Market Value of Installed Capital ÷ Replacement Cost of Capital

When q is greater than 1, investing in the company is recommended, when q is smaller than 1, you should sell, according to q theory.

When q is greater than 1, investing in the company is recommended, when q is smaller than 1, you should sell, according to q theory.

According to BusinessDictionary.com, by definition, Tobin’s q theory is:

“Economics theory of investment behavior where ‘q’ represents the ratio of the market value of a firm’s existing shares (share capital) to the replacement cost of the firm’s physical assets (thus, replacement cost of the share capital).

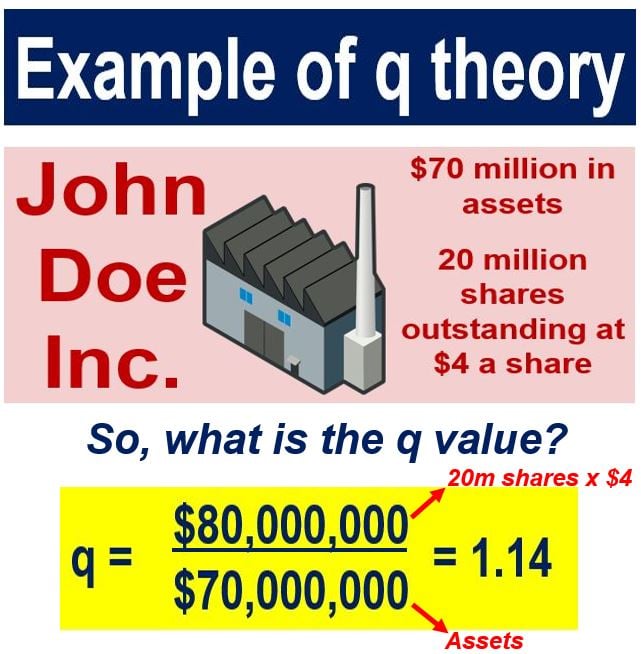

The value of q in this fictitious company – John Doe Inc. – is 1.14, which means it is a good company to invest in. Its market value is greater than its recorded assets. This suggest that the market value reflects some unrecorded or unmeasured assets of John Doe. Inc. A high ‘q’ value (>1) will encourage the company to invest more in capital, so says q theory.

The value of q in this fictitious company – John Doe Inc. – is 1.14, which means it is a good company to invest in. Its market value is greater than its recorded assets. This suggest that the market value reflects some unrecorded or unmeasured assets of John Doe. Inc. A high ‘q’ value (>1) will encourage the company to invest more in capital, so says q theory.

Brief history of Kaldor’s V

Nicholas Kaldor (1908-1986), a Hungarian-born Cambridge economist in the post-war period, introduced the concept of Tobin’s Q in 1966 in an article – Marginal Productivity and the Macro-Economic Theories of Distribution: Comment on Samuelson and Modigliani – published in the Review of Economic Studies.

James Tobin (1918-2002), an American economist, who was on the Board of Governors of the Federal Reserve System and served on the Council of Economic Advisers, and William C. Brainard, also an American economist, currently the Arthur Okun Professor Emeritus of Economics at Yale University, reintroduced it in 1968.

However, the letter ‘Q’ did not appear in the term until Tobin’s article a year later – A General Equilibrium Approach To Monetary Theory – published in the Journal of Money, Credit and Banking.

In an article in 1977 – Asset Markets and the Cost of Capital – published in Private values and Public Policy, Tobin and Brainard wrote:

“One, the numerator, is the market valuation: the going price in the market for exchanging existing assets. The other, the denominator, is the replacement or reproduction cost: the price in the market for the newly produced commodities.”

“We believe that this ratio has considerable macroeconomic significance and usefulness, as the nexus between financial markets and markets for goods and services.”

How relevant is Tobin’s Q?

In practice, companies usually delay their expansion or contraction plans for some time – people do not respond as soon as they see q > 1 or q < 1, and tend to wait until the ratio has veered significantly from one

According to an analysis by Avinash Kamalakar Dixit, an Indian-American economist who is currently John J. F. Sherrerd ’52 University Professor of Economics Emeritus at Princeton University, and Robert Stephen Pindyck, an American economist who is currently Bank of Tokyo-Mitsubishi Professor of Economics and Finance at Sloan School of Management at MIT, companies may delay contraction or expansion for a while, and may only do so if q remains considerably below or above unity (one).

Kaldor’s V shows us that stock price movements will be reflected in consumption and investment changes. However, empirical evidence has revealed that Tobin’s discoveries are not as tight as one would have expected.

This is mainly because companies do not blindly base their decisions regarding fixed investments on movements in the stock price, rather they examine the current value of expected profits and future interest rates.

Apart from teaching at Yale and Harvard Universities, James Tobin (1918-2002) served on both the Council of Economic Advisers (advises the US President) and the Board of Governors of the US Federal Reserve System. After developing ideas of Keynesian economics, Tobin advocated government intervention to stabilize output and prevent recessions. He received the 1981 Nobel Prize in Economic Sciences. (Image: Wikipedia)

Apart from teaching at Yale and Harvard Universities, James Tobin (1918-2002) served on both the Council of Economic Advisers (advises the US President) and the Board of Governors of the US Federal Reserve System. After developing ideas of Keynesian economics, Tobin advocated government intervention to stabilize output and prevent recessions. He received the 1981 Nobel Prize in Economic Sciences. (Image: Wikipedia)

Q influenced by other factors

Q theory measures two variables:

- The current price of capital assets as measured by statisticians and accountants.

- The market value of bonds and equities.

However, there are other factors that could have an impact on the value of q, including:

– Speculation and Market Hype: which may reflect, for example, the views of analysts regarding companies’ prospects, or bid rumors and other speculations.

– Intellectual Capital: in other words, the unmeasured contributions of technology, goodwill, knowledge, and other intangible assets that firms may have but are never recorded by accountants. Some commercial enterprises seek to develop ways to measure intellectual capital and other intangible assets.

Economists say that q theory is influenced by intangible assets and market hype so that q is seen swinging around the value of one.

Video – What is q theory?

This Money Week video explains what Tobin’s Q is – the tutor calls is Tobin’s q – using simple language and easy-to-understand examples.