Shadow economy – definition and meaning

The Shadow Economy refers to all work activity and business transactions that occur ‘below the radar’ – economic activity that is undeclared, hidden, and for which taxes that should be paid are not.

Also known as the informal sector, the black economy, the underground economy, or the gray economy, the shadow economy includes criminal activities such as drug dealing and smuggling, as well as legal jobs, such as gardening, working in construction, or selling products to car drivers at traffic lights.

This part of the economy also includes situations where individuals are forced to work as slaves with no pay, or where work is carried out in exchange for things other than money.

When economists calculate a country’s GDP (gross domestic product), they do not include what goes on in the shadow economy.

This means that every country across the world is probably considerably wealthier than official statistics suggest.

Amidst global economic shifts, the shadow economy adapts rapidly, often serving as a barometer for the efficacy of a nation’s economic policies and the adaptability of its workforce.

Formalizing the shadow economy

Reducing tax evasion – using illegal methods to avoid having to pay taxes – and bringing the shadow economy and informal employment into the formal economy is a top priority for most governments. However, the informal sector is extremely difficult to measure and monitor.

Given how hard it is to measure the underground economy, statistical work on what causes it and how to address it is especially challenging.

Informal economic activity is problematic for a number of reasons. One of the purposes of lawmakers and government is to provide rules and regulations that players in the economy have to comply with.

-

Difficult to monitor

When it comes to the shadow economy, however, those legal institutions are ignored and bypassed – when contracts are broken there is no legal recourse to enforce them, economic relationships may deteriorate into violent confrontations, and it can become virtually impossible for businesses to grow because if they do, they come to the attention of the authorities.

Shadow economy and the tax burden

In countries where the shadow economy is large, tax rates for those in the formal economy are higher to make up for the shortfall in government revenue.

Several studies have shown that there is a relationship between the size of the shadow economy and the country’s overall tax burden.

-

Imaginary situation

Imagine there are two countries – Johnland and Suzyland – with a population of 10,000 working adults each. In order to provide good government, infrastructure and services, the government in each country needs to collect $9 million in taxes each year. Also imagine that in Johnland and Suzyland there is just one type of tax – income tax.

In Suzyland, 9,000 adults work in the formal economy and 1,000 in the shadow economy – so, 9,000 people pay income tax and 1,000 do not.The proportion is 7,000 and 3,000 respectively in Johnland – thirty percent of its people work in the shadow economy.

In Suzyland, if the 9,000 adults in the formal economy pay $1,000 each in income tax, the government will have its required $9 million annually. For Johnland’s government to have the same revenue, its 7,000 formal economy workers will have to pay $1,428 each in income tax. In Johnland, where the shadow economy is larger, the tax burden on those who work in the formal economy is more than 42% greater than in Suzyland.

-

High taxes promote shadow economy

The size of the tax burden for a country’s people is often what causes a shadow economy to grow. If products such as cigarettes are taxed too highly, the tobacco black market flourishes, if businesses and workers are highly taxed, the motivation to work under the radar – evade taxes – is greater, i.e. the shadow economy expands.

Governments and lawmakers need to create an environment in which businesses and workers are motivated to remain within the formal economy – where there are as few regulatory impediments as possible to formalization.

At a broader level, in countries where the shadow economy is huge, people need to be educated about the purpose of taxation so as to improve tax morality, and eventually compliance.

According to fussballwetten.info, an online sports betting website, if all gambling websites in the shadow economy paid taxes, government tax revenue in most countries would increase considerably.

There is a direct relationship between the size of the shadow economy and levels of corruption among politicians and government departments. The cleaner a government and its people are, the smaller the underground economy is. In order to ‘educate’ its population, lawmakers and civil servants need to lead by example.

Shadow economy – a global phenomenon

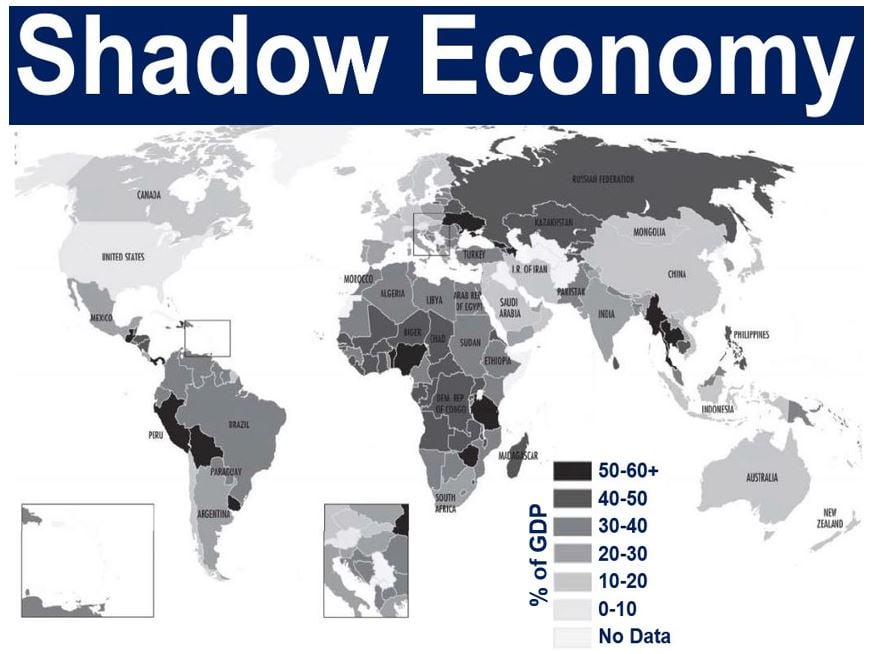

The shadow economy represents an important part of the economies of every country in the world – it represents an especially large proportion of GDP in the developing nations.

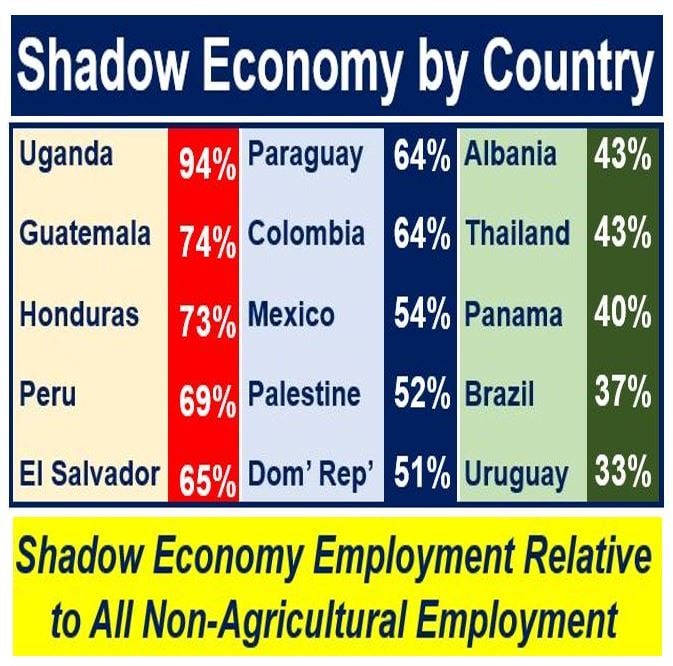

In the rich countries, it accounts for between 10% and 25% of total income, while in some emerging economies, such as Uganda, it represents 94% of GDP.

-

A growing sector of the economy

Economists say that the informal sector provides vital economic opportunities for the poorest people in developing countries. It has been growing steadily across the world since the 1960s – dipping slightly after the late 1990s, and then expanding again after the global financial crisis of 2007/8.

The shadow economy includes both victims, such as children forced to work in sweat shops for $1 per day, and people who deliberately chose to evade taxes, such as the individual who paints your house and insists on being paid in cash.

The drug barons of Latin America, who traffic illicit narcotics to North America and Europe, as well as all the people who work for them, operate within the shadow economy.

Shadow economy in communist countries

People who support socialism or communism typically blame advanced capitalism for the shadow economy. The accusation is naive and short-sighted. In the old Soviet Union and its satellite nations of Eastern Europe, as well as in Cuba and North Korea today – all communist economies – the shadow economy, known as the black market, is/was a huge and key part of the economy.

The underground economy of East Germany, when it was a communist state, was significantly larger than that of West Germany, a free-market democracy. The same difference exists between North Korea and South Korea.

-

Over-restrictive laws help the shadow economy

When governments try to ban a product or activity, they unwittingly encourage the underground economy to thrive.

In the United States, the sale of alcoholic beverages was banned from 1920 to 1933 – during the Prohibition. During that time, mafia-like organizations expanded dramatically.

In countries where abortions are illegal, backstreet procedures are big business. Sadly, in such systems thousands of women either lose their lives or become permanently injured each year because of incompetent and unqualified practitioners.

If the United States and Europe legalized the consumption of recreational drugs, would the drug mafia shrink? Most people believe it would.

Characteristics of the shadow economy

In all parts of the world, the shadow economies share the following characteristics:

-

Entry

This is easy. Individuals who want to join can, in most cases, find work.

-

Scale

Everything is done on a small scale. Unlike legal drugmakers – multinational pharmaceutical companies – that receive many tons of raw materials in one delivery, and have production runs that produce tens of millions of units, illicit sellers of drugs buy and sell goods on a much smaller scale.

-

Skills

Most of the work requires no formal training; it is unskilled. Whatever skills are required are gained outside of a formal education, in most cases.

-

Unstable

Job security does not exist in the shadow economy. There is no stable employer-employee relationship.

Most of the people who work or do business in the shadow economy are not classified as unemployed. There are some exceptions. An individual who is receiving unemployment benefit from the state and moonlights with a bit of gardening and car washing, works in the underground economy and is also registered as unemployed.

The type of work people do in the shadow economy ranges from self-employment to unpaid family labor, and includes car cleaners, street vendors, street musicians and acrobats, shoe shiners, junk collectors, sex workers, bodyguards, gardeners, etc.

Why work in the shadow economy?

There are two main reasons why people work in the shadow economy:

-

Deliberate Strategy

These people do it because they want to. It is the rational behavior of business people who have no intention of paying taxes and do not wish to comply with state regulations. They want to avoid government regulations, labor regulations, as well as income, sales and corporate taxes.

-

Coping strategy

For these people, it is a simple matter of survival. For hundreds of millions of individuals across the world, there is no other choice. They work in an economic environment that lacks opportunities. These include temporary jobs, unpaid jobs, casual jobs, subsistence farming, etc. In many cases, the worker is holding several jobs simultaneously.

-

For some people, there are benefits

The shadow economy plays both a controversial and important role in society. It provides hundreds of millions of people with an income, reduces the devastating effects of unemployment, especially in poor countries where jobless people receive no financial assistance from the state, and helps boost the incomes of those who are underemployed. In the vast majority of cases, work is low-paid and job security is non-existent.

Even though the informal sector boosts entrepreneurial activity, it does so at the expense of regulation compliance, particularly tax and labor regulations.

The role of the shadow economy grows when a country’s economy is in recession and shrinks when GDP is growing.

Shadow economy – United States

Economists say that calculating the black economy in the United States, with millions of illegal workers, is extremely difficult. Since the Great Recession that followed the global financial crisis of 2007/8, a growing proportion of America’s workforce were pushed into the shadow economy.

Some activities are illegal, such as exchanging stolen goods, bootlegging, drug dealing, gambling, sex working, and unauthorized immigrant labor. Although these activities and commodities are mainly banned from the marketplace, Americans spend a great deal of money on them, particularly recreational drugs.

-

Unbanked and underbanked households

The Federal Deposit Insurance Corporation reported that 8.2% of American households in 2011 went unbanked, while 20.1% of households went underbanked.

According to Havocscope, the black market in the United States has three major drivers:

– Counterfeiting: $225 billion

– Drug Trafficking: $215 billion

– Gambling: $150 billion

Other key shadow economy industries include music and movie piracy, sex working, and organ trafficking.

Given that the criminal side of America’s shadow economy is so big, it is a pity that the majority of shadow economy estimates do not include these criminal activities.

Economics Professor Friedrich Schneider, from Johannes Kepler University of Linz, Austria, carried out a comprehensive global study on underground economies. He estimated that in 2007, just before the global financial crisis occurred, that 7.2% of America’s GDP consisted of the shadow economy.

Given that the informal sector has grown since the global financial crisis, America’s underground economy probably represents a larger proportion of GDP today. Prof. Schneider’s estimate did not include criminal activity.

-

Lower than advanced economies’ average

Even so, given that estimates in most countries are done in the same way – without including criminal activities – the US figures can be compared with those of other nations. America’s shadow economy as a proportion of GDP is much lower than the average (13.4%) for the 34 richest countries in the world.

The Federal Reserve Bank of St. Louis says that it is very difficult to measure the underground economy accurately. It uses a number of different approaches to gather and analyze data, including tax audits, surveys and other compliance information. It also looks at discrepancies between national expenditure and income statistics, currency demand, the official and actual labor force, as well as electricity demand.

-

Electricity consumption

Monitoring the consumption of electricity is a good way to separate formal from informal economic activity. The electricity-GDP elasticity is approximately 1.8. The Bank uses electricity as a proxy for overall activity in the US, and then subtracts from it the official estimates, which gives it an indicator of activity in the shadow economy.

On its website, the Federal Bank of St. Louis wrote:

“The difference between the growth of electricity consumption and official GDP is then attributed to the growth of the informal economy.”

-

California

In California, which has America’s largest GDP, between 15% and 17% of the labor force operates within the underground economy, says Inequality.org. The shadow economy of California produces from $60 billion to $140 billion each year.

If the state’s shadow economy paid taxes like everybody else, the Californian government would have from $8.5 billion to $28 billion more in revenue.

“Those who toil in the underground economy generally perform un- or semi-skilled labor, often with little opportunity for advancement, at significantly lower wages than those formally employed.”

“Moreover, they often rely on public assistance, in the form of food stamps and emergency room medical care, to subsidize this lesser pay. In many instances, workers receive wages for only a portion of the hours they worked in a given week, while others are paid on a piece rate basis—as low as $15 for a 10-hour workday hanging drywall.”

The shadow economy – United Kingdom

The underground economy in the UK in 2012 was worth about £150 billion, according to Prof. Schneider and Colin Williams, from the Institute of Economic Affairs.

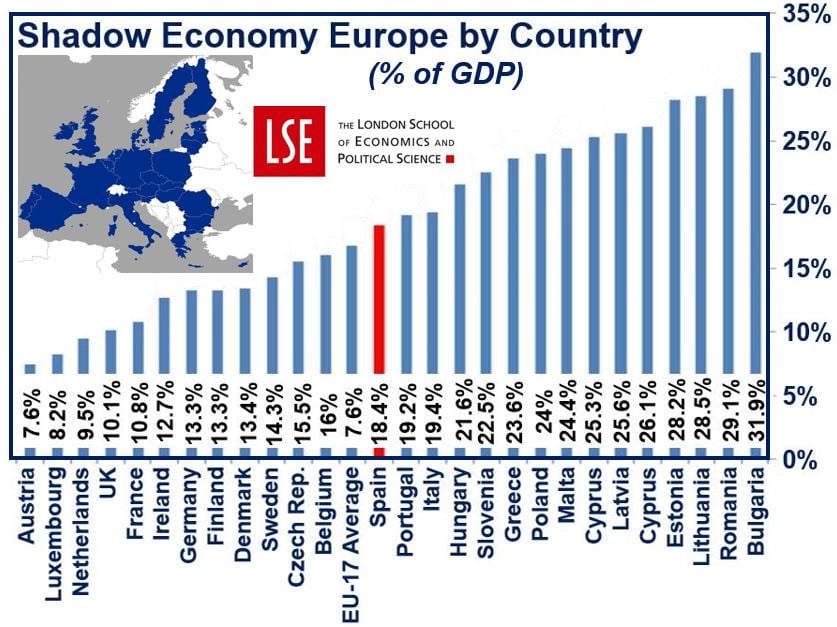

They said that Britain’s shadow economy represents about 10% of the country’s GDP, which is lower than the OECD average – 13.4% – and considerably lower than in Spain, Greece and Italy, where it represents 20% or more.

According to Schneider and Williams:

“A reduction in the tax burden is therefore likely to lead to a reduction in the size of the shadow economy. Indeed, a virtuous circle can be created of lower tax rates, less shadow work, higher tax morale, a higher tax take and the opportunity for lower rates. Of course, a vicious circle in the other direction can also be created.”

“Given this relationship, the high level of non-wage costs (averaging 39% of total labor costs) and the penalty on individuals who move from earning one third to two thirds of the median wage (averaging 58% of the increase in earnings for a one-earner couple) in the European Union should be a matter of real concern.”

“The latter figure is 79% in the UK and thus low-paid UK workers have a huge incentive to supplement their incomes in the shadow economy.”

-

Policy responses not straightforward

The multifaceted nature of the shadow economy often complicates policy responses, as measures that successfully address one aspect may inadvertently bolster another, underscoring the need for a holistic approach.

Emerging digital currencies and payment platforms present new challenges and opportunities in tracking and regulating the shadow economy, as they offer both anonymity and a traceable digital footprint.

Shadow economy – Canada

Canada’s shadow economy has grown more slowly than GDP from 1992 to 2012, according to the Canada Revenue Agency. From 2006 to 2016 its proportion of national income has remained stable.

In 2012, Canada’s underground economy was estimated to have produced $42.4 billion, or 2.3% of GDP. The estimate did not include the value of criminal activities.

Canada’s shadow and formal economies grew by 14% and 17% respectively from 2007 to 2012. In the year 2011-2012, the country’s nominal increase in shadow activity and GDP expanded by 2.2% and 3.5% respectively.

-

Shadow economy strong where cash dominates

According to the report, while the shadow economy exists in virtually every industry, it is especially strong in sectors where a lot of cash is used in settling transactions.

In residential construction, twenty-eight percent of all work is done so ‘informally’, compared to 12% in the retail trade, 12% in food services and catering, and 14% in insurance, finance, rental, leasing, real estate, and holding companies.

According to the Canada Revenue Agency:

“From a provincial-territorial perspective, the total value of underground activity was the highest in the four largest economies: Ontario, Quebec, British Columbia, and Alberta.”

“Overall, the study provides encouraging signs that the underground economy is growing at a slower pace than the Canadian economy. However, any underground economy activity undermines the integrity of the tax system and impedes the ability of governments to protect the revenue base and keep taxes low.”

Synonyms and similar terms

In business/financial/economics English, many terms mean the same as or similar to “the shadow economy.” Let’s take a look at some of them, understand their meanings, and how they can be used in a sentence:

-

Black Economy

The same as the shadow economy, often associated specifically with illegal activities such as drug trafficking or unreported income from legal work to evade taxes.

Example: “Many small businesses operate in the black economy to avoid the financial burden of taxes and regulations.”

-

Gray Economy

The gray economy is a part of the shadow economy that operates within the boundaries of the law but involves unregistered or undocumented economic activities.

Example: “Selling home-baked goods to neighbors is an example of the gray economy, as it’s typically not recorded for tax purposes.”

-

Underground Economy

The underground economy is the same as the shadow economy, encompassing all economic activities that are not reported to the government and hence outside the tax system.

Example: “The underground economy includes a variety of jobs, from street vending to freelance graphic design, that go unreported to tax authorities.”

-

Unofficial Economy

The unofficial economy is the same as the shadow economy, referring to economic activities that contribute to the overall economy but are not officially recorded.

Example: “Many countries have a large unofficial economy, with workers getting paid in cash and not appearing in any official employment statistics.”

-

Hidden Economy

The hidden economy is the same as the shadow economy, involving economic activities that are concealed from authorities to evade regulation or taxation.

Example: “The hidden economy can be substantial in size, often including everything from unreported income to off-the-books employment.”

-

Cash Economy

The cash economy refers to transactions made in cash to avoid taxation and regulation. It’s a part of the informal sector, but specifically excludes non-cash transactions.

Example: “Paying for a haircut or a gardening service in cash without a receipt is part of the cash economy.”

-

Second Economy

The second economy is a term used particularly in the context of socialist economies to describe activities that occur outside the official state-run economy. It can be similar to the shadow economy but is often used to describe a parallel market alongside a centrally planned economy.

Example: “During the Soviet era, the second economy was a crucial supplement to the official economy, providing goods and services that were otherwise unavailable.”

-

Subterranean Economy

The subterranean economy is the same as the shadow economy, particularly emphasizing the hidden nature of these activities beneath the surface of the observed economy.

Example: “The subterranean economy thrives in areas where high taxes and strict regulations make official business too costly.”

-

Informal Sector

The informal sector encompasses economic activities that are not covered by formal arrangements such as government regulations, employment laws, or taxation systems.

Example: “Street vendors are a visible part of the informal sector, offering goods without the overhead of a traditional store.”

Three Videos

These three YouTube videos come from our sister channel, Marketing Business Network. They explain what the terms “Shadow Economy”, “Informal Sector”, and “Black Economy” mean using easy-to-understand language and examples:

-

What is the Shadow Economy?

-

What is the Informal Sector?

-

What is the Black Economy?