What is a soft currency? Definition and examples

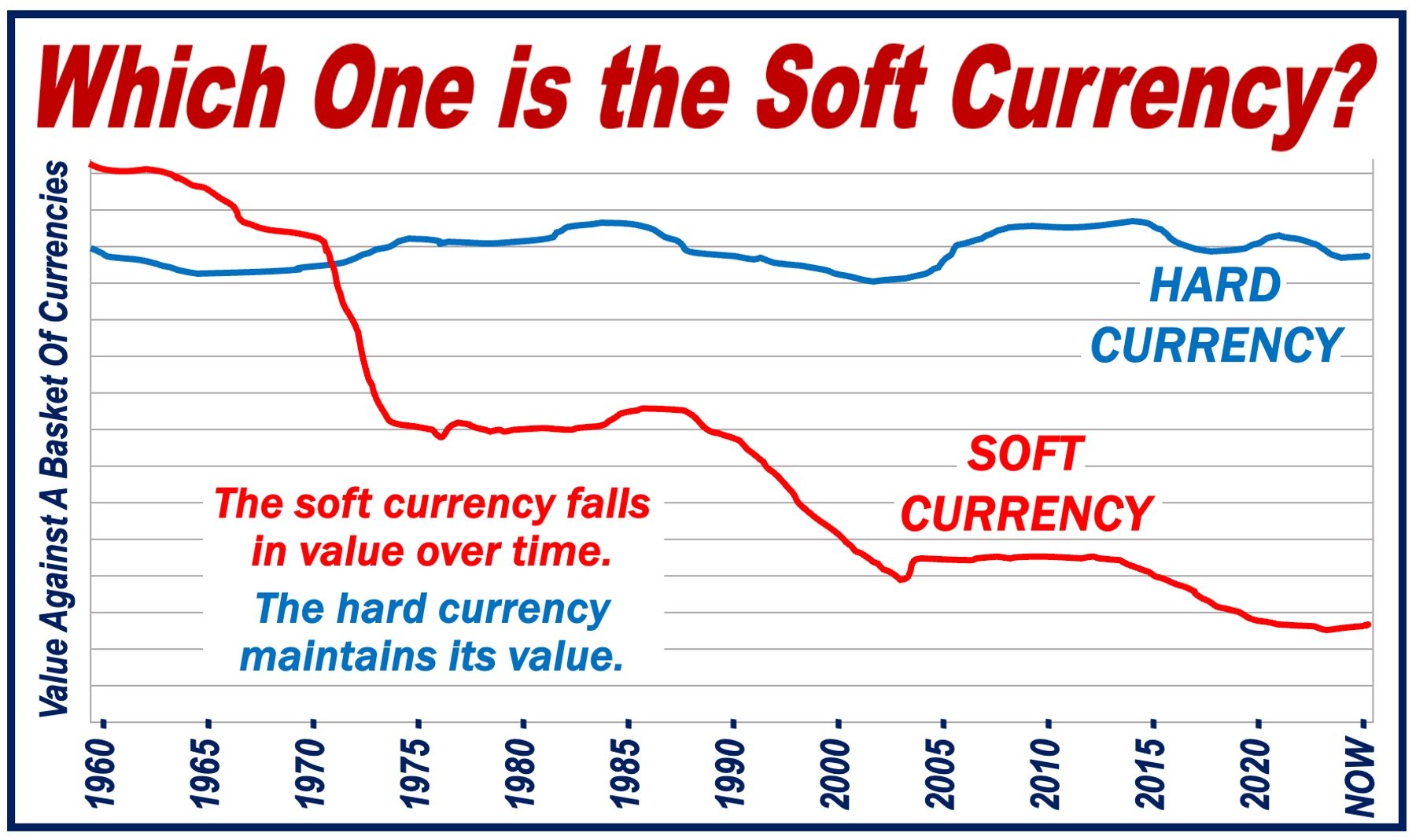

A Soft Currency is ultra-sensitive to internal and external harmful events and often fluctuates sharply. People do not expect a soft currency to maintain its value over time compared to the US dollar, euro, British pound sterling, Japanese Yen, or Swiss franc. Most currencies across the world are soft currencies. The opposite is a hard currency, one that people trust – they expect it to maintain its value over the medium- and long-term.

Also known as a weak currency, a soft currency is unstable. Most of these currencies exist in emerging and developing nations, which compared to the advanced economies, have unstable governments. Foreign exchange dealers favor the hard currencies – the US dollar, Japanese yen, pound sterling, Swiss franc, and euro – and don’t like holding onto soft currencies.

Soft currencies are the least popular for international trade or holding foreign exchange reserves.

An example of a mega-soft currency today is the Venezuelan bolivar, which in November 2016 alone fell in value against the US dollar by 60% – compounded annually, this represents a devaluation of more than 28,000%.

What determines a soft currency?

The three main factors that determine whether people see a currency as hard or soft are:

- the country’s fiscal and political condition and outlook,

- the country’s central bank’s policy position, and

- the currency’s long-term stability and purchasing power.

If I want to buy a Big Mac at a McDonald’s in the United Kingdom, the United States or Germany, its price in pounds sterling, US dollars or euros will not be that much higher than it was ten years ago. This is not the case in Venezuela, Zimbabwe, Russia or Argentina – in those countries, a Big Mac has increased in price relatively steeply over the past decade.

Countries with a strong currency have very low inflation rates and stable economies, while those with a soft currency have unstable economies and more rapidly-rising prices. Soft currencies lose their purchasing power at a much faster rate.

A soft currency’s volatility can often amplify the country’s economic disparities, making it more challenging for the population to achieve upward mobility due to the diminished buying power.

When the euro was born in the 1990s, there were fears that it would be a soft currency. This did not happen, in fact, it soon became clear that it would be one of the leading hard currencies.

With hindsight, economists say this is not a surprise, given the nature of the countries that have the euro as their currency – Germany, the Netherlands, Austria, Finland, etc. – as well as the stringent entry requirements.

When a soft currency collapses, its purchasing power declines dramatically. If you could buy one week’s supply of household essentials with one bill representing 100 units of currency in January, by the end of that year you might need a wheelbarrow full to purchase the same goods.

Why does a soft currency devalue?

Sometimes a country’s government may deliberately force a devaluation in order to reduce its trade deficit – when it is importing too much and not exporting enough.

If the currency declines in value compared to other currencies, exports will be cheaper in the world market and imports will be more expensive – this should boost export sales and reduce imports.

A currency can also devalue or depreciate dramatically when companies, investors, governments and even private citizens lose confidence in that economy. This could be triggered by a simple comment made by the President, or leaked information that is made public by the press.

For example, if a newspaper leaked information about the President and his family making arrangements to leave the country forever, investors and private citizens would immediately start exchanging their currency for dollars, pounds, euros, etc. The soft currency would consequently decline in value rapidly.

A hard currency can withstand rumors, as well as internal and external harmful events, more successfully than a soft currency.

Has the British pound become a soft currency?

The pound sterling has been a hard currency throughout most of modern history. However, on 23rd June, 2016, Britons voted for Brexit – Britain Exiting the European Union (EU).

As soon as the referendum result was announced, the pound declined by 15%. Today, six months later, it is still at least 15% cheaper than it was before the vote.

Will leaving the EU make the British economy more or less stable, or will it make no difference? Nobody knows.

Experts say that if the British Government is able to negotiate a free trade deal with the EU, the country will thrive. If it can’t, Britain will suffer and so will the pound.

If the pound continues suffering, and the economy’s outlook is uncertain, Britain could well end up with a soft currency.

2 Videos

These two educational videos come from our sister channel Marketing Business Network. They explain what “Soft Currency” and “Hard Currency” means using easy-to-understand language and examples.

-

What is a Soft Currency?

-

What is a Hard Currency?