What is a SWIFT code (BIC code)?

A SWIFT code, also called a BIC code, is a form of bank identification to help facilitate international wire transfers.

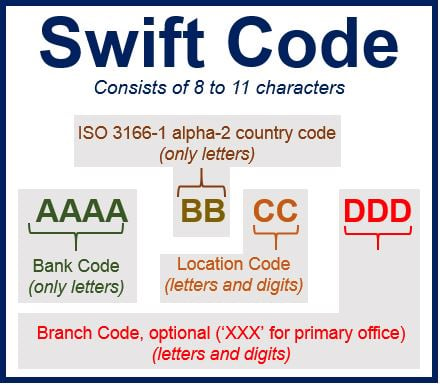

A SWIFT code contains from 8 to 11 characters:

- The first four characters identify the bank

- The following two characters identify the country

- The next two characters identify the town

- The optional last three characters identify the branch (‘XXX’ refers to the primary office)

It is possible to use just eight characters if you are transferring money through the bank’s main office.

It is possible to use just eight characters if you are transferring money through the bank’s main office.

An International Bank Account Number (IBAN) and SWIFTBIC are necessary to carry out all international transfers to and from Europe.

Is a BIC code the same as a SWIFT code?

Yes – the two terms can be used interchangeably. BIC stands for Bank Identifier Code. However, because BIC codes are managed by the The Society for Worldwide Interbank Financial Telecommunication (SWIFT), they are also frequently called SWIFT codes.

Examples of SWIFT codes:

Deutsche Bank (head office in Frankfurt, Germany) SWIFT code = DEUTDEFF

- DEUT = the bank code for Deutsche Bank

- DE = the country code for Germany

- FF = the location code (for Frankfurt)

Royal Bank of Scotland (London, Great Britain) SWIFT code = RBOSGB55

- RBOS = the bank code for Royal Bank of Scotland

- GB = the country code for Great Britain

- 55 = the location code

HSBC Bank Canada (Vancouver, Canada) SWIFT code = HKBCCATTVAN

- HKBC = the bank code for HSBC Bank Canada

- CA = the country code for Canada

- TT = the location code of the branch

- VAN = the branch code

Danske Bank (Denmark, Copenhagen) SWIFT code = DABADKKK

- DABA = the bank code for Danske Bank

- DK = the country code for Denmark

- KK = the code for the city of Copenhagen

Nordea Bank AB (Stockholm, Sweden) SWIFT code = NDEASESS

- NDEA = the bank code for Nordea

- SE = the country code for Sweden

- SS = the code for the city of Stockholm

The ABA Routing Number is a nine-digit number found in check books and deposit slips in the United States. It identifies the financial institution that issued the check.