What is tax? Definition and meaning

Tax is a compulsory charge that a government imposes on corporate profits, land value, and personal income. It also charges a levy on the sale of goods and services and other financial assets and activities. National, regional, and local governments charge taxes so that they can fund their activities and pay their bills.

The principle of tax fairness, often debated in policy circles, seeks to ensure that taxes are equitable and proportional to one’s ability to pay, aiming to balance the tax burden among different segments of the population.

The government uses the money it gathers through taxes to fund public spending. Direct taxation refers to taxing what entities earn. Indirect taxes, on the other hand, we pay when we spend money In other words, it is a levy the goods and services that we purchase.

We have to complete a form each year so that we can calculate how much they owe the government. We call this form a tax return.

Tax evaders face punishment

Paying taxes is compulsory – those who do not pay it but should are guilty of evasion. If you should but don’t pay you are liable to a penalty. In fact, you could even go to prison.

Some celebrities have gone to prison evading taxes. Wesley Snipes, the actor of the Blade movies, went to prison for three years.

Italy’s iconic actress Sophia Loren served 17 days of a 30-day jail sentence in 1982 for evading taxes. In 2013, a Rome-based court ruled that she was innocent and had calculated her tax correctly.

The majority of governments use a department or agency to collect the charges they levy.

In the United States and United Kingdom, the Internal Revenue Service (IRS) and HM Revenue and Customs perform this function. Canadians call their agency the Canada Revenue Agency (respectively).

Tax: purpose and effect

The purpose of taxation is to raise income to fund government. Humans have been paying taxes for many thousands of years.

The money the state spends, i.e., public spending, goes on economic infrastructure, scientific research, the military, and public works. Education, public safety, legal systems, sanitation, public transportation, and roads, for example, are items of infrastructure.

The government also spends money on culture & arts, the operation of government itself, and data collection and distribution.

Fiscal capacity

We refer to the ability of government to raise taxes as ‘fiscal capacity.’

When public spending (expenditure) exceeds tax revenue the government accumulates a debt. The government uses part of the money it collects through taxes to service past debts.

The government also uses taxes to fund public services, welfare and utilities, including the education system, pensions for retired people, public transportation, unemployment benefits, energy, water, and waste management systems.

In some countries, the private sector runs and sets up the utilities infrastructures. The term ‘utilities’ refers to water, electricity, natural gas.

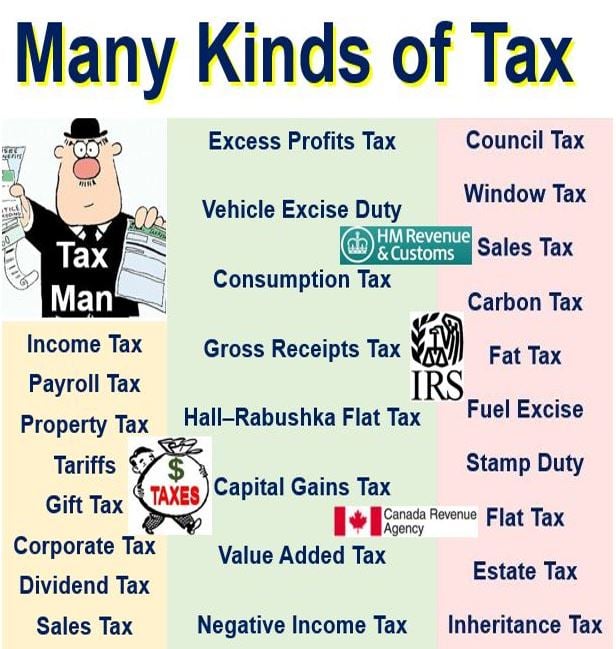

Types of taxes

-

Income Tax

Many jurisdictions tax the income of individual people and business entities, including large corporations. Businesses pay taxes on their net profits, net gains, and other income. Workers on salaries, on the other hand, pay according to how much they earn.

Most countries have a tax-free threshold, i.e., anything below that amount per year is tax-free. This threshold is generally higher for married main earners. However, as many families today have both parents working, some working couples find themselves better off by remaining single.

In most countries, people on higher incomes pay a greater proportion of their earnings compared to their counterparts on lower incomes. In other words, most countries have a vertical equity tax system.

Most employers deduct taxes from the salaries of their employees at source. In other words, the exist in a pay-as-you-earn system.

Sometimes, they make small corrections at the end of the financial year. The taxpayer will either have to pay an additional amount or will get a refund.

-

Businesses vs. employees

Businesses are able to deduct lots of items. Subsequently, the taxes they eventually pay are much lower than the standard national rates. Most businesses manage to pay much less in taxes, proportionally, than employees on salaries.

In some countries, a part of an individual’s monthly mortgage repayments may be tax-deductible.

Negative income – this is an economics term for supplemental pay in a progressive tax system. Employees who earn below a certain amount receive supplemental pay from the government. In other words, the government pays out rather than collects.

Progressive taxation is a system in which higher earners pay a greater percentage of their income than lower earners.

Tax incidence, a key concept in economics, examines how the burden of a tax is distributed between buyers and sellers, influencing prices, market demand, and overall economic equilibrium.

-

Capital Gains

Capital gains tax is levied on the profit when you dispose of (sell) an asset. Specifically, when that asset has appreciated in value, i.e. you sell it for more than you bought it for.

The British Government says that disposing of an asset includes:

- Selling it.

- Giving it away as a gift.

- Transferring it to somebody else.

- Getting compensation for it (e.g. if you lose something you get insurance money).

- Swapping it for something else.

The government charges you on the gain you make, not the total amount of money you receive.

For example:

Imagine you bought an antique table for $5,000 and sold it at a later date for $25,000. This means your gain was $20,000. Therefore, the gain, i.e., $20,000, would be liable for capital gains.

In some countries, a number of assets are tax-free. Every country has a tax-free allowance. In other words, if your profit is below that amount, you will pay no capital gains.

How much individuals have to pay in taxes depends on their tax bracket. Therefore, higher earners in most countries probably have to pay higher rates of capital gains.

-

Corporate tax

Governments levy corporate tax (Corporation tax in the UK) on the profits of companies. In the US/Canada, people also call it corporate income tax. Rules surrounding how much companies have to pay vary considerably from country to country.

According to PricewaterhouseCoopers (PwC), a multinational professional services network, in the United States, resident corporations pay taxes on their global income.

On its website, PwC writes:

“Generally, a foreign corporation engaged in a US trade or business is taxed at regular US corporate tax rates on income from US sources that is effectively connected with that business and at 30% on US-source income not effectively connected with that business.”

-

Estate or inheritance tax

Americans call the levy on the transfer of the estate of a deceased person estate tax. Britons call it inheritance tax.

The levy applies to property that is transferred through a will or an intestate estate or trust. It also applies to the payment of certain types of life insurance benefits.

In the US, if a spouse or a federally-recognized charity inherits the estate, it does not usually pay any tax. Up to a certain amount may be given by an individual before and/or upon death without incurring deferral estate taxes.

People who operate in the shadow economy, i.e., ‘below the radar,’ pay no taxes on income, sales, and profits. They don’t pay because they operate secretly and never declare any of their activities.

In some countries, the shadow economy – also known as the informal sector or underground economy – represents more than half their GDP. Their governments either tax those in the formal sector more heavily to make up for the shortfall, or provide very basic services.

Tax evasion and the shadow economy not only deprive governments of necessary revenues but can also lead to increased tax rates for compliant taxpayers and result in underfunded public services and infrastructure.

There are many other types of taxes, including stamp duty, road tolls, vehicle excise duty, environmental tax, amusement tax, severance tax, occupation tax, franchise tax, payroll tax, tariffs, documentary stamp tax, alternative minimum tax, flat tax, insurance premium tax, transfer tax, excess profits tax, windfall profits tax, bank tax, and congestion tax.

Video- What is Tax?

This interesting video presentation, from our sister channel in YouTube – Marketing Business Network, explains what a ‘Tax’ is using simple and easy-to-understand language and examples.