Trust fund – definition and meaning

A trust fund is a fund where assets are transferred to be held or managed by a single or multiple trustees. A trust fund aims to benefit an individual, usually a family member, or an organization. For example, nonprofit organizations or charities commonly benefit from trust funds.

It is common to use the terms ‘trust’ or ‘fund’ with the same meaning as ‘trust fund.’

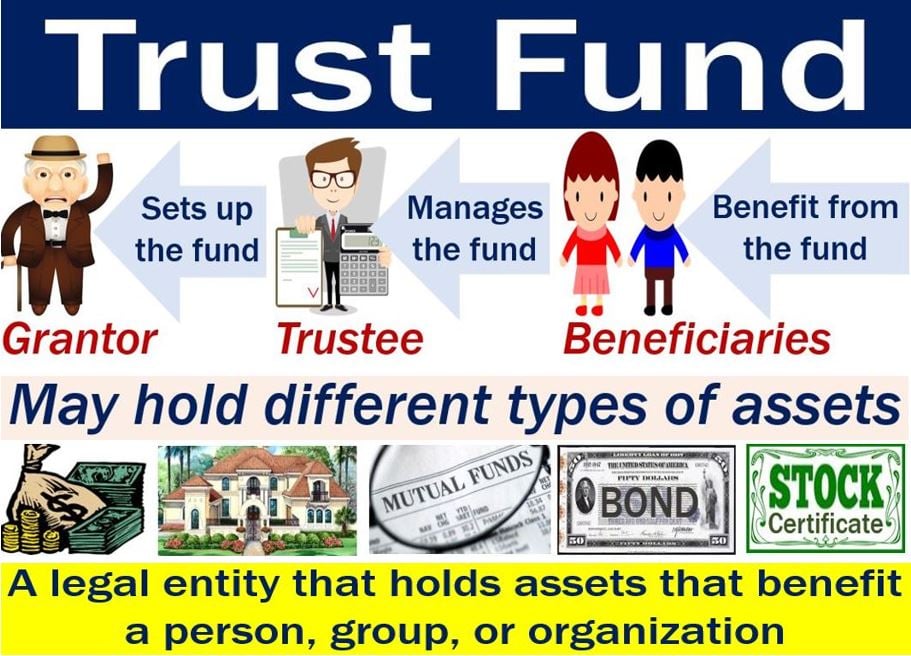

There are three parties in a trust fund:

The grantor – this is the person who creates and puts their assets in the trust.

The beneficiary – this is the person benefiting from the trust.

The trustee – this is an individual or a group that the grantor assigns to manage the trust.

In a trust fund, the grantor sets up the conditions so that the beneficiary can receive money from the trust. The grantor may, for example, specify a length of time, a certain age, or a specific moment.

The trustee manages the assets so that they yield the highest possible profit for the beneficiary.

Grantors can personalize trust funds according to their needs and specifications. They may include cash deposits, mutual funds, and bonds. They may also include equity shares and real estate. In fact, the grantor can choose from a virtually endless range of assets.

Anyone can set up a trust, including business persons, homeowners, or investors.

Trust fund – limitations

Trust funds may have some limitations. For example, if the beneficiary is a minor, they might not have the right to receive annual profits from the fund.

However, beneficiaries may receive a certain amount of money each month. The money may be for treating an illness, education, or living expenses.

Adult beneficiaries may have either limited or full right to the fund. They may also receive profits from the fund each year.

Why set up a trust fund?

People often create this type of fund to manage and protect their family assets or business assets.

As soon as the grantor transfers the assets to the trust fund, they belong to the fund. In other words, they no longer belong to the grantor.

Consequently, the trust fund protects the assets from creditors, financial settlements, lawsuits, high taxes, legal fees, etc.

“A trust fund is a type of legal arrangement in which a trustee holds title to property, such as stocks, bonds, or real estate, and administers it for the benefit of another person or institution, known as the beneficiary, according to the terms of the trust instrument.”

Video – How does a trust work?

Many people think only wealthy people set up a trust fund. This is not true. In fact, they are suitable for a wide range of incomes.