What are vulture funds? Definition and examples

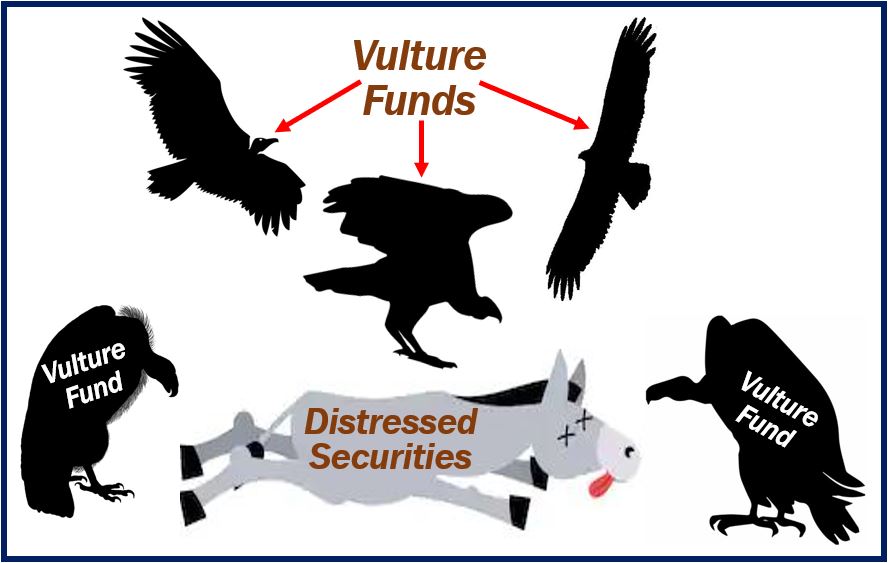

Vulture funds are mutual funds which invest in properties, businesses, or sovereign debts that are performing very badly. Many of these funds are undervalued. Vulture funds are a subset of hedge funds. We refer to these investments – which are considered in default or extremely weak – as distressed securities. If the investment is a property, we call it a distressed property.

If a debtor defaults, it means they were unable to (or did not) pay back a debt. A debtor is a person, company, organization, or any entity that owes money.

Cambridge Dictionary defines a vulture fund as “an investment fund that buys shares cheaply in companies that are failing in order to take control, improve their performance, and so make money”.

We call somebody or an organization that buys financial instruments at knock down prices from distressed countries, businesses, and other entities a vulture investor.

Vulture funds operate in the secondary market

Vulture funds purchase risky debt instruments in the secondary market at knock-down prices. The secondary market is where previously issued financial instruments such as bonds and stocks are sold. It contrasts with the primary market, where new securities are sold.

The fund benefits by taking the original issuers of the financial instruments to court to recover the debt.

According to the Corporate Finance Institute:

“The fund buys risky debt instruments at highly discounted prices in the secondary market and benefits by taking legal action against the issuers for debt recovery. Vulture fund portfolio managers seek investments offering very high potential returns due to their high risk of default.”

This type of mutual fund focuses on fixed income instruments, including high yield bonds. It also targets equities that are either in bankruptcy or nearly bankrupt.

Vulture funds – examples

The Argentinian debt crisis

In February 2016, after negotiating for fifteen years, Argentina agreed to repay six vulture funds. They had bought instruments in the form of Argentinian sovereign debt.

The bondholders – including Aurelius Capital Management, and Elliott Management’s NML Capital unit – were eventually paid $6.5 billion.

The Puerto Rican debt crisis

Puerto Rico, an unincorporated territory of the United States, now finds itself in a similar situation. Its government filed for bankruptcy. It currently owes more than $75 billion in pension and bond debt to its creditors.

Most of the creditors are US hedge fund and mutual fund managers, including Aurelius Capital Management, Franklin, and Oppenheimer.

On June 16th, 2019, CNBC Markets reported:

“The oversight board in charge of Puerto Rico’s ongoing debt restructuring saga announced late on Sunday they have come to terms with bondholders of around $35 billion, which accounts for nearly 50% of the bankrupt island’s total bonded debt.”

“The agreement, which is on the framework for the plan of adjustment, provide for more than a 60% average haircut for all $35 billion, a 36% haircut on pre-2012 general obligation or “GO” bonds, and a 27% haircut on public authority bonds that carry a constitutional guarantee on payment.”

In this context, a ‘haircut‘ is the percentage of an asset that is used as collateral; it is deducted from its market value.