Wealth tax – definition and meaning

Wealth Tax is a tax on a person’s assets, on his or her net worth. It is not an income tax, but rather on an individual’s wealth. Targeting wealthy people for taxation is popular among politicians.

In other words, wealth tax is a tax on what we have, as opposed to income tax, which is a tax on what we earn.

In virtually every country in the world, most of the wealth is in the hands of a very small percentage of the population.

By focusing on wealthy people and proposing or implementing a wealth tax, a great deal of money can be raised from a relatively small number of people – so the theory goes.

Yet, this strategy may influence the investment decisions of the wealthy, potentially leading to more cautious or conservative investment approaches that could affect overall economic growth.

This may be popular for the rest of the population because they are told that their tax burden is either reduced or kept down.

Most politicians and some economists claim that a wealth tax helps reduce inequality – the difference in wealth between the top 1% or 10% richest people in the country and the rest of the population or the poorest individuals.

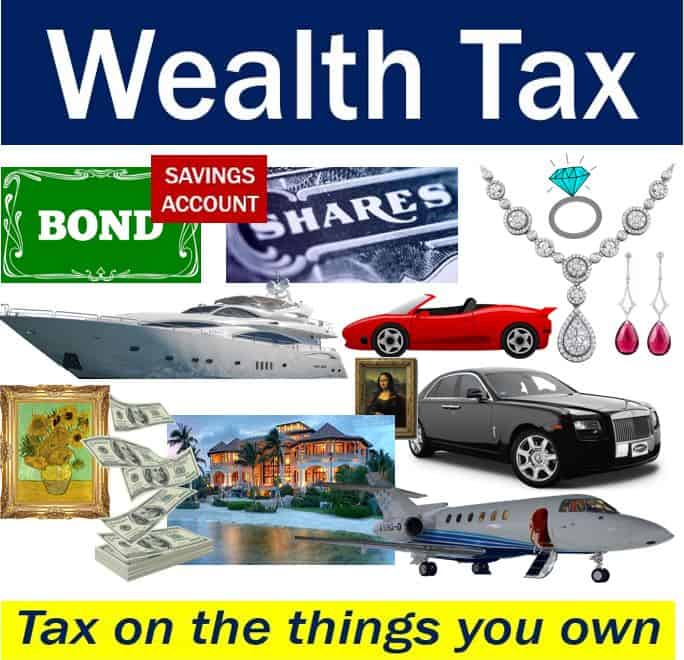

Wealth tax is a tax levied on personal capital, the things you own, your possessions, including cash, bank accounts, cars, airplanes, homes, bonds, shares, jewelry, expensive works of art, patents, copyrights, antiques, etc.

Wealth tax is a tax levied on personal capital, the things you own, your possessions, including cash, bank accounts, cars, airplanes, homes, bonds, shares, jewelry, expensive works of art, patents, copyrights, antiques, etc.

In most cases, when calculating how much wealth is to be taxed, the person’s liabilities are deducted, hence it is often referred to as net wealth tax.

There are many wealth tax critics

Wealth tax critics say that it discourages creative and hardworking people from being creative and working hard – both wealth-generating economic activities. In other words, if you target the assets of wealthy people, you may be erasing future assets that would have been created if the wealth tax had not existed.

If it prevents future assets from being created or accumulated, the tax is self defeating, because in future tax revenue from this source will decline, critics argue.

Critics add that this type of tax destroys jobs, because it discourages the accumulation of wealth, which they insist drives economic growth.

Wealth tax brings in little revenue

Most governments that introduce a wealth tax are soon disappointed at the tiny amount of revenue it generates. The world’s richest people have the smartest, best-trained accountants and lawyers. These people are experts in **tax avoidance.

** Tax avoidance refers to legal methods for reducing one’s tax bill, unlike tax evasion, which is illegal.

Across the OECD (Organization for Economic Co-operation and Development) nations, wealth tax represents less than two percent of total tax revenue for governments.

The world’s richest people find it much easier to emigrate than their counterparts further down the socioeconomic ladder. Emigrating costs a lot of money – something rich people have in abundance.

Wealth taxes may lead to a brain drain, where not only wealth but also innovation and talent are lost to countries with more favorable tax conditions.

Additionally, the administrative costs of enforcing and collecting the wealth tax can be substantial, potentially offsetting some of the revenue gains anticipated by its implementation.

If lawmakers target wealthy individuals too severely, they are likely to move abroad into countries with more ‘rich-friendly’ tax regimes. History has shown that this always happens if the tax burden on a country’s wealthiest individuals reaches a certain point.

In an article published in the Washington Post in 2006 – Old Money, New Money Flee France and Its Wealth Tax – Molly Moore wrote that while France’s wealth tax brought in approximately $2.6 billion annually in revenue, it cost the country more than $124 billion in capital flight from 1998 to 2006.

Examples of wealth tax

-

Argentina

Called Impuesto a los Bienes Personales, the tax is imposed on assets above $53,500 (ARS 800,000) at an annual rate of 0.75% for 2016, 0.5% for 2017, and 0.25% in 2018.

-

France

Known as Impôt de solidarité sur la fortune, it applies to any assets above €800,000 ($872,000) if an individual’s net worth is at least €1.3 million ($1.42 million). Marginal tax rates range from 0.6% to 1.5%. In 2007, just 1.4% of total tax revenue came from this wealth tax.

-

Spain

Called Patrimonio, it is a progressive tax that ranges from 0.2% to 3.75% of net assets for individuals with a net worth of at least €700,000 ($763,000). Tax rates vary between provinces.

-

India

India used to have a wealth tax. This was abolished in 2016.

-

Norway

Individuals with a net worth of more than Kr1.2 million ($139,413), as of 2015, pay 0.7% (municipal) and 0.15% (national), i.e. a total of 0.85%, which is levied on their assets. The Progress and Conservative parties in Norway’s current government, as well as the Liberal Party say they plan to reduce and eventually abolish wealth tax.

-

Switzerland

The majority of cantons have no such taxes for people with a net worth lower than CHF100,000 ($100,603), and progressively increase the tax rate on net assets from 0.13% to 0.94%. Wealth tax is levied against the global assets of Swiss residents, but not against the assets held by non-resident individuals in Switzerland.

Types of taxes

There are many types of taxes, covering every type of income, wealth, and many transactions. Let’s take a look at some tax terms, their meanings, and how we can use them in a sentence:

A tax system that imposes the same percentage rate of taxation on everyone, regardless of income. It is synonymous with flat tax.

Example: “Under a proportional tax system, both low and high earners pay the same proportion of their income in taxes.”

-

Flat Tax

A tax system with a constant marginal rate, usually applied to individual or corporate income, which is synonymous with proportional tax.

Example: “The new flat tax policy means everyone will contribute the same percentage of their income, regardless of how much they earn.”

A taxing mechanism in which the taxing authority charges more taxes as the income of the taxpayer increases.

Example: “The progressive tax system means that he pays a higher percentage in taxes as his earnings exceed each threshold.”

A tax imposed on businesses within a certain jurisdiction for the privilege of conducting business in that area.

Example: “The local government enforced an occupation tax on all retail establishments operating within the city limits.”

A tax levied by a government directly on financial income generated by all entities within their jurisdiction.

Example: “Her annual income tax return showed a significant deduction due to her charitable donations.”

A tax imposed on the net income of the company. In the UK/Ireland and some other countries, it is called Corporation Tax.

Example: “The corporation faced an increased corporate tax liability this year due to higher profits.”

-

Sales Tax

A consumption tax imposed by the government on the sale of goods and services.

Example: “A 7% sales tax was added to the total cost of her purchase at the checkout counter.”

A consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale.

Example: “The price tag includes a value added tax, which is calculated based on the cost of production at every point of sale.”

Two Videos

These two YouTube videos come from our sister channel, Marketing Business Network or MBN. They explain what the terms “Wealth Tax” and “Progressive Tax” mean using easy-to-understand language and examples:

-

What is Wealth Tax?

-

What is Progressive Tax?