Singapore may be a tiny and quiet country, but it is one of the biggest countries in Southeast Asia in terms of its economy. The country’s state-owned enterprises can be credited for its successful economy. Its sovereign wealth fund Temasek holdings own the majority states in some of the country’s biggest and most affluent companies, including SingTel, Singapore Airlines, ST Engineering, and MediaCorp.

The country also earned its revenue from various industries like chemicals, electronics, and services. Wealth management services are also considered as the main source of income of the Lion City. It is why there are plenty of people who would look for the best licensed money lender in Singapore.

But before you start applying for loans and borrowing money from the best licensed money lender in Singapore, you need to learn all the facts. It will help you get approved faster and protect you from incurring additional costs.

Essential Loan Elements

It is always beneficial to know the most important key terms used in all kinds of loans. These terms include:

Principal

It is the initial amount of money that you are borrowing from a licensed lender. The principal amount will be computed with the added costs to determine how much you have agreed to pay back to your lender.

Term

It refers to the period that the lender will let you borrow the money. You need to pay back your loan within the term mentioned on the loan contract. Most of the time, there are different terms stated for different loans. Credit cards are regarded as revolving loans. It means that you may borrow and repay for as long as you want without applying for a new loan.

Interest Rate

It is the amount that the lender will collect from you for borrowing money. It is often a small percentage of the amount of loan that you will borrow. The lenders also base it on the rate approved by the Singapore Interbank Offered Rate (SIBOR).

How To Qualify For A Loan

You need to qualify for the requirements set by the lenders to get a loan. These requirements will allow the lending companies to assess if you can repay the money you borrow.

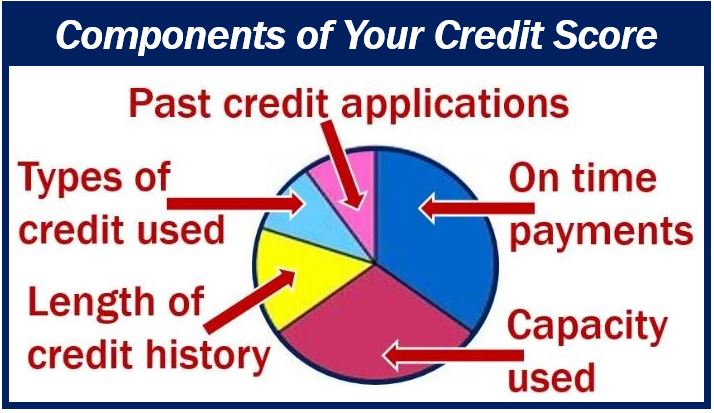

Your credit score is the most crucial factor in making you qualify for the loans. It will let the lenders know how you handle your loans in the past. Higher credit scores will most likely guarantee the approval of the loan.

It is also important to present several documents to show that you can repay the loan. The lenders will analyze your debt-to-income ratio or the amount of money you ask to borrow compared to the total amount you are earning.

If you do not have a competitive credit rating or plan to loan a huge amount of money, you might also need to file the loan with collateral. It will let the lender get something from you and sell it if you cannot repay the money.

How To Apply For A Loan

When you plan to borrow money, you need to find the best licensed money lender in Singapore to accept your loan application. Some will require you to apply for the loan in person, while others let you apply online.

Once you send in your basic information, the lender will check out your application and decide whether you deserve to get the loan or not. If you get approved, the lender will send the funds to your account or give it in case. Some can also send the funds to the organization where you plan to spend the money, like car dealers or your real estate agent.

After receiving the funds, you need to repay the loan on or before the agreed date. You need to include the predetermined interest rate in all your payments.

Applying for monetary loans in Singapore also requires you to be wary about where you will submit your application. The country’s Ministry of Laws warned individuals to be careful about unlicensed money lenders and scammers who deceive victims.

You need to be careful about borrowing money from companies that encourage you to file a loan through text messages of websites that claim to represent a licensed money lending firm. It would help to check the list of licensed money lenders in Singapore through the MLAW website. If the lender’s name is not on the list, it may be dangerous to ask them for any loans since they may ask you to repay them with staggering interest rates.

Interesting related article: “What is a Personal Loan?”