The Great Recession was a period of severe economic decline that occurred following the Global Financial Crisis of 2007/8. It was the most severe and long-lasting period of negative GDP growth since the Great Depression of the 1930s. The Great Depression followed the Wall Street Crash of 1929.

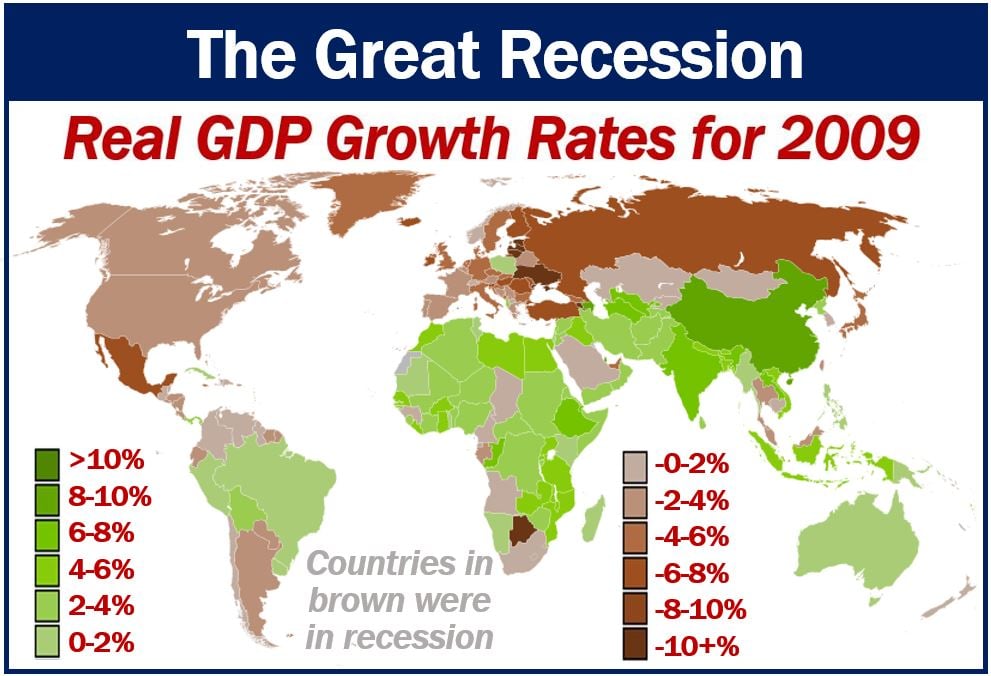

The Great Recession affected many countries across the world; some more than others. North American and Europe suffered more severely than Australia, India, China, and some other emerging economies.

During the Great Recession, governments spent trillions of dollars bailing out scores of banks across the world.

The first sign of the crisis was when BNP Paribas, a French bank, suspended three of its funds. It did so because the US subprime mortgage sector prevented proper calculation of their value.

The Great Recession – USA

The Great Recession, in the United States, started in December 2007 and lasted until June 2009. It was the longest recession since the Great Depression in the 1930s.

Real GDP shrank by -4.3% from its peak in the Q4 of 2007 to its trough in Q2 of 2009. Just before the recession began, US unemployment stood at 5%. By June 2009, it had risen to 9.5%. In October 2009, it peaked at 10%.

According to Federal Reserve History:

“Lasting from December 2007 to June 2009, this economic downturn was the longest since World War II.”

The Great Recession also damaged the following sectors:

- House prices declined by about 30%, on average from mid-2006 to mid-2009.

- The net worth of non-profit organizations and US households declined from $69 trillion in 2009 to $55 trillion in 2009.

- The S&P Index dropped by 57% from October 2007 to March 2009.

The Great Recession – UK

During the last two quarters of 2008, the UK economy had shrunk. Technically, a country is in recession if there are two consecutive quarters of negative GDP growth. On 23rd January 2009, the Office for National Statistics announced that the country was in a recession.

With the economic news, there also came news of a rash of bankruptcies, with Waterford Wedgwood and Woolworths among them. AstraZeneca, GKN, and Corus announced severe reductions in their workforce due to a slump in industrial demand.

Even demand for electricity declined as households began to tighten their belts and factories shut down.

In January, the Royal Bank of Scotland posted a massive £28bn ($38bn) loss. The government had to bail out several banks.

After six successive quarters of negative GDP growth, the UK economy finally moved out of recession in Q4 of 2009.

According to Parliament.uk:

“At the height of the recession, GDP fell by -2.6% in a single quarter (Q1 2009) – the same percentage by which the economy expanded during the whole of 2007.”

“The recession was the ‘deepest’ recession (in terms of lost output) in the UK since quarterly data were first published in 1955.”

“Actual growth in 2009 saw the sharpest fall in GDP (-5.0%) in a calendar year since official figures began in 1949 and the highest fall since 1931, excluding the recession following the Second World War.”

The Great Recession affected all sectors of the UK economy, though construction and manufacturing were hit the hardest.

The Great Recession – Canada

Canada was one of the last advanced economies to enter into a downturn. In Q1 2008, there was negative GDP growth. In Q2 and Q3 of 2008, on the other hand, growth was positive.

The Great Recession officially started in Canada in Q4 of 2008.

According to Wikipedia, the Canadian economy entered into a recession one year later than the US for two reasons:

“First, Canada has a strong banking sector not weighed-down by the same degree of consumer-related debt issues that existed in the United States. The United States economy collapsed from within, while the Canadian economy was being hurt by its trade relationship with the United States.”

“Second, commodity prices continued to rise through to June 2008, supporting a key component of the Canadian economy and delaying the start of recession.”

Even though the Bank of Canada announced that the recession was over in July 2009, the true economic recovery did not start until November 30, 2009.

Canada’s recovery had a hiccup in 2015 when GDP shrank in Q1 and Q2.

Australia

Australia did not enter into a recession during the 2007-2010 period. Its proximity to the booming Chinese economy helped it fare better than the other advanced economies. Government stimulus spending also helped.

While most of the industrialized world was suffering, Australia’s GDP grew by 2% in 2009.

The Reserve Bank of Australia, the country’s central bank, said the country fared better than others because:

“1. Australian banks had very small exposures to the US housing market and US banks, partly because domestic lending was very profitable.”

“2. Subprime and other high-risk loans were only a small share of lending in Australia, partly because of the historical focus on lending standards by the Australian banking regulator (the Australian Prudential Regulation Authority (APRA)).”

“3. Australia’s economy was buoyed by large resource exports to China, whose economy rebounded quickly after the initial GFC shock (mainly due to expansionary fiscal policy).