It is imperative to have appropriate knowlegde and information about loans before you apply for an emergency loan for the first time in your life. Jumping into without proper insight will make your first experience awful.

Apart from that, if you approach a financial institution or a lender with proper information, your chances of getting a loan approved will increase. Although, it is easier to get personal loans than any other type of loans, still there are many factors that may decrease your chances of loan approval.

As you may know, the final decision to approve/disapprove your loan resides in the hands of the financial institution or lender. Imagine you have to get your vehicle repaired or you don’t have enough funds to pay your hostel fees? In such a case you can get an emergency loan of upto fifty thousand bucks.

With that, let’s look at some of the important points to consider before you go out to apply for an emergency loan.

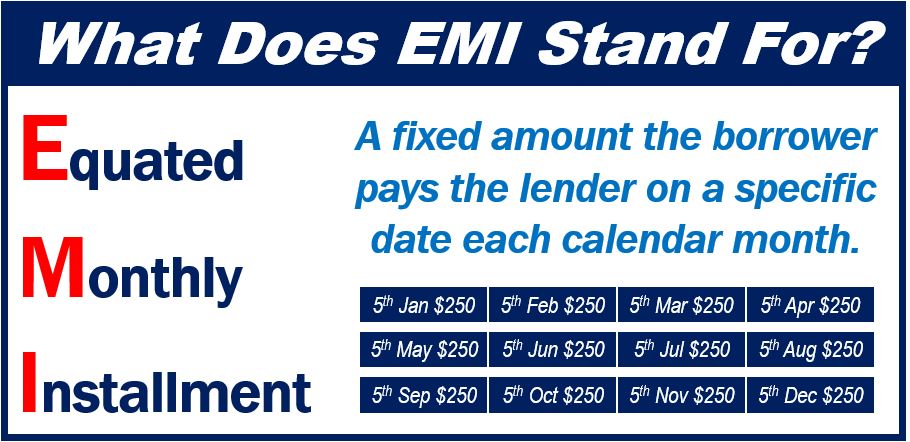

Check the EMIs

Generally, these loans are unsecured in nature, therefore the interest charged for these loans is higher as compared to other kinds of loan. If you are someone looking to apply for a loan online, then you can get it with an interest rate of 10.3% that goes upto 30% per annum if your profile is not good enough.

EMIs are the most important part of the loan. Therefore, you have to look at this point with more caution. You can try EMI calculator tools to get an idea of how much will be your EMIs for a loan amount that you need.

Hence, if you know the EMI aspect of your loan, it will make the process easier and hassle free.

Comparing is better than complaining

As a matter of fact, all financial institutions have different policies, procedure and rate of interest for personal loans. Also, not all banks would easily accept your loan application.

Therefore, it is better to compare the rates that other banks offer, before you select the best one from the ones that are available. You don’t even have to visit the bank’s branch. You can get all the info from the bank’s website or portal.

This will give the facility to check the best option from the comfort of your home and get rapid cash instantly.

Take what you can repay on time

Once you know that you are eligible to get a loan, you will see how lenders would offer fascinating schemes to you. But make sure that you don’t get trapped in such offers in a temptation to get more money.

Always remember to take a loan of the amount that you really need, not more than that! Because if you go with temptation of getting more money, repaying the amount could be troublesome for you in the end.

Miscellaneous factors

Most people might not know, but there are a whole lot of other costs that are involved in the process of getting a personal loan. Such as processing fees, taxes and others.

Also, get yourself informed about the prepayment charges amount, penalties in case of late payment among other costs.

In the end, go with a financial institution that offers you a loan with minimal such charges and have a flexible policy for loan applicants.

Interesting related article: “What is Interest Rate?“