For many entrepreneurs, business owners, and people with inherited capital, investing is one way of putting savings and earnings to use if you want to earn a secondary income. There are several different ways you can invest and utilise your capital.

For many entrepreneurs, business owners, and people with inherited capital, investing is one way of putting savings and earnings to use if you want to earn a secondary income. There are several different ways you can invest and utilise your capital.

If you’re looking to put some of your hard-earned money to work for you, you should be seeking investment options that offer healthy growth.

What is a portfolio?

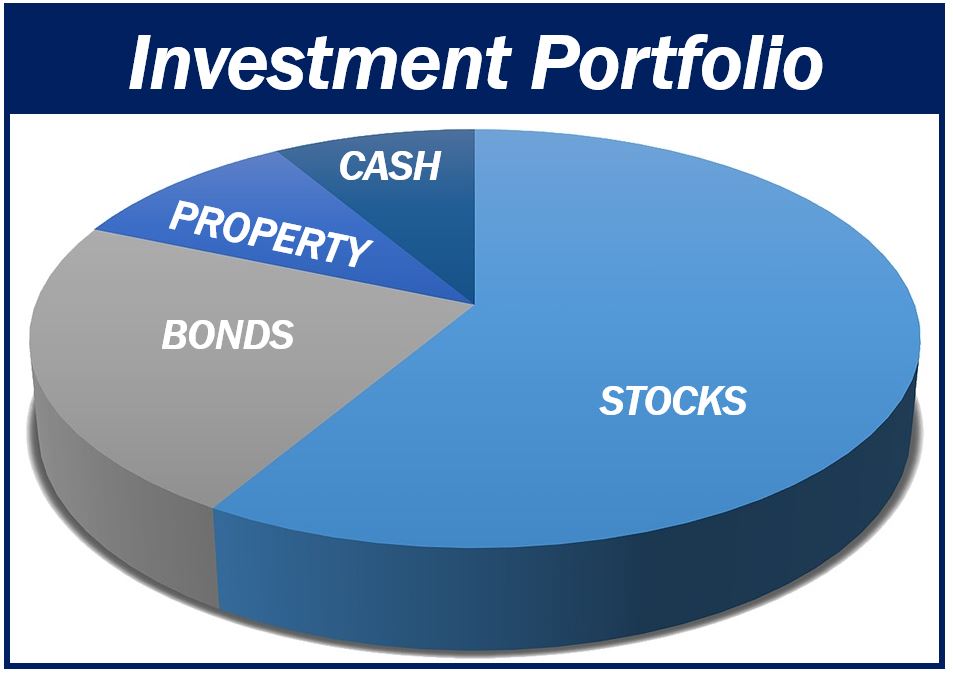

A portfolio is a spread of investments that a person, company, hedge fund, fund manager, or financial institution owns. The value of each asset or financial instrument in a portfolio determines its risk-to-reward ratio, which we refer to as their asset allocation.

The long-term goal of every investor is to get the highest returns possible while at the same time minimizing risk.

A typical portfolio should have a good spread of stocks and shares, bonds, and cash and equivalents. Some people also like to include gold.

Real estate

Investing in real estate can be a lucrative move as long as the properties are in the right areas.

Real estate is ideal for people who are interested in long-term investments. For example, the current market reaction in the UK to the Brexit troubles should not put you off given that your investment horizon is long-term.

Buy-to-let

According to RW Invest, buy-to let is a very popular and lucrative investment method. If you purchase a buy-to-let property, you can generate excellent returns and also benefit from owning real estate.

RW Invest has the following definition of buy-to-let:

“Buy-to-let is a term that refers to purchasing a property for the purpose of letting it out to a tenant. Buy-to-let investors buy a property and make money from the rent paid by their tenant. These properties can either be purchased outright or with a buy-to-let mortgage.”

In the UK, buy-to-let has been a popular investment option since 1996. Over the last couple of decades, it has become increasingly more prevalent. There were more than one million outstanding buy-to-let mortgages in 2007, compared to just 500,000 in 2004.

When investing in property, you can do so on your own or with the help of a property investment company. These companies specialize in offering property developments which are especially attractive to investors.

Benefits of diversification

A good investment portfolio should be diversified. Investments are no different to any other activity with an element of risk. Follow the strategy of never putting all your eggs in one basket.

An interesting article published in the journal Money has the following portfolio recommendation for investors in the United States.

A simple mix of:

- 55% American stocks

- 30% US bonds

- 10% foreign developed country stocks

- 5% emerging markets stocks

How you allocate your investments depends mainly on what type of risk tolerance you have. If you are risk-averse – you don’t like taking risks – you might have a greater percentage of bonds and fewer shares.

A risk-seeking investor, on the other hand, might do the opposite – own fewer bonds and more shares.

It is normally a rule of thumb that when the potential short-term rewards are greater, so are the risks. Conversely, the safest investments tend to have the lowest returns.

Do not overextend yourself

If you don’t have millions of dollars, pounds, or euros to fall back on, be careful not to overextend yourself. With the exception of gold or government bonds, you should only invest what you are willing to lose.

If you’re investing with the aim of having an auxiliary source of income to your main business, particularly if you run a smaller operation, consider the outgoing payments and projections of that venture as a priority.

With a lot of investments, your money might be tied up – sometimes for a long time. Make sure you always have access to some cash.