When most of us want some quick cash to finance a purchase or pay for an emergency situation, bad credit is the thing that keeps us from getting a loan application approved. Because most of the lenders perform a hard credit check to determine the ability of a borrower to repay a loan. But poor credit score should not be a barrier in your way to getting a loan approved to meet your sudden financial needs. However, you may need to put some extra effort to apply and qualify for a loan with bad credit.

Below is a beginner’s guide on how to get a personal loan with bad credit and where you can get one with the poor credit score.

Where to get a loan with bad credit

-

Credit unions

One must have membership in a credit union to get a loan but most people turn to them as they are the best option to get a loan with bad credit. Credit unions work by considering the credit history of a consumer when making a final decision of loan approval. And maintaining strong and positive relations with a union can help you qualify for a loan even when you have a poor credit score.

-

Online lenders

There are so many lenders that offer quick loans online and lend money to people with bad credit. They usually provide features like quick access to cash and help consumers build good credit. Hence, it is great to compare online lending companies and loan offers from other institutes to shop for the lowest interest rate and better repayment terms.

How to get a personal loan with bad credit

To help you get a loan from the right lender with bad credits, our team has gathered some important steps you should take to make the process easier and more effective.

-

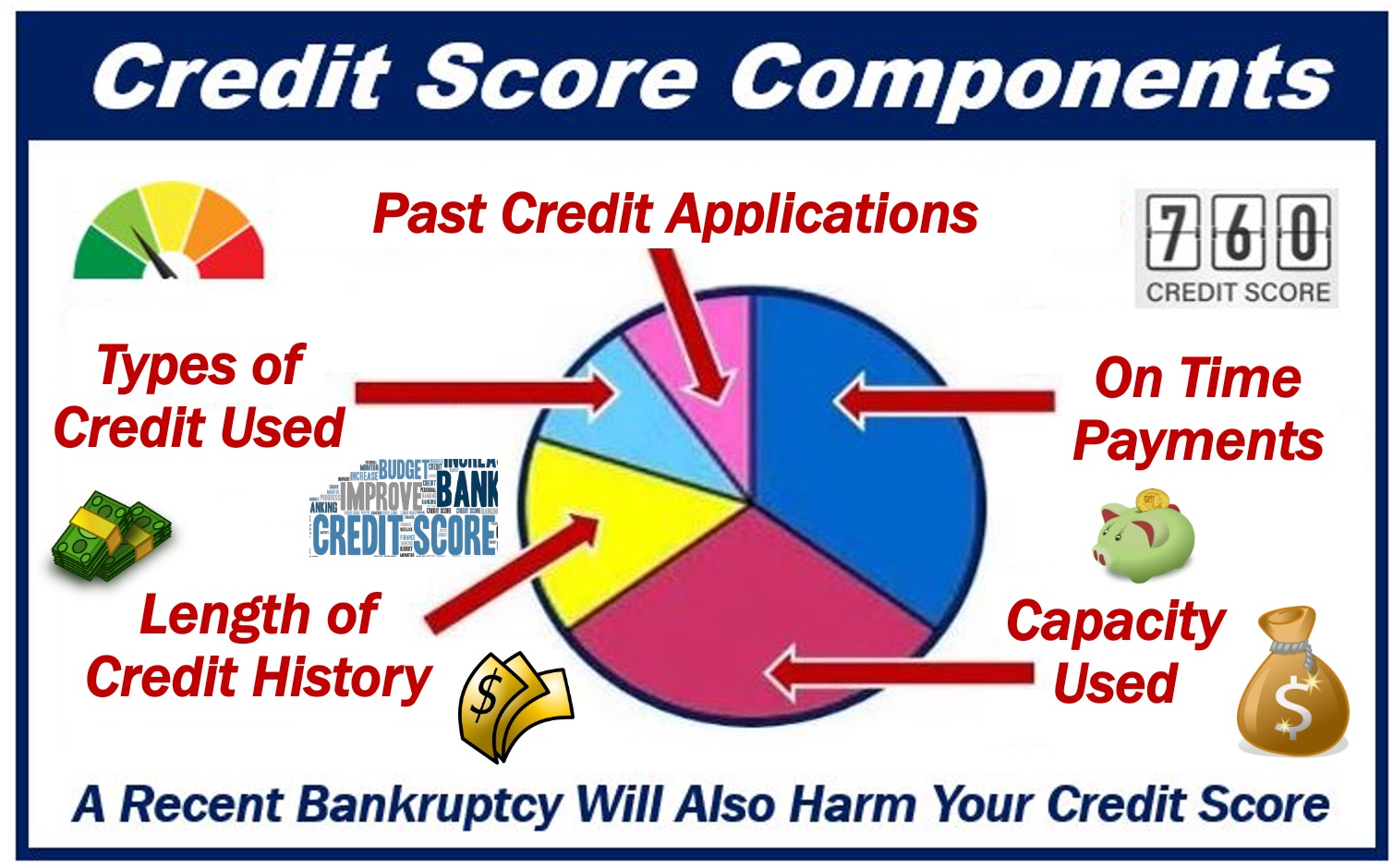

Check your credit score

Online lenders usually have minimum credit score requirements and your application could be easily rejected if you don’t meet the criteria. This means you should check your credit score before you apply for a quick personal loan. Use a reliable online platform or tool to have a glance at your credit history and see whether you meet the minimum credit requirements or not. If there are some errors in your credit report that can be fixed easily, go ahead and fix them as soon as possible to improve your credit.

-

Compare loan companies for the best rates

Not all lenders and loan companies have the same credit requirements, offers, and rates. So it helps you compare different options available. A company that offers the best bad credit loan offers may also provide features like quick funding, mobile application to manage loan repayment and tools to build good credit, etc. Compare different options manually or use an online platform that helps compare lending companies.

-

Pre-qualify for a loan

Pre-qualification is the best way to see what rate you are being offered, the amount of the loan you can apply for and repayment terms, etc. Pre-qualifying a personal loan doesn’t affect your credit which makes it a good option to check and compare the lender before making a final decision. Most online loan providers offer this feature.

-

Add another person to your loan application

When it comes to getting a loan with bad credit, secured and co-signed loans are the prominent solutions. When you apply for a loan with a co-signer, the income and credit information of the other person is added to your loan application. This increases the chances of getting your application approved. While secured loans require collateral like property, a car or a savings account. the lender takes the collateral if the borrower is unable to repay the loan.

-

Submit your loan application with all necessary details and documents

Gathering all the important information and documents ahead of time makes sense to save time and effort when submitting a personal loan application. Applying for a quick personal loan may require you to provide personal information, pay stubs, financial statements and social security number etc. Instant personal loan providers usually review the application and approve it within 24 hours. While some others may take a couple of days to approve or reject the loan application.

Conclusion

Getting a personal loan with bad credit is easier these days as there are so many online lenders that offer loans with no credit check. However, you should check the monthly payments toward the loan and interest rate to determine the affordability of a loan. For this purpose, you can use an online loan calculator or other tools provided by the lender.