Companies make money by spending money, as the saying goes. From payroll and supplier invoices to SaaS subscriptions and the operation’s team annual team dinner, spending money keeps your business running.

However necessary, spending has to be controlled, analysed and optimised. The finance team has the main responsibility for this.

As businesses of all sizes undergo digital transformation initiatives, they’re turning to expense management software such as Payhawk to optimise spending and retain financial control – a current pressing concern for finance teams in this economic climate.

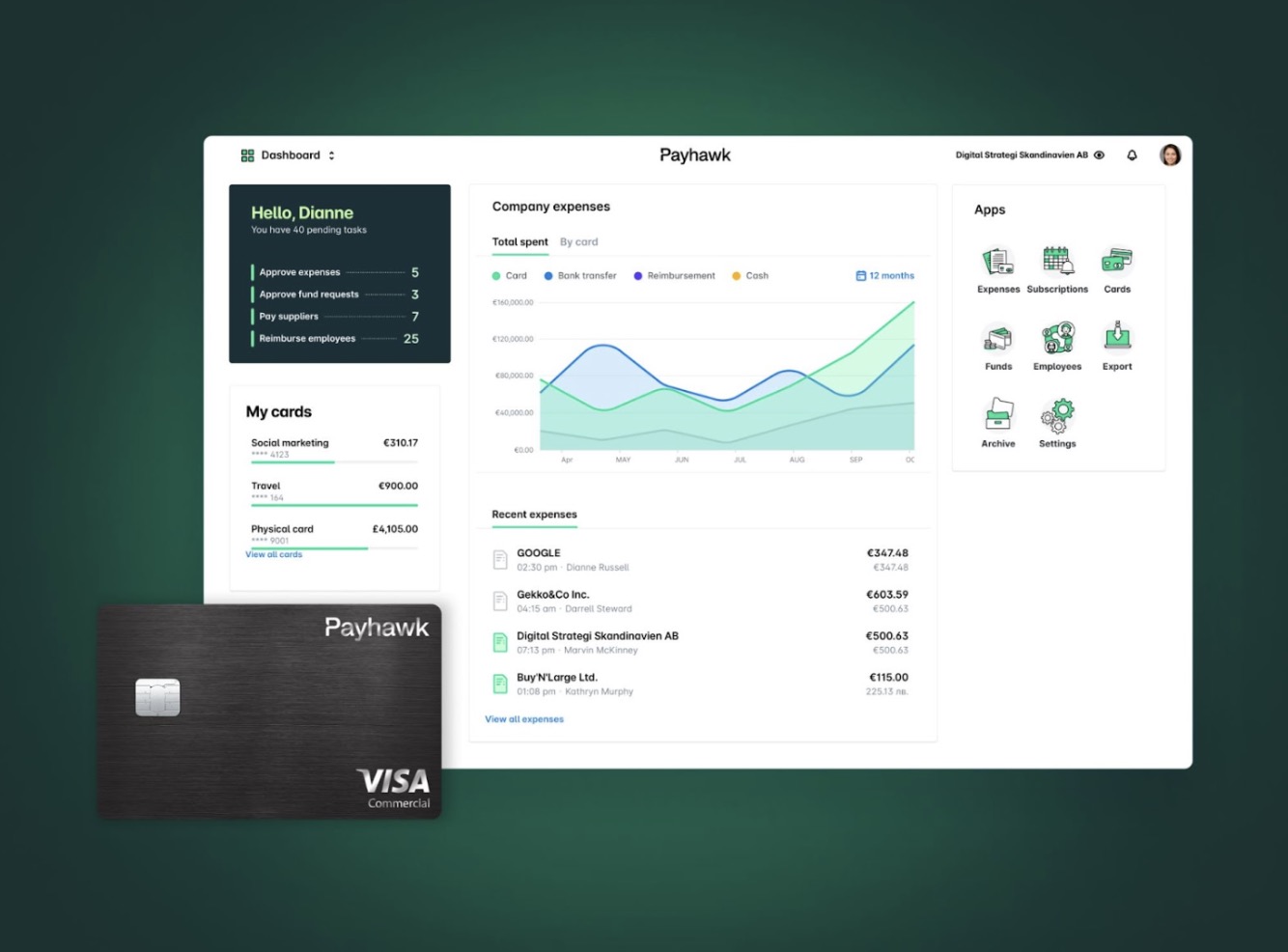

What is Payhawk? It is an all-in-one expense management software with corporate credit and debit cards, reimbursements, accounts payable and integration to all the leading ERP systems. With Payhawk, businesses of all sizes can optimise their spending, reduce unnecessary expenses and offer employees a better work experience.

What is expense management software?

Expense management software is a business tool to manage your company’s spending. It enables finance teams to issue corporate debit cards (whether physical or virtual), set rules and limits, pay for employee reimbursements and manage accounts payable – all in one platform.

What are the benefits of expense management software?

Expense management brings together all cost centres of the business so that the finance team has full visibility and active control over how the company is spending money across invoices, bills, subscriptions and employee expenses.

The main benefits are as follows:

Spending governance

Expense management software keeps track of who gets each corporate visa card: whether an individual, a team or a project. Then, it traces every transaction against assigned allowances. This gives businesses total visibility.

Beyond visibility, the finance team now has active control. With expense management software, finance controllers can set spending thresholds and limits. For example, the marketing team can receive a visa card with a credit line in sync with their approved annual budget. Or the ops team can receive a card with their staff entertainment budget.

In addition to limits, cards can have associated expense policies and rules to keep them in check. These rules can limit the context in which the cards are used by the team. For example, you might not allow ATM withdrawals for the marketing team’s card, since the card has been granted for online payments of advertising campaigns only.

This is ideal for employees too, who are no longer unsure of what can be claimed or not, and what the budget allows.

Payhawk enables businesses to define their own approval chains, and do so for every project individually. With this feature, employees can also request funds through the platform, if for example, a situation arises out-of-policy.

Better planning and forecasting

The ability to monitor every business expense and transaction in real-time is not just great governance – it will also allow the business to gain important insights that will help with planning and forecasting.

One of the pitfalls of employee reimbursements is the delay of expense submissions, given the predominantly bad experience of using outdated software. These delays can often increase uncertainty with budgeting, which can cost growing businesses important information for sound decision-making.

With real-time, well-classified information, finance teams can obtain a good insight into what’s being spent and where, in turn improving forecasting and more agile budgeting.

Empowering employees

With Payhawk, every team can get their budget, empowering them to spend it without delays.

With debit cards issued per team, they can pay for their online subscriptions, bills and even staff entertainment, with full visibility of what they’re spending and what they have left.

Additionally, when employees are issued their individual corporate Visa cards, they no longer have to use their own money and submit a claim after the fact, a terrible experience for them. Instead, they can spend more time doing the high-value work they’ve been hired to do.

As a result, employees feel more satisfied, less stressed and more focused on their important tasks – not their admin.

Faster, more convenient accounting

With Payhawk, you can replace 80% of manual finance processes with automation.

Closing the month becomes a lot faster and easier for finance teams with real-time monitoring of transactions. Chasing expense submissions is no longer necessary, as employees with cards get alerted of unsubmitted receipts.

Finance teams and employees also save time with automated receipt matching, invoice categorisation and VAT rates. This way, financial leaders can use their time to scale business operations.

Making regular payments

Payhawk can also help the business manage any regular payments, from rent to online subscriptions. Not only that, but with automated alerts, you will never miss a payment again.

As companies increase the number of micro-services they licence from third-party companies, finance teams can sometimes lose track of all the regular payments and associated contractual obligations.

With Payhawk, the finance team can now be notified before renewals (so the business doesn’t renew a subscription, if no longer necessary) and even of duplicated instances.

Designed to work at a global scale

Payhawk’s visa cards don’t accrue fees in GBP and EUR, and benefit from a low 1.99% exchange markup on all other currencies.

Seamless integrations with accounting software

Payhawk’s expense management software sends expenses and receipts to the business ERP and other accounting software, drastically reducing the workload for the finance team due to cutting out time consuming manual uploads.

Businesses are always looking for efficiencies to allow them to run faster than their competitors. Digital solutions such as all-in-one expense management software can help businesses move faster while retaining greater control and developing better insight.

With company cards backed by powerful financial software, businesses can optimise their spending, streamline their processes and make their employees happier in the workplace, leading to increased job satisfaction and higher productivity; what every company strives to achieve.

You may be interested in: Best Tips for Forex Trading Beginners