Many people dream of owning their own home. However, buying one’s dream home is easier said than done. Before you purchase a home, you need to determine how much you can realistically afford.

Here, we will focus on how to qualify for a home purchase, as well as how to best prepare yourself before you begin your house hunting journey.

What You Should Do Before Buying a House

You should begin saving as much money as possible so that you can put down a sizable down payment. You also need to determine how much you can afford, and you should also start working on building a good credit score.

You may not qualify for a home loan if you have a poor credit score, as your lender may see you as a big credit risk.

You need to calculate what your closing costs will be, as well as what your move-in expenses will be (i.e., repairs, renovations, furnishings). You can also use a virtual home affordability calculator in order to determine what you can realistically afford to buy.

You should also explore the various mortgage options at your disposal, which may include VA, UDSA, FHA, and/or conventional mortgages. You can choose from a variable rate or fixed rate mortgage, as well as different mortgage terms, such as a 15-year or a 30-year mortgage.

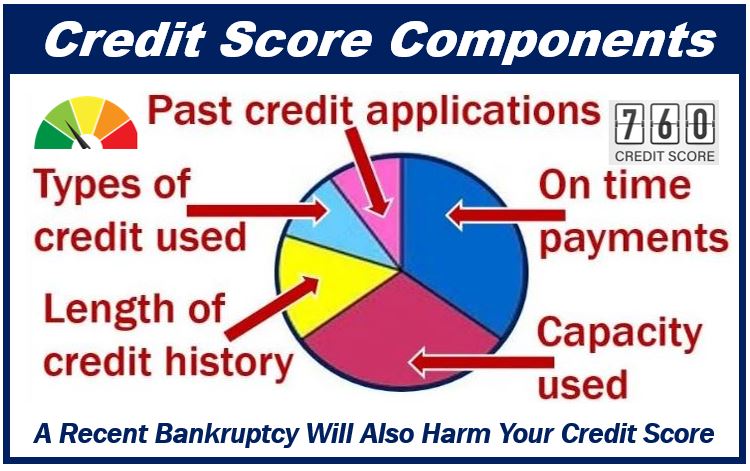

You should also know your credit score, so that you can compare it to your credit report in order to determine if it is accurate. You should also reduce your debt, as your lender will want you to keep your credit card balances low.

In fact, most lenders will use debt ratios in order to determine if you qualify for your mortgage, so keeping debts low will greatly help your cause.

What are the Financial Requirements You Need to Qualify for a Home Purchase?

You should have a sufficient amount of liquid capital so that you can put down a sizable down payment on your new home. Your debt-to-income ratio should also be sufficient. Your lender will assess your debt-to-income ratio in order to determine if you can afford to buy your home.

It is important to be honest and realistic about what you can afford in order to avoid having to foreclose on your home in the future.

In order to determine your debt-to-income ratio you should take all of your debt payments for the month and add them together. Then, take the calculated amount and divide it by your gross (pre-tax) income for the month.

You should also try and find a loan with a low-interest rate, as doing so may save you thousands in the long run.

You must also have enough money saved up in order to pay all of your closing costs, which may include credit reports, closing agent fees, processing fees, and the appraisal.

Moreover, your credit score must, at the very least, meet the minimum requirements. If you do not have a credit score, or if your credit score is poor, then you will likely not qualify for a mortgage.

Documents Required to Apply for a Mortgage

You will need to provide pay stubs for your two most recent pay periods. A letter of employment will outline your job description, the amount of time worked, and will also serve as proof that you do in fact work for the company that you claim to work at.

Your lender may also ask that you provide them with the most recent 3 to 6 months of bank statements. You will also be asked to submit a T1 general tax form in order to determine the cumulative income that you made last year.

A list of investments and/or assets that you have accumulated over the years should also be provided. Examples may include real estate market assets, and stock or bond investments.

You will also need to submit a report or notice of assessment so that your lender can calculate your debt-to-income ratio.

You will also need to submit a credit report. However, please ensure that the report is accurate, as errors are made in 25% of cases.

Also, if you are the owner or co-owner of a business then providing your lender with your business license or articles of incorporation may also help you qualify and obtain a lower interest rate.

Having a pre-approval letter on-hand before beginning the mortgage application process can also make your life easier. With the right knowhow a mortgage approval can be a relatively easy and streamlined process.

Taking the First Step

A mortgage broker can help you obtain the home of your dreams. A mortgage broker is a licensed professional who goes over your finances in order to help find the ideal mortgage solution for you.

They will also assess the proposed mortgage packages and determine if you meet the criteria of your lender.

Interesting related article: “What is Mortgage Protection Insurance?”