Title loans are becoming increasingly popular — and for good reasons too! Short terms and excellent repayment schemes are amazingly attractive.

But, how on earth do you find a good lender? How do you know if they are trustworthy?

These are great questions. And we’re going to help you answer them.

What Does a Trustworthy Lender Look Like?

The most important part of acquiring a title loan is to find a transparent lender to obtain it from. Picking the first one you find will usually leave you in a bit of a pickle. So, take some time to shop around and find a lender who has your interests at heart.

With that in mind, let’s take a detailed look at what features a trustworthy lender tends to have. Ready? Excellent, we’ll get straight into the nitty-gritty.

1. Transparency

What do we mean by transparency? Well, it’s all about the fees and terms.

Some lenders like to put their fees in the small print. This tends to catch people off guard as they believe they’ve been told all the important information. Unfortunately, in these cases, they haven’t been.

The first quality of a responsible lender is that they tell you all about their fees outright. Whether it is service charges, processing fees, interest rates, or anything else, the loan company should tell you about everything.

ProTip: You can use Titlelo’s title loan store locator to find the nearest lender near you.

2. It’s All in Writing

Anything that you and the lender have agreed on should be in a written contract. This should then be signed by both of you.

Obtaining a loan is not a one-way street. You and the lender you choose will have to meet in the middle. A good one will always write everything into the contract.

3. They Have the Correct Documentation

To tell you the truth, we aren’t just talking about the lender here. While they should display their relevant qualifications and any other certifications on their website, you need to cooperate with them too.

A trustworthy lender will tell you about the paperwork you need to submit for approval. Then, they will give you enough time to gather it together and, finally, send them off.

4. They Have a Well-Written Application Form

Lenders tend to display their application forms on the home page of their website. It should ask you appropriate and relevant questions only. If you feel like something is off, then it probably is!

Trust your gut in this case. You don’t want to fall for a dodgy provider.

A great title loan application form will ask you the following information:

- Your title (Mr, Miss, Mrs, Ms, Dr, etc.)

- Your first and last name

- Your address

- Your contact information (cell number and email are the most widely used)

- Your vehicle’s registration number

- Other information about your vehicle (this varies from lender to lender)

Anything else tends to be covered in the additional details section of the application form.

Now you can call yourself an on the qualities of a decent title loan lender! But we’re not finished yet. Let’s take a look at the steps you can take to ensure you find a trustworthy company.

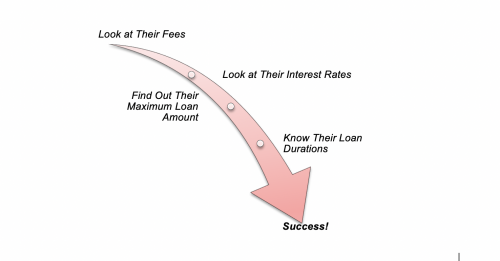

How to Find a Trustworthy Title Loan Lender: A Step-by-Step Guide

We’ll just jump straight into it!

Step One: Look at Their Fees

Even though title loan lenders will take your car title and put a lien on it, reputable companies will usually charge you an additional fee.

Sometimes, this will be called a service charge, but they tend to refer to it as the “loan fee”.

Alongside this, you need to check for the following charges:

- Lien fees

- Roadside assistance program fees (a few trustworthy companies do this, but not many)

- Processing fees

- Document fees

- Late fees (i.e. if you are late making the repayments or sending identification documents)

Step Two: Look at Their Interest Rates

Interest rates and loans go hand in hand. There’s simply no escaping them (sadly).

To save yourself, you need to ensure you know (and understand) the interest rates before agreeing to the loan.

Reputable companies will typically offer this information without you having to ask. However, some like to pull the wool over your eyes (hence why finding a trustworthy, reliable lender is such a big deal).

Step Three: Find Out Their Maximum Loan Amount

The best lenders will give you a loan amount that will help you when you’re struggling but is easy for you to repay.

Generally speaking, they will lend you almost 50% of your car’s total value. However, this varies wildly depending on which company you choose.

Step Four: Know Their Loan Durations

You know the title loan term is going to be short. But you need to ensure you know the exact length of your one so it’s easy for you to repay it. Reputable lenders will not want to catch you in a trap. They are there to help.

Interesting Related Article: ” Important Facts You Need to Know About Loans“