There are a few ways that you can secure a loan with bad credit. However, it is important to keep in mind that the interest rates and fees will be much higher than if you had good credit. One option is to get a co-signer. A co-signer is someone who agrees to be responsible for the loan if you are not able to repay it. This can be a risky move as if you do not make your payments, the co-signer will be on the hook for the entire amount.

Another option is to try to apply for a secured loan using an online loan broker service listed on this page. A secured loan is one where you offer collateral, such as your home or car, as security. This reduces the lender’s risk and makes it more likely that you will be approved for the loan.

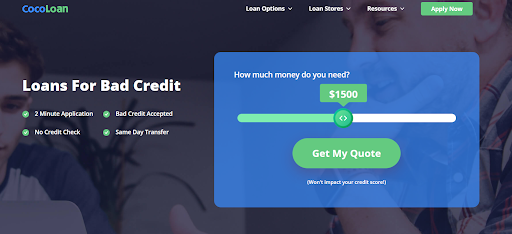

If you have bad credit, it is also important to be prepared to pay a higher interest rate and fees. Make sure you compare offers from different lenders using a broker service like CocoLoan to find the best deal.

Finally, be sure to keep up with your payments. Late payments can damage your credit score and make it even more difficult to secure future loans.

What Types of Bad Credit Loans Can I Get?

If you’re looking for a bad credit loan, you may be wondering what types of loans are available to you. While it can be difficult to find a loan if you have bad credit, there are still a few online loans for bad credit from CocoLoan that you can choose from. One option is a personal loan. Personal loans are unsecured loans, which means you don’t need to put up any collateral. This can be a good option if you need a smaller loan amount and you have a decent credit score.

Another option is a secured loan. Secured loans are backed by collateral, such as your home or car. This can be a good option if you need a larger loan amount and you have bad credit.

Finally, you may want to consider a payday loan. Payday loans are short-term loans that are typically due in full on your next payday. They are typically very expensive, but they can be a good option if you need money quickly and you have bad credit.

So, what types of bad credit loans are available to you? It depends on your situation and your credit score. However, with multiple options available on CocoLoan, you should be able to find a loan that meets your needs.

Where Can I Get Approval for a Bad Credit Loan?

Your credit score is one of the most important factors lenders consider when you’re applying for a loan. However, there are times when your credit score might not be as stellar as you’d like it to be. This is where bad credit loans come in, as they are typically offered by lenders who are more willing to take on a higher risk.

In this respect, if you’re wondering where you can get approved for a bad credit loan, there are four places you can go to get the money you need:

-

Your Local Bank or Credit Union

Your local bank or credit union is a great place to start when looking for a bad credit loan. Many of these institutions offer loans specifically for people with bad credit. They may also be more willing to work with you on your loan terms, which can be helpful if you’re struggling to make ends meet.

-

Online Lenders

Online direct lenders and broker services like CocoLoan are another great option for those looking for a bad credit loan. These lenders typically have more relaxed eligibility criteria than traditional lenders, and they may be more willing to work with you on your loan terms.

-

Peer-to-Peer Lending Networks

Peer-to-peer lending networks are another great option for those looking for a bad credit loan. These networks connect borrowers with lenders, and they typically have more relaxed eligibility criteria than traditional lenders.

-

Credit Card Companies

Credit card companies are often willing to work with borrowers who have a less-than-perfect credit score. They may offer you a credit card with a lower limit or a higher interest rate, but it’s a good option if you’re looking for a quick and easy way to get your hands on some cash.

No matter where you decide to get your bad credit loan, make sure you do your research first. Read reviews and compare rates to make sure you’re getting the best deal possible.

Steps for Applying for a Bad Credit Loan

If you’re thinking about applying for a bad credit loan, here are the steps you need to take:

-

Research different lenders

There are a lot of different lenders out there who offer bad credit loans, so it’s important to do your research and find the right one for you. You can often make use of a lending service like CocoLoan to compare interest rates, fees, and other lending terms and conditions.

-

Complete the application

Once you’ve found a lender you want to work with, you’ll need to complete an application. This will typically require submitting some basic information like your name, address, and income.

-

Provide proof of income

In order to qualify for a bad credit loan, you’ll need to provide proof of income. This can be done by providing recent pay stubs or bank statements.

-

Provide proof of identity

Lenders will also require proof of your identity in order to approve your loan. This can be done by providing a copy of your driver’s license or passport.

-

Await approval

Once you’ve submitted your application, you’ll need to wait for the approval. Typically, you can expect to hear back within a few days, but with some lending services, it can be as fast as a few minutes or hours.

-

Receive your loan

If your application is approved, you’ll receive the money you need directly into your bank account. Be sure to read the terms and conditions carefully before accepting the loan.

A bad credit loan can be a great option for people who need money quickly but don’t have excellent credit. By following these steps, you can ensure that you’re applying for a loan that’s right for you.

Is There Risk in Bad Credit Loans?

Bad credit loans can be a great way to get the money you need to cover a financial emergency. However, there is always a risk associated with any type of loan. So, is there a risk in bad credit loans?

The answer to this question depends on a number of factors, including the type of bad credit loan you get and your credit history. For example, a payday loan may be a high-risk option for someone with bad credit, while a personal loan may be a lower-risk option.

If you have bad credit, it’s important to be aware of the potential risks associated with bad credit loans. Make sure you understand the terms and conditions of any loan you borrow and be prepared to pay back the loan on time.

If you can’t afford to pay back a bad credit loan, you may end up in even more financial trouble. So, be sure to only borrow what you can afford to pay back.

Interesting Related Article: “How to choose the best loan?“