Many movies portray a time when importers would stand at a port waiting for their shipment of goods to arrive and be offloaded onto a dock. Next is a scrabble of filling in forms, signing off on others, and paying taxes and duties as required. However, doing business has shifted to all things digital and paperless – an evolution that streamlines systems, speeds up lengthy processes, simplifies others, and saves time and money. The import industry is catching on and should be catching up.

U.S. online customs clearance

The U.S. is the second-largest importer of goods and services, especially consumer goods. Competition is rife, and adhering to all the import rules and regulations can arduous, especially for first-time importers or small businesses. As such, they need to embrace all cost- and time-saving measures to survive.

Using online customs clearance solutions can make the difference by simplifying complex processes without having to fork out their hard-earned dollars on middle-men or customs brokers, saving precious time, and, probably most importantly, cutting costs.

Why use online customs clearance?

The internet gives importers the autonomy to fulfill many vital requirements with the click of the mouse – from tracking shipments to managing logistics, automating administrative tasks, and the list goes on. If online solutions mean importers can do most day-to-day business transactions themselves, why should they not do the same when it comes to customs clearance? For instance, do they need a customs broker for ISF and Entry Summary (CBP Form 7501) filing?

The answer is not necessarily. All across the global customs supply chain, freight forwarders, carriers, agents, traders, and border agencies have begun implementing smart digital technologies. An excellent example is the U.S. Customs and Border Protection (CBP) that supports all electronic payment methods authorized by the Department of Treasury’s Fiscal Service. These include payments for import duties, taxes, fees, and much more.

However, for the most part, online or e-customs clearance solutions are provided by different companies serving a similar purpose. Imagine the benefits of a uniform digital global trading system. While certain countries, or destinations, would surely take longer to catch up technologically, the current trade jungle would be a fluid passage from point a to point b.

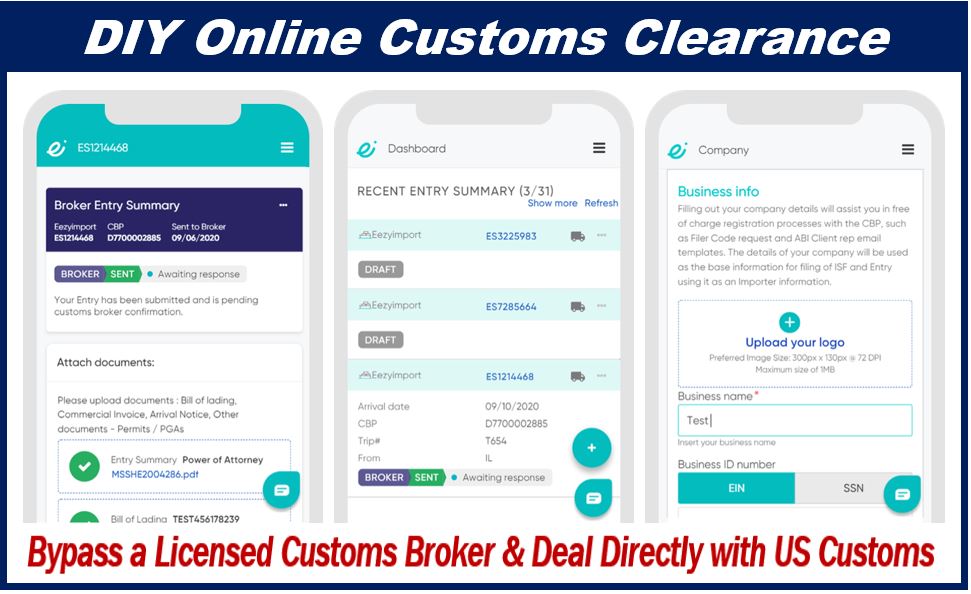

Currently, one can use digital platforms for self-filing – this means being accountable for directly communicating with U.S. Customs and then filing the required documentation to allow your goods to move across the border. The alternative is using the services of a licensed Customs Broker to file import documentation on your behalf.

eezyimport self-filing

eezyimport offers an online customs clearance solution that enables small businesses to navigate the challenging and costly world of importing. When using eezyimport’s Self Filer Module, you are not required to upload the documents to your Entry filing; however, you do have to have them should they be requested by the CBP. For the Broker Module, you will be asked to upload the shipment documents for the broker to review.

Both modules save you time and money and make it easier to meet all requirements. The system enables companies to adequately control their goods’ movement, monitor them more carefully, improve traceability and auditability and strengthen transparency and compliance.

Interesting related article: “What is Import Duty?“