This decade has seen changes that have caused some interesting economic times. In the past two years, we have been witness to a pandemic, massive supply chain issues, an ongoing war between Russia and Ukraine, and oil prices spiking.

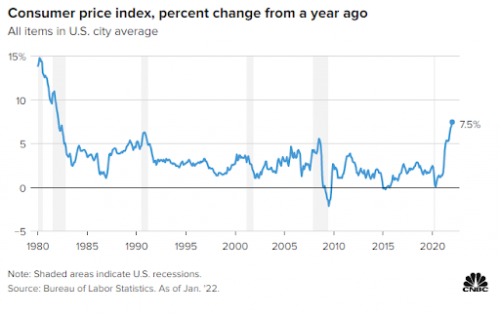

These massive events are sparking fears of the worst inflation seen in the western world in decades. Inflation in recent years has typically been between 1-3% on average, but due to the events mentioned above are expected to be much higher in 2022. According to CNBC, inflation rates in 2022 are expected to reach 7.5% this year or higher, the highest levels are seen since 1982. This rise is due to affect residential housing and can be an indication that an economic recession may be on the horizon.

Interest Rates & Inflation

As part of the U.S. Government’s attempt to combat the wave of inflation, federal interest rates are expected to rise. The Federal Reserve has increased interest once this year and is anticipated to increase them six more times in 2022 according to USA Today. Additionally, the Federal Reserve seems to be aiming at a minimum of three additional hikes in 2023.

Interest rates tend to follow inflation rates with a slight delay. This is because central banks tend to use interest rates as a weapon to combat inflation. By increasing interest rates, all loans tend to become more expensive and lending becomes discouraged. In the prior decade, when inflation rates were very low, central banks lowered interest rates to encourage borrowing and stimulate the economy.

Inflation indirectly tends to affect most financial markets via changing interest rates. This includes the stock market, real estate, cryptocurrencies, bonds, and even commodities. Usually, the effect of inflation and interest rates is negative for most markets except possibly for “safe haven” assets. So-called “safe haven” assets such as gold, real estate, bonds, and to an extent cryptocurrencies are seen as a hedge against inflation. As such their value can increase, although each asset class contains its own particular risks.

According to Barron’s, Federal interest rates are expected to reach at least as high as 2.75% by 2023 per their forecast. For reference, rates were between 0 to 0.25% from 2020 to 2022 and the majority of the 2010s. This is a major increase for a short time period, and quick changes tend to cause erratic market conditions.

Interest Rates & Residential Housing

Rising interest rates and inflation can affect residential real estate markets in different ways. Inflation seems to be causing a buying spree of residential housing in the United States and is contributing to soaring real estate prices. Despite that, rising interest rates could put a damper on the party. As rates are due to reach close to 3% and most mortgage lenders will charge a higher or much higher rate, many may be discouraged to buy property.

This may cause a correction or slight cool-down for residential real estate in a few years’ time. In the near future, however, real estate seems hotter than ever. Prices are increasing rather sharply from quarter to quarter in most of the United States.

Real Estate investors and homeowners have taken advantage of low interest rates these past few years at these historically low rates. According to Yahoo Finance, 2021 was a record year for home refinancing with over $1.2 trillion in home cash-out refinancing. While this number fell by 34% in 2022, it seems that many are still looking to make the most out of low-interest rates.

Foreign or international real estate investors also tend to play a big part in the US residential real estate market. It has been estimated that roughly 3-7% of all homes owned in the US were purchased by non-US based investors. According to research by Gorback and Keys, house prices and rents have risen in places that have seen large doses of foreign investment. International investors make use of specialized lenders such as USA-Mortgages, Lendai & GMG (or Global Mortgage Group) to secure fixed-rate mortgages in the USA.

“At USA-Mortgages we are seeing continued demand from international investors,” remarked Saul Kramer, Co-Founder and Chief Underwriting Officer at USA-Mortgages “Especially those who already own properties in the US seeking to reap the benefits of the increase in property value in order to take out equity and purchase additional investment properties.”

The real estate market in 2022 in the United States is rather competitive. There tends to be bidding wars on nearly every type of property and speed or a fat wallet seems to be key to winning. Despite this, real estate investors continue to view the property as a safe investment during economic times when the stock market is showing volatility and as a hedge against inflation.

Interesting Related Article: “What is interest? Definition and examples“