Organizations and investors in asset classes such as real estate often use a metric known as the internal rate of return (IRR) to decide where to put their capital, or to see how existing projects are performing. But did you know the tool can also be used to help you make personal financial decisions, such as regarding a mortgage or investments in the stock market? Let’s look at the internal rate of returns and investment returns – and more.

What is Internal Rate of Return?

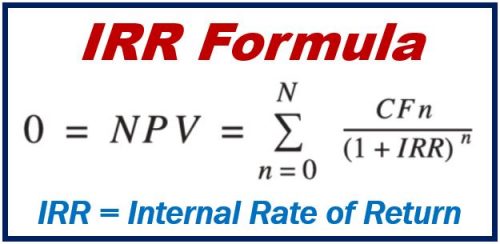

At its essence, the IRR is whatever discount rate puts at zero a project’s net present value (NPV). The discount rate is the interest rate that’s used to fix the existing value of future cash flows. Another way to say it is, the internal rate of return is roughly the compounded annual rate of return that you can expect from a project or investment.

How is the IRR Calculated?

The general IRR formula is a bit unwieldy and includes terms such as NPV, holding period, initial investment, and cash flows. The good news for many is that an IRR calculator can be employed to handle the computations quickly and easily, with just a few inputs.

In any case, here’s an example with which you may be able to relate, as it concerns a simple mortgage: say you have a $200,000 mortgage with monthly payments of $1,050 over 30 years. That makes the loan’s annual IRR 4.8 percent (the IRR is always expressed as a percentage).

Since the payment amounts are the same and are due at the same time monthly, you can also discount your payments at a 4.8% interest rate, which will get you an NPV of $200,000. Now, should the payment increase to $1,100, say, the loan’s internal rate of return would increase to 5.2%.

How is IRR Used?

As we say, IRR is commonly used in real estate as well as corporate finance. A real estate investor will, for example, use the metric to determine how a project is performing, or whether another investment opportunity would likely be worth it.

Regarding organizations, say a company is assessing whether it should invest in a new factory or put money into shoring up an existing one. It will use the IRR of each project to help it decide. Once it’s determined that each project generates an IRR that exceeds the organization’s cost of capital – and all other factors are equal, including risk – the project with the highest IRR would be considered the best investment.

What About Other Uses?

The IRR can also help you see how formidable compounding is. Say you put $50 monthly in the stock market over a decade. At the end of those 10 years, that cash would amount to $7,764 with a 5% IRR. That exceeds the current 10-year Treasury rate, by the way. In fact, a good way to use the IRR is to compare lump-sum investments versus over-time payments.

Using the IRR can also demonstrate that when it comes to whether you should take prize winnings all at once or in monthly payments over time, for instance, the lump-sum payment is usually always the best option.

Another way the IRR can help you in your personal doings is by computing mutual fund, portfolio, or individual stock returns. Usually, the percentage the IRR will give you assumes that any cash dividends will be reinvested in stocks or the portfolio. That’s why it’s crucial to pay close attention to the assumptions when sizing up various investment returns.

Perhaps you knew about the metric, but never associated internal rate of return with investment returns or other personal uses. The tool is not perfect – it does rely heavily on assumptions – but there are many ways it can be utilized.

In some instances, for example, you may need to determine the discounted cash flow value using a calculator or another formula to understand the sum of the present value of all cash flows from an investment. This can determine if an investment is worthwhile in the long run.

Interesting related article: What is an Investment?