Early on, very few individuals were sure of what to think of, or what to do with, cryptocurrencies. How was it money? What backed the system? No one knew if it could be spent like real currency or saved like a stock.

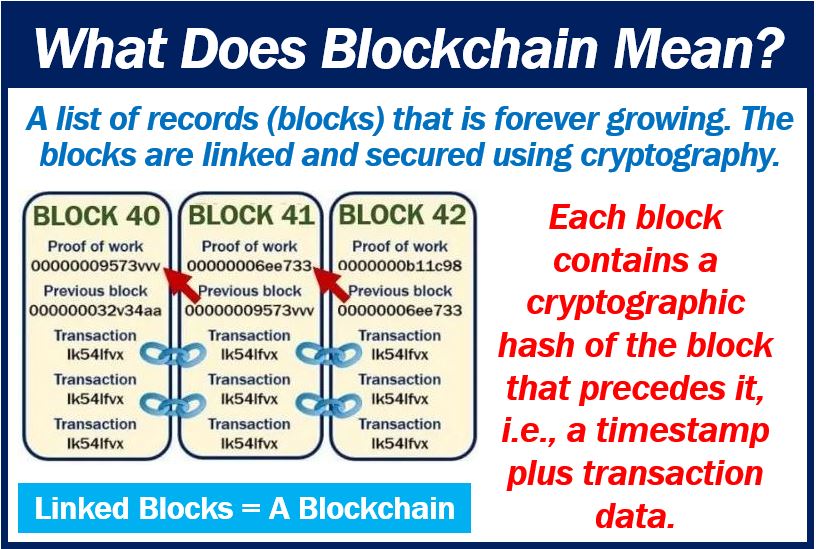

Today, a large percentage of people still can’t explain how cryptocurrency works. While it has become more popular, it’s standing as an accepted form of money or financial collateral remains unclear. One key aspect of this nontraditional currency includes its position on the decentralized ledger, otherwise known as the blockchain. Colbeck Capital Management recently discussed in their newsletter some of the challenges and rewards currently offered through blockchain lending.

What Is Blockchain Lending?

There are a lot of concerns surrounding crypto lending, and rightly so. With an anonymous currency, it can be tricky to secure loans in the traditional sense. Cryptocurrencies are built on the understanding that middlemen are not welcome.

With fewer intermediaries involved in the transfer or holding of assets, there are hypothetically fewer opportunities for corrupt policies and sluggish systems to interfere. Removing the system inefficiencies that hurt or exploit average consumers, and you would have a smarter system, some theorized.

Cryptocurrency has sought to achieve this equilibrium. But without a middle party, there have been questions how currencies such as Bitcoin or Ethereum can be handled with respect to lending. Can they be treated like assets when a consumer wants to hold on to them but needs fast cash?

The UCC, a standard developed far before cryptocurrency’s inception, defines them as General Intangibles at best. This is not ideal for lending situations because there is no way to establish a perfect lien in the case of a default.

As a workaround, blockchain provides lenders with smart contracts that hold lenders and borrowers to the same set of rules. If the borrower defaults on the loan, the smart contract will also act as collector, immediately liquidating the crypto asset and sorting out the financial aftermath of fees, debts, and remaining assets.

The Growing World of DeFi

Within this new world is DeFi, a marketplace of decentralized lending apps (Dapps) that work with an Ethereum-based system of smart contracts. Each Dapp sets its own contract protocol to establish a predictable environment.

Within these Dapps are pools of excess funds that can be pulled from or added to at any time. As the value within those lending pools shifts, an algorithm adjusts the interest rate. Every 15 minutes, the rate could change based on supply and demand.

Some feel that the setup for DeFi is far too close to traditional lending. They want cryptocurrency to be completely separate from traditional banking practices. But this separation can get in the way of cryptocurrency attaining widespread use, which was always its intention.

One key difference is how agile DeFi lending is. Users can borrow or deposit within the pool at any time without penalty or taxable events. However, users also have to be careful, or they will default on their loans if the values change too drastically.

Can You Default on a Blockchain Loan?

The flexible nature of blockchain lending means you must have extra funds in your account at all times. You are often lending at incredibly high rates of 150% to 200%, which are required for collateral.

That means that you need to have a much larger collateral up on the block than the amount you are planning to take and use for your own purposes. If at any time you slip below that required amount, you default on the loan. This means that your assets held as collateral are immediately liquidated, and a penalty is added to your loan repayment.

Unfortunately, this has caught some traders off guard in the past. Colbeck noted that over 775,000 traders had over $8.5 billion worth of Ethereum and Bitcoin liquidated from their accounts when the price fluctuated beyond expectations. It’s not something anyone is taking lightly.

Why Pledge High Collateral?

When it comes to lenders, no one wants to back a nameless account without a credit score or home address. It is simply too risky. The only way a lender is tempted to take that risk is if the collateral is extremely high. This high-risk, high-reward lending approach has been in practice since the Black Plague inspired new financial approaches in medieval Venice.

At such high rates, the defaults are few and far between. But what tempts a borrower to take the money at high personal risk to themselves? In some cases, people find themselves in situations where they need money quickly and do not (or cannot) sell another asset. They would rather put the asset up on the block until they can reclaim that asset and continue on, explained Colbeck Managing Partner Jason Colodne.

In other cases, the near opposite can occur with individuals who are looking to take advantage of the bull-bear system by short-selling cryptocurrency. This includes taking out a loan when one currency market is low and then selling the currency when it rises in price. Playing the market can come with costs.

For example, if the price of one Ether (ETH) was worth $2,000 USD and you decided to short-sell it, then you are hoping that price drops. Let’s say you borrow 5 ETH and exchange it for $10,000. When your prediction occurs and the ETH price drops to $1,200, you buy back the 5 ETH to return to the lender, pocketing $4,000.

This works in reverse, too. You can deposit a stablecoin (backed by an underlying asset, like the U.S. dollar) to purchase the cryptocurrency. When the price fluctuates in the upward trend, you sell that cryptocurrency for more of the same stablecoin, paying back your initial debt with some left over.

About Jason Colodne

As a managing partner and co-founder of Colbeck Capital Management, Jason Colodne has spent the past two decades managing credit investing and underwriting businesses. His role at Colbeck currently includes senior transaction partner where he oversees investment portfolio execution and management.

Before establishing Colbeck, Colodne acted as managing director and head of the Strategic Finance Division at Morgan Stanley. Before his work at Morgan Stanley, he was at Goldman Sachs where he was head of Proprietary Distressed Investing and the Hybrid Lending Group in the Fixed Income Currencies and Commodities Division.

About Colbeck Capital Management

Colbeck Capital Management is based on decades of combined finance expertise, offering non-traditional lending solutions for companies facing periods of transition. Since founding Colbeck in 2009, Jason Beckman and Jason Colodne have overseen the firm as managing partners and expanded the company to include offices in New York City and Los Angeles.

Interesting related article: “What are Blocks?”