Investors should consider the stock float because of how this metric does have an impact on the price of the stock. A number of metrics can influence it, but this ranks as one of the most important.

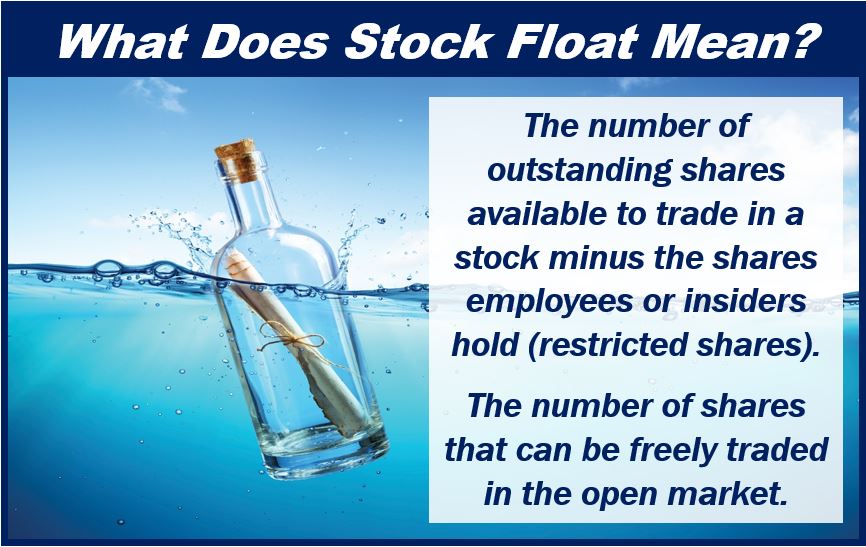

What is a Stock Float?

When investors go to buy stocks, the stock float matters because it ranks as one of the factors. With how many stocks investors can trade, it looks at both freely traded stocks and the insider owned stocks. A person should, however, keep in mind that they can’t own insider traded stocks, so this doesn’t count.

These shares come with restrictions, but the free floating stocks don’t have the same level of restrictions. Through understanding the stock float, investors can make guesses about the projected volatility because the insider owned and institutionally owned stocks will usually have less volatility than the other stocks.

Stocks with a lower float usually aren’t recommended to trade because they come with higher risk that they will drop in price. When stocks have a higher float number, this usually means that they will experience less volatility. In general, 30 to 40 percent stock floats are quite common, but it is not as easy to find with the higher stock floats.

What is the Difference between a Market Cap and Free Float Cap?

When looking at the market cap, this refers to the total current value of the company, which is subject to change. On the other hand, a free float cap looks at the outstanding shares that have been made available to the public. It excludes the shares that institutions and insiders have put on lockdown as they plan to hang onto the shares for a long time, which takes them mostly out of the market and makes them unavailable to the public.

Can the Stock Price Be Manipulated with Float?

Through restricting the amount of tradable float, firms can manipulate the stock prices. As the float contracts, the prices rise, and when the float gets released, the prices fall. The manipulation of stock prices is considered illegal in most cases. That said, regulators and other stock market authorities have a hard time detecting it. With a company that has a larger market cap, it can be much harder to manipulate the market cap because of how it requires more stock in the company to manipulate.

What is a Low Stock Float?

We know what a stock float is, but we don’t know exactly what a low stock float is. Let’s have a look at it. This could be defined as having a lower number of shares. It depends on the size of the company, but they typically consider a low stock float 15 million available shares or less. They will have a lower supply and a greater demand, which will increase the share price while being less volatile. According to the experts at SoFi, “A stock with a low (or small) float may be more volatile than a stock with a large float. Since there are fewer shares available, it may be harder to find a buyer or seller.”

Hopefully this outlines some of the basics when it comes to the stock float. Through understanding this type of thing, investors can have greater success in the stock market.

Interesting related article: “What is a company share?“