Depending on what your goals are, some types of loans are better than others. However, you may not qualify for all loans. For instance, if you have bad credit your options are limited; you’ll have to settle for a loan that has a higher-than-average interest rate.

When you have decent to excellent credit, you’re more likely to find a loan with terms in your favor. However, some loans are almost never worth taking out.

Here’s a breakdown of which loans are worth pursuing and which loans to skip.

Skip the payday loans

It’s tempting to get a fast cash advance on your paycheck, but think twice before you hit up that payday loan shark. Although getting a payday loan is relatively easy with minimal paperwork, the interest rates are unbelievably high. For instance, the average payday loan APR is 541% and the loan (plus interest) is expected to be paid back within 2-4 weeks. If you need a payday loan to start with, you’re unlikely to be able to pay it back in that short period of time.

It’s tempting to get a fast cash advance on your paycheck, but think twice before you hit up that payday loan shark. Although getting a payday loan is relatively easy with minimal paperwork, the interest rates are unbelievably high. For instance, the average payday loan APR is 541% and the loan (plus interest) is expected to be paid back within 2-4 weeks. If you need a payday loan to start with, you’re unlikely to be able to pay it back in that short period of time.

When you need to roll over a payday loan, the charge for each rollover can be $30 for every $100 you need to roll over. After 4 rollovers, you’ll pay $120 extra all on a $100 loan balance.

Payday loan sharks know how easy it is for people to get caught in a cycle of using the next paycheck to pay back the loan. Statistics show that 80% of payday loans are late. Payday loan sharks count on people having a hard time catching up and gathering charges.

Car loans are fantastic

Need a new car, or even a pre-owned vehicle? A car loan is a smart move. In addition to getting a new vehicle, car loans are one of the top ways people rebuild their credit. If you’re using a car loan to rebuild your credit, you’ll pay a higher interest rate, but in the short-term it’s worth the extra cost.

Need a new car, or even a pre-owned vehicle? A car loan is a smart move. In addition to getting a new vehicle, car loans are one of the top ways people rebuild their credit. If you’re using a car loan to rebuild your credit, you’ll pay a higher interest rate, but in the short-term it’s worth the extra cost.

Once you have better credit, you can refinance your loan and get a lower interest rate. In the end, you’ll have the credit you need to pursue bigger goals like buying a house.

Car loans are easy to manage. They’re much smaller than home loans and once you know how much your payments will be, you’ll know exactly when it will be paid off. Unlike a mortgage, you can pay off a decently sized car loan in about 7 years. However, before signing any paperwork, calculate your repayments to know how much you’ll need to pay and to estimate when the loan will be paid in full.

The hidden benefits of car loans

You may have noticed that your credit is factored into your car insurance premiums. It’s not fair, but that’s how it works. When you successfully repay a car loan and build credit, your car insurance rates will drop.

Skip the student loans

If at all possible, don’t take out any student loans – especially private loans. They’re harder to pay back because of the high interest and inflexible repayment terms.

If at all possible, don’t take out any student loans – especially private loans. They’re harder to pay back because of the high interest and inflexible repayment terms.

If you’re going into a profession that requires a degree, you won’t have a choice. However, if your chosen profession doesn’t require a degree, see if you can learn the skills online through courses on sites like Udemy, Coursera, Lynda, and even YouTube. You’d be surprised at how many employers prioritize actual skill above a degree.

Skip consolidation loans

There are debt consolidation companies and debt consolidation loans. The former is the only way to consolidate your debt without going further into debt.

There are debt consolidation companies and debt consolidation loans. The former is the only way to consolidate your debt without going further into debt.

A debt consolidation company will negotiate with creditors on your behalf and get them to accept a smaller amount than what you actually owe. The consolidation company will then charge you one monthly fee to cover the negotiated debt and their service fees. You’ll make one easy monthly payment.

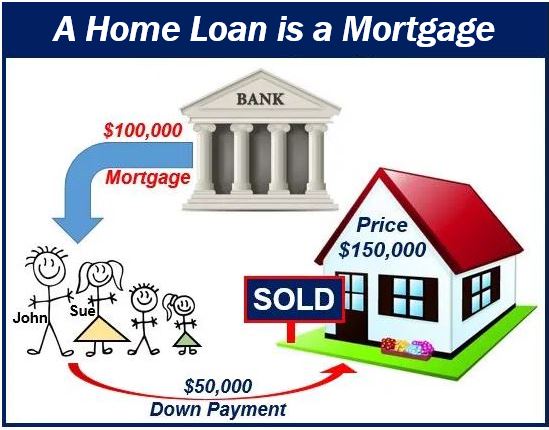

Go for a home loan

If you need to buy a home, a home loan is unavoidable. However, there’s nothing inherently risky about a home loan unless you lose your income and can’t pay it back.

If you need to buy a home, a home loan is unavoidable. However, there’s nothing inherently risky about a home loan unless you lose your income and can’t pay it back.

Home loans are straight forward and you’ll know exactly how much your monthly mortgage will be when you sign the papers. You may want to consider getting pre-approved for a home loan that won’t take more of your paycheck than you’re comfortable with. Plan ahead for the possibility that your pay might fluctuate if you need to change companies or lose some hours.

Read all loan agreements thoroughly

Regardless of how straightforward a loan seems, read the agreement thoroughly before signing on the dotted line. For extra security, pass the paperwork by a lawyer first.

_______________________________________________________

Interesting related article: “What is my Credit Score?”